Concept explainers

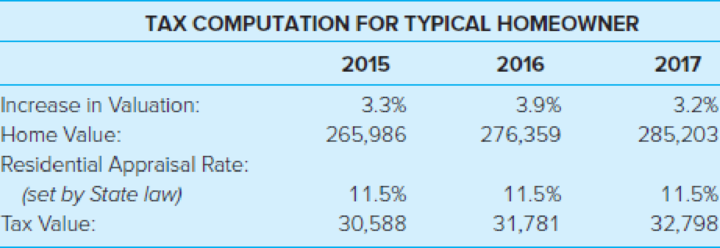

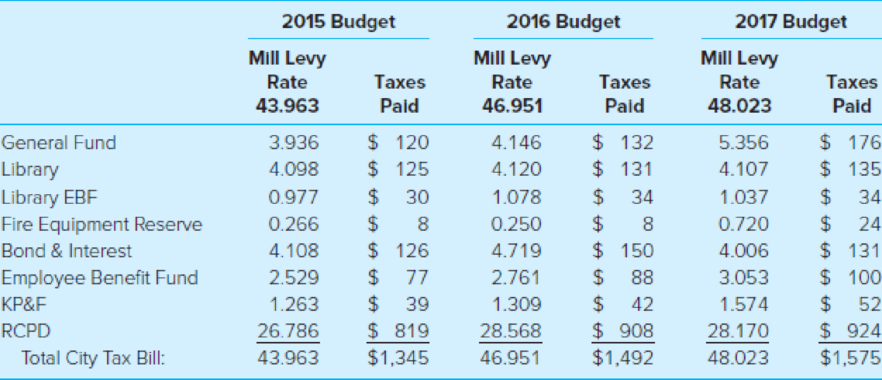

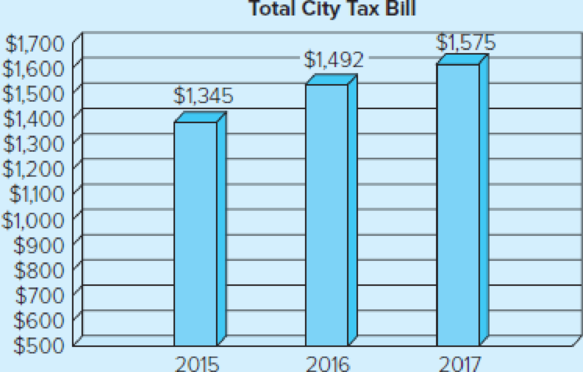

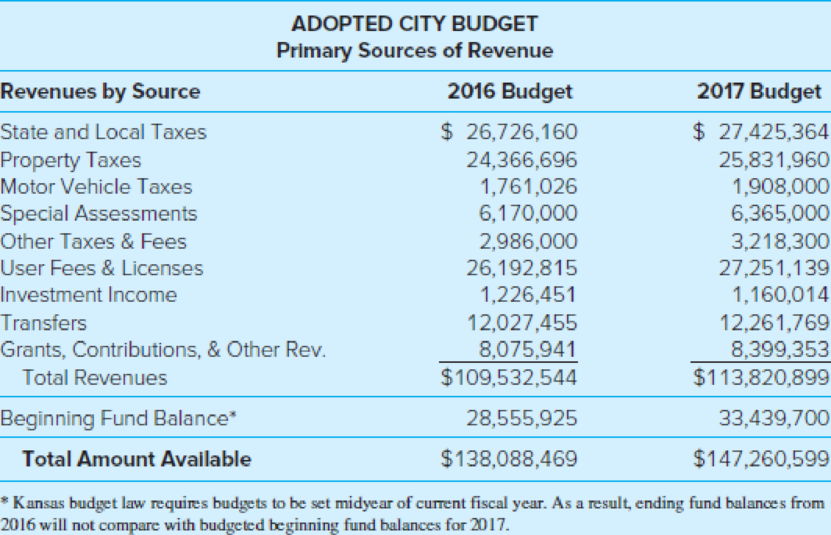

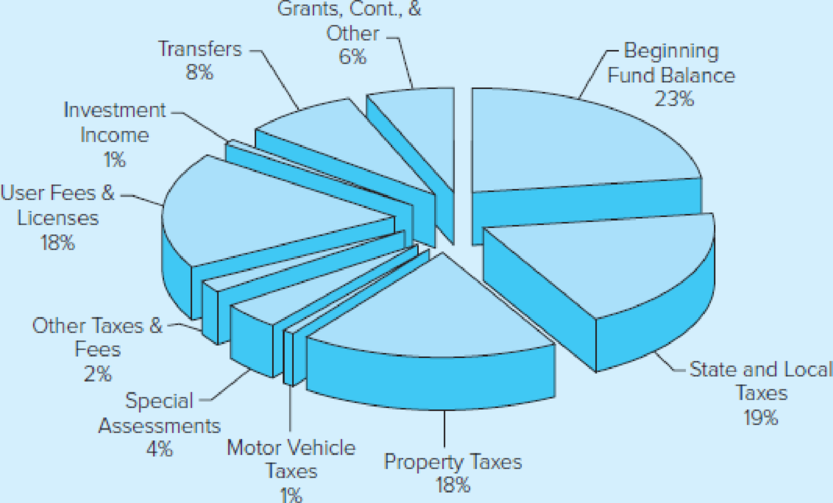

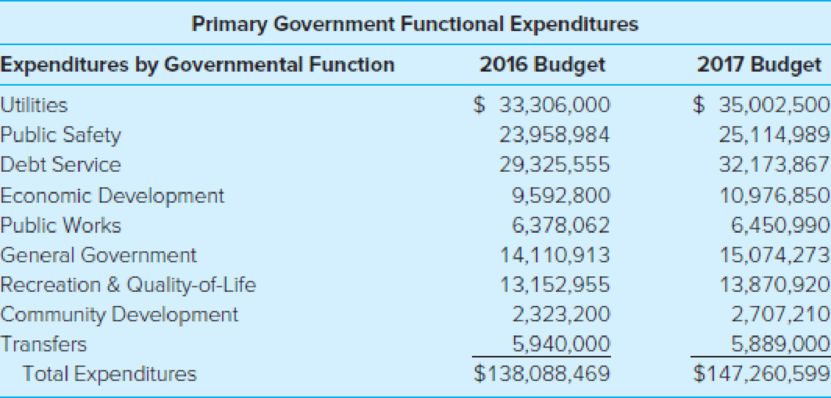

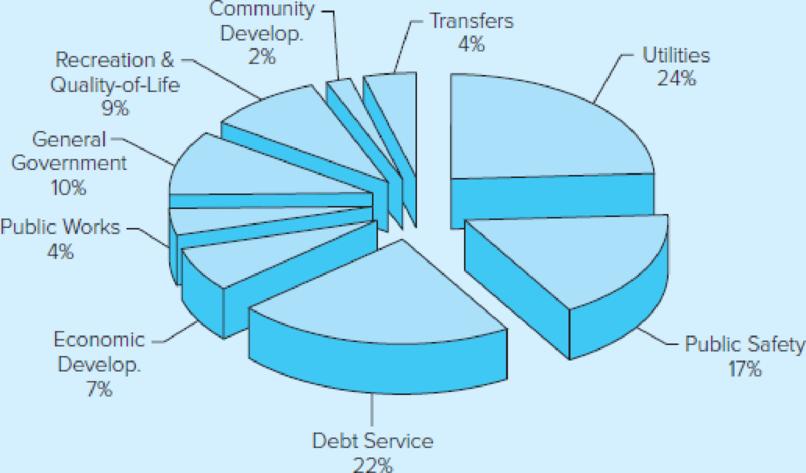

The City of Manhattan, Kansas, prepares an annual Budget Book, a comprehensive document that includes a citywide budget, as well as department budgets. The city has received the GFOA Distinguished Budget Award for more than 25 years. Following are graphical excerpts from the 2017 Budget Book that disclose typical taxpayer tax payments and primary revenue sources and functional expense categories.

Required

- a. Examine the taxpayer calculation for the three-year period. What observations can you make from this illustration? What questions might you ask city budget officials at a public budget hearing?

- b. Examine the pie charts and data provided for revenue sources and functional expenses. What are the primary revenue sources? What are the greatest expenditure categories? Taken together, do you have any questions regarding the city’s finances?

- c. As a citizen, did you find these illustrations user-friendly and relevant?

State & Local Sales Taxes: Includes city/county sales taxes, and franchise fees

Property Taxes: Includes ad valorem, delinquent taxes, and PILOT’s

User Fees & Licenses: Includes licenses & permits, services and sales, program revenue, utility sales, and fines

Investment Income: Includes land rent, farm income, and misc. investment income

Transfers: Includes transfers for utility administrative services, sales tax, debt service, etc.

Grants, Cont., & Other Rev.: Includes contributions, grants, and misc. revenues

Utilities: Includes Water, Wastewater, and Stormwater operations

Public Safety: Includes Fire Operations, Administration, Technical Services, Building Maintenance, Fire Equipment Reserve, Fire Pension K. P. & F., and R.C.P.D

Debt Service: Includes all long-term debt payments

Economic Development: Includes General Improvement, Industrial Promotion, Economic Development Opportunity Fund, CIP Reserves, and Downtown Redevelopment T.I.F.

Public Works: Includes Admin., Streets, Engineering, Traffic, and Special Street & Highway

General Government: Includes General Government, Finance, Human Resources, Airport, Court, General Services, Outside Services, Municipal Parking Lot, City University Fund, Employee Benefits, and Special Alcohol Programs

Recreation & Quality-of-Life: Parks & Recreation, Zoo, Pools, Flint Hills Discovery Center, Library, and Library Employee Benefits

Community Development: Administration and Planning, Business Districts, and Tourism & Convention Fund

Transfers: Includes transfers from Sales Tax to General Fund and Special Revenue Funds

Source: City of Manhattan, Kansas, 2017 Budget Book, pp. 46-49.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Accounting For Governmental & Nonprofit Entities

- Prepare entries to record the following events and transactions for Tropical Township for the year 2018. The Township adopted a budget calling for appropriations of $360,000. The estimated revenues (all property taxes) were $350,000. The Township sent property tax bills amounting to $350,000 to property owners. Property owners paid $339,000 of property taxes to the Township. A purchase order of $25,000 was sent to a vendor of supplies. The supplies ordered in transaction d. were received in good order and the accompanying invoice of $24,000 was approved. Below are the names to use for the entries: Appropriations Budgetary fund balance Cash Property tax receivable Revenue – property tax Estimated revenue – property tax Encumbrances Expenditures – supplies Budgetary fund balance reserved for encumbrances (BFBRFE) Vouchers payable Transaction (letter) Account Debit Creditarrow_forwardBudget planners for a certain community have determined that $6,391,000 will be required to provide all government services next year. The total assessed property value in the community is $110,000,000. What tax rate is required to meet the budgetary demands? (Express your answer as a tax rate per $100 to two decimal places rounded up.) ______arrow_forwardPreparation of financial statements and interpretation of operating results Below is the December 31, 2022 trial balance for Radnor City's General Fund. Trial Balance Account Debit Credit Estimated revenues-property taxes $500,000 Estimated revenues-intergovernmental 150,000 Estimated revenues-licenses and fees 100,000 Estimated revenues-fines 50,000 Budgetary fund balance Appropriations-general government 10,000 $159,000 Appropriations-parks and recreation 175,000 Appropriations-public safety 446,000 Appropriations-social services 30,000 Expenditures-public safety 441,000 Expenditures-general government 150,500 Expenditures-parks and recreation 170,500 Expenditures-social services 27,000 Cash 35,600 Property taxes receivable 67,200 Tax anticipation notes payable 10,000 Interest payable 800 Revenues-property taxes 497,000 Revenues-intergovernmental 154,000 Revenues-licenses and fees 99,000 Revenues-fines 48,000 Fund balance 62,000 Vouchers payable 21,000 Total $1,701,800 $1,701,800arrow_forward

- The general ledger of the County of Konstantin contains the following selected account balances: $91400 $35600 $16500 $5700 Appropriations Outstanding Encumbrances Expenditures Vouchers Payable Konstantin wants to order additional goods and services before the fiscal year end. What is the unencumbered balance (i.e., the remaining authority) of the budget that may be expended by Konstantin? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000.arrow_forwardThe City of Troy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $2,500,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $770,000 of cash on hand and $830,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $1,100,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 6 percent per annum to a local bank. Record the issuance of the tax anticipation notes in…arrow_forwardThe City of Iroy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $1,800,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $700,000 of cash on hand and $760,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $750,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 7 percent per annum to a local bank. Record the issuance of the tax anticipation notes in the…arrow_forward

- Edwards City has the following information for its general fund for the upcoming fiscal year. Which of the following would be the appropriate effect to budgetary fund balance when the budget is recorded? Estimated revenue Appropriations Property tax 3,500,000 Salaries 2,690,000 Sales tax 490,000 Capital items 1,320,000 Other 50,000 Other 15,000 None of these Credit budgetary fund balance $30,000 Credit budgetary fund balance $15,000 Debit budgetary fund balance $30,000arrow_forwardThe board of commissioners of Perry City approved the city budget for the year starting July 1, 2019, which indicated estimated revenue of $1,000,000 and appropriations of $900,000. When the city CLOSES OUT the budget at the end of the fiscal year, the entry would include: O A) a debit to Budgetary Fund Balance - Unassigned in the amount of $100,000. B) a credit to Budgetary Fund Balance – Unassigned in the amount of $100,000. C) a debit to Appropriations in the amount of $900,000. D) a debit to Estimated Revenues in the amount of $1,000,000. E) both A. and C.arrow_forwardThe City of Weston is preparing its budget for calendar year 2024. After estimating revenues from all other sources, the City calculates that it must raise $6,000,000 from property taxes. You are given the following information regarding the tax rate: Property taxes to be collected $6,000,000 Allowance for uncollectible property taxes= 5% of levy Total assessed value of property $84,000,000 Assessed value of City property, not subject to tax $1,100,000 Adjustments to assessed values for senior citizen exemptions $2,200,000 The Tax rate per $100 of net assessed valuation is:arrow_forward

- 1. The City of Access collects its annual property taxes late in its fiscal year. Consequently, cach year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, 2016, the City estimated that it will require OMR 2,500,000 to finance governmental activities for the remainder of the 2016 fiscal year. On that date, it had OMR 790,000 of cash on hand and OMR 830,000 of current liabilities. Collections for the remainder of FY 2016 from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at OMR 1,100,000. Required: Calculate the estimated amount of tax anticipation financing that will be required for the remainder of FY 2016. Show work in good form.arrow_forwardPrepare journal entries in general journal format to record the following transactions for the City of Dallas General Fund (subsidiary detail may be omitted) 1. The budget prepared for the fiscal year included total estimated revenues of $4,693,000, appropriations of $4,686,000 and estimated other financing uses of $225,000. 2. Purchase orders in the amount of $451,000 were mailed to vendors. 3. The current year’s tax levy of $4,005,000 was recorded; uncollectible taxes were estimated to be 2% of the tax levy. 4. Collections of delinquent taxes from prior years’ levies totaled $82,700; collections of the current year’s levy totaled $3,524,900. 5. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in transaction (#2) of this problem. The estimated liability for the related items was $351,200. Actual invoices were $353,500. 6. Revenue other than taxes collected during the year consisted of licenses and permits, $177,600;…arrow_forwardBudget planners for a certain community have determined that $9,235,400 will be required to provide all government services next year. The total assessed property value in the community is $122,500,000. What tax rate is required to meet the budgetary demands? (Express your answer as a tax rate per $100 and round to the nearest hundredth)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education