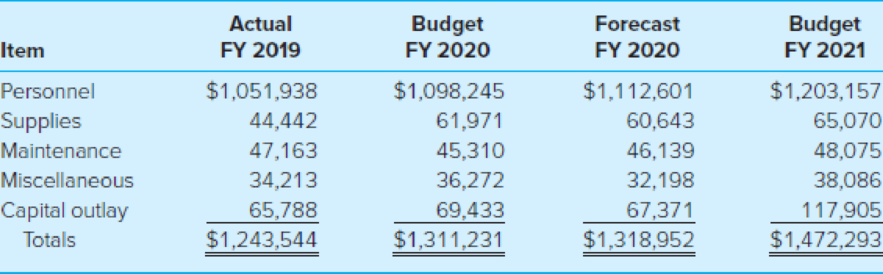

The police chief of the Town of Meridian submitted the following budget request for the police department for the forthcoming budget year 2020–2021.

Upon questioning by the newly appointed town manager, a recent masters graduate with a degree in public administration from a nearby university, the police chief explained that he had determined the amounts in the budget request by multiplying the prior year’s budget amount by 1.05 (to allow for the expected inflation rate of 5 percent). In addition, the personnel category includes a request for a new uniformed officer at an estimated $50,000 for salary, payroll expenses, and

Required

- a. Evaluate the strengths and weaknesses of the police chief’s argument that his budget request is reasonable.

- b. Are the town manager’s instructions reasonable? Explain.

- c. Would the town council likely support the town manager or the police chief in this dispute, assuming the police chief might take his case directly to the town council?

- d. What other improvements could be made to the town’s budgeting procedures?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Accounting For Governmental & Nonprofit Entities

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education