FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

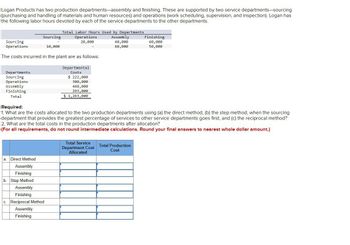

Transcribed Image Text:Logan Products has two production departments-assembly and finishing. These are supported by two service departments-sourcing

(purchasing and handling of materials and human resources) and operations (work scheduling, supervision, and inspection). Logan has

the following labor hours devoted by each of the service departments to the other departments.

Total Labor Hours Used by Departments

Sourcing

Operations

Sourcing

10,000

Operations

20,000

The costs incurred in the plant are as follows:

Departments

Sourcing

Operations

Assembly

Departmental

Costs

$ 222,000

300,000

Assembly

40,000

60,000

Finishing

60,000

50,000

Finishing

Total

Required:

448,000

293,000

$ 1,263,000

1. What are the costs allocated to the two production departments using (a) the direct method, (b) the step method, when the sourcing

department that provides the greatest percentage of services to other service departments goes first, and (c) the reciprocal method?

2. What are the total costs in the production departments after allocation?

(For all requirements, do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

Total Service

Department Cost Total Production

Allocated

Cost

a. Direct Method

Assembly

Finishing

b. Step Method

Assembly

Finishing

c. Reciprocal Method

Assembly

Finishing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Blinks 984 2 7 Dinks 2,096 8 7 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $107,300. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $85,100. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks isarrow_forwardMartay Creations produces winter scarves. The scarves are produced in the Cutting and Sewing departments. The Maintenance and Security departments support these production departments, and allocate costs based on machine hours and square feet, respectively. Information about each department is provided in the following table: Department Total Cost Number of Employees Machine Hours Square Feet Maintenance Department $2,200 5 40 600 Security Department 4,500 3 0 500 Cutting Department 21,200 21 3,600 2,400 Sewing Department 24,900 19 5,400 3,000 Using the sequential method and allocating the support department with the highest costs first, allocate all support department costs to the production departments. Then compute the total cost of each production department. Line Item Description CuttingDepartment SewingDepartment…arrow_forwardAleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor Hoursper Unit Machine Hoursper Unit Rings 1,080 7 7 Dings 2,050 5 9 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $84,700. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $72,600. Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The Assembly Department's factory overhead rate isarrow_forward

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Number of Direct Labor Hours Per Unit Product Units Blinks Dinks 1,101 2,269 3 4 Machine Hours Per Unit 8 5 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $80,200. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $102,700. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks is Oa. $308.12 Ob. $23.17 Oc. $44.34 Od. $59.10arrow_forwardAleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number of Units Rings 910 3 Dings 2,270 9 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $85,800. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $70,800. Direct Labor Hours per Unit 6 5 Oc. $3.70 per direct labor hour Od. $4.21 per direct labor hour Machine Hours per Unit Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The Assembly Department's factory overhead rate is Oa. $4.48 per machine hour Ob. $4.10 per machine hourarrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Assembly Department $280,000 Testing Department 800,000 Total $1,080,000 Direct machine hours were estimated as follows: Assembly Department 4,000 hours Testing Department 5,000 Total 9,000 hours In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: Commercial Residential Assembly Department 2.0 dmh 3.0 dmh Testing Department 6.0 1.5 Total machine hours per unit 8.0 dmh 4.5 dmh…arrow_forward

- Aleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Rings 1,120 5 5 Dings 2,320 7 7 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $84,400. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $70,600. Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The total factory overhead allocated per unit of Dings is a.$49.63 b.$35.45 c.$45.06 d.$3.75arrow_forwardAleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Rings 1,000 5 7 Dings 2,740 7 10 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $89,300. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $65,100. Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The total factory overhead allocated per unit of Rings is a.$31.65 b.$3.44 c.$44.83 d.$41.28arrow_forwardThe Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $489,600 are allocated on the basis of machine hours. The Accounting Department's costs of $122,400 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $210,000 and $410,000, respectively. Maintenance Accounting A B Machine hours 895 80 2,400 320 Number of employees 2 2 8 4 What is the Maintenance Department's cost allocated to Department A using the direct method? Note: Do not round intermediate calculations.arrow_forward

- Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows:Indirect labor $507,000Cutting Department 156,000Finishing Department192,000 ________Total $855,000 _______ The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows:Activity Budgeted Activity Cost Activity BaseProduction control $237,000 Number of production runsMaterials handling 270,000 Number of moves ________Total $507,000 ________ ________The activity-base usage quantities and units produced for the two products follow:Instructions1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is…arrow_forwardA-2arrow_forwardReady Company has two operating (production) departments: Assembly and Painting. Assembly has 210 employees and occupies 56,400 square feet; Painting has 140 employees and occupies 37,600 square feet. The company has indirect expenses that consist of administrative expenses of $87,000 and maintenance expenses of $105,000. Administrative expenses are allocated based on the number of workers in each department and maintenance is allocated based on square footage. The amount of maintenance expenses that should be allocated to the Assembly Department for the current period is: Multiple Choice O $52,200. O $63,000. O $115,200. O $115,950. O $126,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education