FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

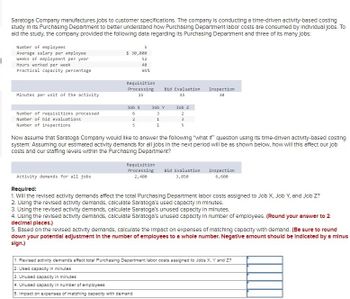

Transcribed Image Text:Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing

study in Its Purchasing Department to better understand how Purchasing Department labor costs are consumed by Individual jobs. To

ald the study, the company provided the following data regarding its Purchasing Department and three of its many jobs:

Number of employees

Average salary per employee

Weeks of employment per year

Hours worked per week

Practical capacity percentage

$ 30,000

52

40

85%

Requisition

Processing

15

Bid Evaluation

Inspection

45

30

Minutes per unit of the activity

Job X

Job Y

Job Z

Number of requisitions processed

Number of bid evaluations

6

3

2

2

1

3

Number of inspections

5

1

5

Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing

system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job

costs and our staffing levels within the Purchasing Department?

Activity demands for all jobs

Required:

Requisition

Processing

2,400

Bid Evaluation

3,850

Inspection

6,600

1. Will the revised activity demands affect the total Purchasing Department labor costs assigned to Job X, Job Y, and Job Z?

2. Using the revised activity demands, calculate Saratoga's used capacity in minutes.

3. Using the revised activity demands, calculate Saratoga's unused capacity in minutes.

4. Using the revised activity demands, calculate Saratoga's unused capacity in number of employees. (Round your answer to 2

decimal places.)

5. Based on the revised activity demands, calculate the impact on expenses of matching capacity with demand. (Be sure to round

down your potential adjustment in the number of employees to a whole number. Negative amount should be Indicated by a minus

sign.)

1. Revised activity demands affect total Purchasing Department labor costs assigned to Jobs X, Y and Z?

2. Used capacity in minutes

3. Unused capacity in minutes

4. Unused capacity in number of employees

5. Impact on expenses of matching capacity with demand

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Foam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company’s activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 5.55 per direct labor-hour Batch processing Number of batches $ 107.00 per batch Order processing Number of orders $ 275.00 per order Customer service Number of customers $ 2,463.00 per customer The company just completed a single order from Interstate Trucking for 1,000 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.25 direct labor-hours. The selling price was $20 per unit, the direct materials cost was $8.50 per unit, and the direct labor cost was $6.00 per unit. This was Interstate Trucking’s only order during the year. Required: Calculate the customer margin on sales to…arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below, along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor. Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $10 per direct labor-hour $90 per batch $286 per order $ 2,602 per customer The company just completed a single order from Interstate Trucking for 2,800 custom seat cushions. The order was produced in four batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $102 per unit, and the direct labor cost was $14.20 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forwardAnalyzing cost data, recording completion and sales of jobs Clement Manufacturing makes carrying cases for portable electronic devices. Its costing records yield the following information: Requirements Which type of costing system is Clement using? What piece of data did you base your answer on? Use the dates in the table to identify the status of each job at October 31 and November 50. Compute Clements account balances at October 31 for Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold. Compute, by job, account balances at November 30 for Work-in-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold. Prepare journal entries to record the transfer of completed jobs from Work-in-Process Inventory to Finished Goods Inventory for October and November. Record the sale of job 3 for $2,300 on account. What is the gross profit for Job 3?arrow_forward

- please explain how you came with the answers and include any formulasarrow_forwardMFCB Ltd uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system. Activity Cost Pool Total Cost (RM) Total Activity Cleaning 442,068 78,800 hours Job support 52,801 1,900 jobs Client support 9,170 350 clients Other 110,601 Not applicable Total 614,640 The expenses of idle capacity and organization-sustaining expenditures are included in the 'Other' activity cost pool. One particular client, DNO Ltd, requested 46 jobs during the year that required a total of 92 hours of housecleaning. For this service, the client was charged RM2,230. TASK: Compute the predetermined overhead rate if the company chooses cleaning hours as the allocation base.arrow_forwardChurchill Products is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. The company’s cost accountant has identified three overhead cost pools along with appropriate cost drivers for each pool. Cost Pools Costs Activity Drivers Utilities $ 310,000 62,000 machine-hours Scheduling and setup $ 290,000 580 setups Material handling $ 795,000 1,590,000 pounds of material The company manufactures three models of water basins (Oval, Round, and Square). The plans for production for the next year and the budgeted direct costs and activity by product line are as follows. Products Oval Round Square Total direct costs (material and labor) $80,000 $80,000 $70,000 Total machine-hours 30,000 10,000 22,000 Total number of setups 60 300 220 Total pounds of material 490,000 290,000 810,000 Total direct labor-hours 3,500 2,000 4,500 Number of units produced 4,400 2,000 6,000 Required: (Do not…arrow_forward

- Requlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure, Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 242,400 $ 114,400 86,000 $ 302,400 Expected Activity 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 Product Z 3,800 180 1. 3,800 8,200 4. What is the activity rate for the Machine Setups activity cost pool? 灣灣彩 Activity rate per setup 15 of 15 Axt > < Prev 4 5 9. 92 F AQI…arrow_forwardAccountingarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Variable and Absorption Costing-Service CompanyJensen's Tailoring provides custom tailoring services. After the company's first year of operations, its owner prepared the following summarized data report: Sales (500 completed jobs) $100,000 Tailoring costs (550 jobs) Direct labor 47,000 Manufacturing overhead Variable 12,000 Fixed 9,000 Operating expenses Variable 5,600 Fixed 5,800 a. Prepare an income statement based on full absorption costing. b. Prepare an income statement based on variable costing. c. Assume that you must decide quickly whether to accept a special one-time order to alter 50 band costumes for $125 per costume.Which income statement…arrow_forward

- Foam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Activity Rate $ 11 per direct labor-hour $ 93 per batch $ 290 per order $ 2,611 per customer Number of batches Number of orders Number of customers The company just completed a single order from Interstate Trucking for 1,900 custom seat cushions. The order was produced in five batches. Each seat cushion required 0.4 direct labor-hours. The selling price was $142.20 per unit, the direct materials cost was $111 per unit, and the direct labor cost was $14.60 per unit. This was Interstate Trucking's only order during the year. Requirec: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forwardSaratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs: Number of employees Average salary per employee 11 $ 27,000 Weeks of employment per year Hours worked per week 52 40 Practical capacity percentage 85% Requisition Minutes per unit of the activity Processing 15 Bid Evaluation Inspection 45 30 Job X Job Y Job Z Number of requisitions processed Number of bid evaluations 6 3 2 4 3 5 Number of inspections 7 3 7 Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job…arrow_forwardJob Order Costing for a Service Company The Fly Company provides advertising services for clients across the nation. The Fly Company is presently working on four projects, each for a different client. The Fly Company accumulates costs for each account (client) on the basis of both direct costs and allocated indirect costs. The direct costs include the charged time of professional personnel and media purchases (air time and ad space). Overhead is allocated to each project as a percentage of media purchases. The predetermined overhead rate is 45% of media purchases. On August 1, the four advertising projects had the following accumulated costs: August 1 Balances $59,100 17,700 41,400 25,400 $143,600 Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages Total During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts: Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education