Concept explainers

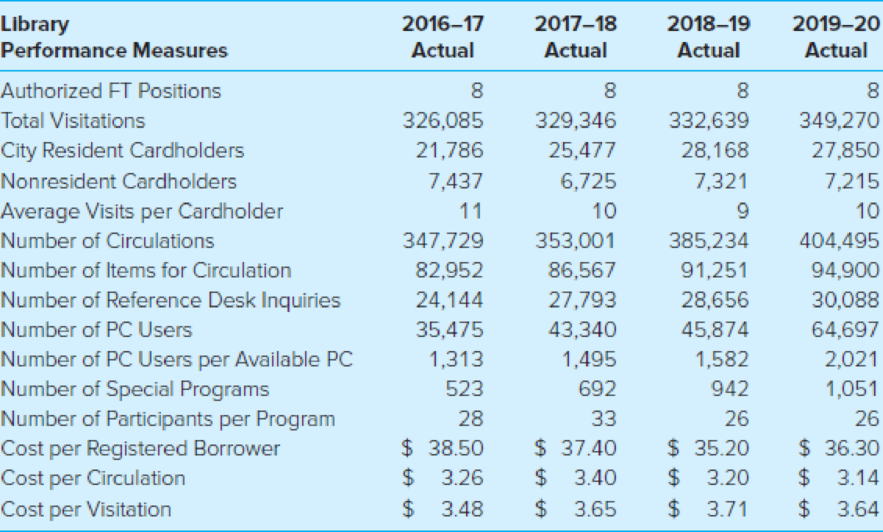

The City of Ashcroft has produced a Service Efforts and Accomplishments report for the past four years in an attempt to answer the question “How are we doing?” for its citizens. Reproduced here is an excerpt from the 2016–2020 SEA report that details library services. The report shows the efforts of library staff to offer more library programs to the increasing population and customer base in the city. Program participation has seen steady increases over the past four years, with some programs so high in demand waiting lists to participate are starting to occur.

Citizen Perceptions

The 2018 community survey reported that 86 percent of city residents rated library services as “good” or “excellent,” only marginally down from 88 percent in 2016. For the variety of materials at the library, 79 percent of citizens rated the variety as “good” or “excellent,” unchanged from 2016.

Library Budget

The owner of a house with a total assessed valuation of $200,000 paid property taxes of $67 in FY 2020 to support the library. Twenty-six percent (26%) of the library’s FY 2020 budget depends upon support from Fairview County in return for services provided to rural Polk County residents. Fairview County’s support is expected to decrease after FY 2020. Options being considered to offset the loss of county funding include allocation of General Fund monies and/or reduction in library services.

Source: SEA reports issued by the City of Ankeny, Iowa.

Required

- a. Which of the performance measures best represents inputs, outputs, and outcomes?

- b. How does the city demonstrate that its financial resources are used efficiently?

- c. How would you address a citizen who feels he or she is not getting his or her money’s worth?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Accounting For Governmental & Nonprofit Entities

- Cobalt Industries Ltd. is a company engaged in manufacturing and sale of electronic components. The trial balance of Cobalt Industries Ltd as at 31st December 2024 is as follows: Debit £'000 Credit £'000 Sales revenue 400 Purchases 300 Inventory (as of 31st Jan. 2024) 20 Admin & Distribution expenses 140 Loan interest expense 6 Loan 50 Payables 20 Receivables 30 Share capital 150 Dividends 12 Retained profits (as of 1st Jan. 2024) 50 Bank balance 27 Machinery 150 Share premium (as of 1st Jan. 2024) 11 Office furniture 30 Computer 5 Motor vehicle 15 708 708 Additional information: • The company owes £3,000 for unpaid electricity bill at the year end, which has not been included in the trial balance. This expense was not included in the admin & distribution expenses. The company paid £12,000 for insurance, which cover a 12-month period starting from 1st November 2024. This figure was included in the admin & distribution expenses. • Taxation to be accrued is £22,000. • The closing…arrow_forwardKindly help me with accounting questionsarrow_forward4 PTSarrow_forward

- tutor solve account questions. no ai strictlyarrow_forwardIn June, Jose Hebert's Beauty Salon gave 4,360 haircuts, shampoos, and permanents at an average price of $36. During the month, fixed costs were $17,700 and variable costs were 72% of sales. Determine the contribution margin in dollars, per unit, and as a ratio. Find out correct answersarrow_forwardChalen include in her gross income?arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning