FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Preparation of financial statements and interpretation of operating results

Below is the December 31, 2022 trial balance for Radnor City's General Fund.

Trial Balance

Account

Debit

Credit

Estimated revenues-property taxes

$500,000

Estimated revenues-intergovernmental

150,000

Estimated revenues-licenses and fees

100,000

Estimated revenues-fines

50,000

Budgetary fund balance

Appropriations-general government

10,000

$159,000

Appropriations-parks and recreation

175,000

Appropriations-public safety

446,000

Appropriations-social services

30,000

Expenditures-public safety

441,000

Expenditures-general government

150,500

Expenditures-parks and recreation

170,500

Expenditures-social services

27,000

Cash

35,600

Property taxes receivable

67,200

Tax anticipation notes payable

10,000

Interest payable

800

Revenues-property taxes

497,000

Revenues-intergovernmental

154,000

Revenues-licenses and fees

99,000

Revenues-fines

48,000

Fund balance

62,000

Vouchers payable

21,000

Total

$1,701,800 $1,701,800

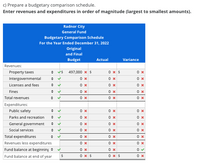

Transcribed Image Text:C) Prepare a budgetary comparison schedule.

Enter revenues and expenditures in order of magnitude (largest to smallest amounts).

Radnor City

General Fund

Budgetary Comparison Schedule

For the Year Ended December 31, 2022

Original

and Final

Budget

Actual

Variance

Revenues:

Property taxes

497,000 x $

0 x $

Intergovernmental

Licenses and fees

Fines

Total revenues

0 x

0 x

Expenditures:

Public safety

0 x

0 x

Parks and recreation

0 x

General government

0 x

0 x

Social services

Total expenditures

0 x

Revenues less expenditures

Fund balance at beginning +

0 x

Fund balance at end of year

$4

0 x $

0 x $

0 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- please do not give images formatarrow_forwardScenario and General Fund budgetary journal entries The scenario: Croton City maintains four governmental-type funds: a General Fund, a Library Special Revenue Fund, a Capital Projects Fund, and a Debt Service Fund. Croton City started its calendar year 2019 with the following General Fund balances (all numbers are in thousands of dollars). Debits Credits Cash $1,800 Property taxes receivable 800 Salaries payable $700 Deferred property tax revenues 300 Unassigned fund balance - 1,600 Totals $2,600 $2,600 Croton has adopted the following budgetary and accounting policies: Encumbrance accounting is used only for the acquisition of supplies and for the award of contracts for construction and construction-related activities. Open encumbrances lapse at the end of the year, but are considered in developing the next year's budget. Because final income tax returns are not required to be filed until April 15 of the year following the end of a calendar…arrow_forwardDuring January 2023, General Fund supplies ordered in the previous fiscal year and encumbered at an estimated amount of $2,000 were received at an actual cost of $2,200. The entry to record this transaction will require a debit to: Multiple Choice Expenditures-2023 in the amount of $200. Expenditures-2023 in the amount of $2,200. Expenditures-2022 in the amount of $200. Expenditures-2022 in the amount of $2,200.arrow_forward

- The City of Wolfe issues its financial statements for Year 4 (assume that the city uses a calendar year). The city’s general fund is composed of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for an art museum. The city also has one discretely presented component unit. The government-wide financial statements indicate the following Year 4 totals. Education had net expenses of $698,000. Parks had net expenses of $113,000. Art museum had net revenues of $59,250. General revenues were $977,750. The overall increase in net position for the city was $226,000. The fund financial statements for Year 4 indicate the following: The general fund had an increase of $47,750 in its fund balance. The capital projects fund had an increase of $45,500 in its fund balance. The enterprise fund had an increase of $90,000 in its net position balance. Officials for the City of…arrow_forwardPreparation of appropriations ledger The following transactions and events occurred in Marilyn County during calendar year 2019: 1. The legislature adopted the following budget: Estimated revenues and other sources: Property taxes $1,740,000 Sales taxes 1,000,000 Use of fund balance 10,000 Total $2,750,000 Appropriations: General government—salaries $ 420,000 General government—supplies 30,000 Parks department—salaries 2,000,000 Parks department—plants and supplies 300,000 Total $2,750,000 2. The Parks department placed PO 2019-1 for shrubbery in the amount of $52,000 and PO 2019-2 for gardening supplies in the amount of $11,000. The orders were charged to the appropriation for Parks department—plants and supplies. 3. The supplier delivered the shrubbery ordered on PO 2019-1; however, the supplier said he could not deliver some of the shrubs because he no longer carried them. The invoice for $49,000 was approved and forwarded to the comptroller’s…arrow_forwardCity of Smithville General Fund Operating statement account balances For year 2023 Estimated Revenues Dr(Cr) Revenues Dr(Cr) Balance Dr(Cr) Acct 3020/4020 Estimated Revenues-Property Taxes $1,877,413 $1,877,578 ($165) Acct 3030/4030 Estimated Revenues-Sales Taxes 1,578,000 1,579,203 (1,203) Acct 3040/4040 Estimated Revenues-Interest and Penalties on Taxes 15,000 12,571 2,429 Acct 3050/4050 Estimated Revenues-Licenses and Permits 500,000 497,960 2,040 Acct 3060/4060 Estimated Revenues-Fines and Forfeits 175,000 173,590 1,410 Acct 3070/4070 Estimated Revenues-Intergovernmental Revenue 789,000 789,000 0 Acct 3080/4080 Estimated Revenues-Charges for Services 659,720 661,253 (1,533) Acct 3090/4090 Estimated Revenues-Miscellaneous Revenues 91,300 91,250 50 Encumberances Dr(Cr) Expenditures Dr(Cr) Appropriations Cr(Dr) Available Balance Cr(Dr) Acct 5020 / 6020 / 7020 Appropriations-General…arrow_forward

- A county's general fund has $4,000,000 in supplies on hand at the beginning of 2020. It purchases $25,000,000 in supplies and uses supplies costing $26,000,000 during 2020. If the county uses the consumption method to report supplies inventories, what balances appear in the general fund financial statements for 2020? Multiple Choice Expenditures of $26,000,000 and fund balance-nonspendable of $3,000,000 Expenditures of $25,000,000 and fund balance--unassigned of $3,000,000 Expenditures of $25,000,000 and fund balance-nonspendable of $3,000,000 Expenditures of $26,000,000 and fund balance--unassigned of $3,000,000arrow_forwardces Following are transactions and events of the General Fund of the City of Springfield for the fiscal year ended December 31, 2020. 1. Estimated revenues (legally budgeted) Property taxes Sales taxes Licenses and permits Miscellaneous 2. Appropriations: General government Culture and recreation Health and welfare. 3. Revenues received (cash) Property taxes Sales taxes Licenses and permits General government Culture and recreation Health and welfare. 5. Goods and services received (paid in cash) General government culture and recreation Health and welfare Miscellaneous 4. Encumbrances issued (includes salaries and other recurring items) Estimated $5,275,000 4,630,000 995,000 6. Budget revisions Estimated Revenues Appropriations Increase appropriations: General government $ 140,000 110,000 Culture and recreation. 7. Fund balance on January 1, 2020, was $753,000. There were no outstanding encumbrances at that date. a. Record the transactions using appropriate journal entries, b. Prepare…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education