Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.46P

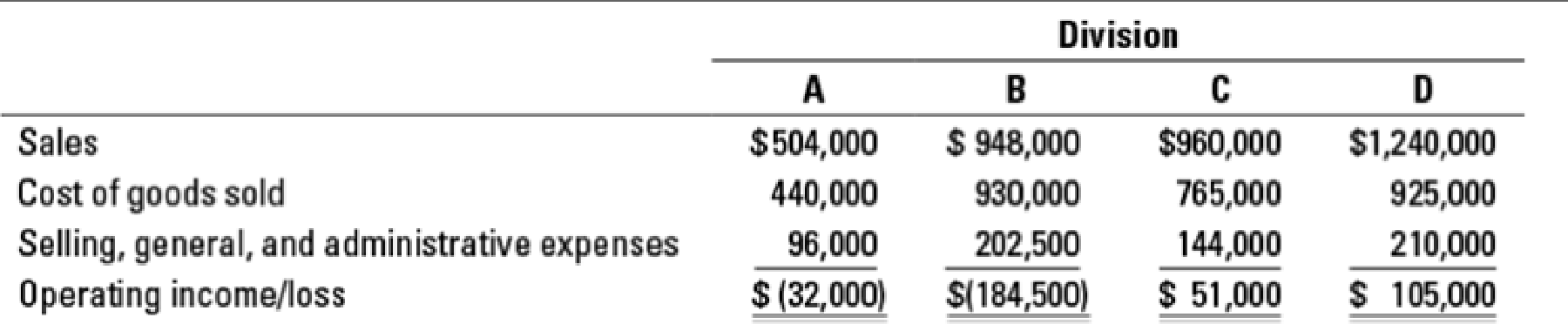

Closing down divisions. Ainsley Corporation has four operating divisions. The budgeted revenues and expenses for each division for 2017 follows:

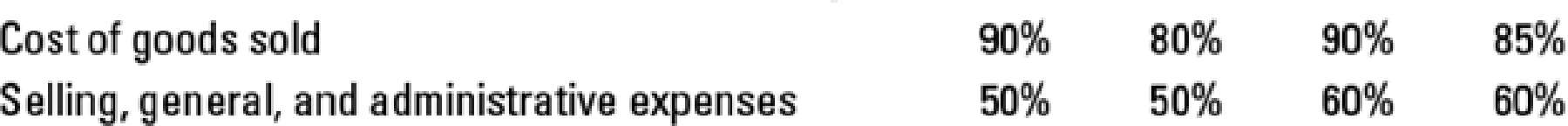

Further analysis of costs reveals the following percentages of variable costs in each division:

Closing down any division would result in savings of 40% of the fixed costs of that division.

Top management is very concerned about the unprofitable divisions (A and B) and is considering closing them for the year.

- 1. Calculate the increase or decrease in operating income if Ainsley closes division A.

Required

- 2. Calculate the increase or decrease in operating income if Ainsley closes division B.

- 3. What other factors should the top management of Ainsley consider before making a decision?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Leslie Corporation uses both ROI and residual income (RI) to measure performance. One of the company's divisions currently has $480,000 of capital invested

in assets and is expected to earn operating income of $120,000 in the current period. The division is considering an investment in new equipment costing

$345,000 that will likely increase its annual operating income by $45,000. The minimum ROI for all divisions within the company is 9%. 1. If the division does

not purchase the equipment, its estimated ROI will be

%. 2. If the division invests in the equipment, its ROI will likely decrease to

%. 3. If the division does not purchase the equipment, its estimated RI will be $

4. If the division invests in the

equipment, its RI will likely increase to $

A study has been conducted to determine if one of the departments in Parry Company should be discontinued.

The contribution margin in the department is $40,000 per year. Fixed expenses charged to the department are

$65,000 per year. It is estimated that $30,000 of these fixed expenses could be eliminated if the department is

discontinued. These data indicate that if the department is discontinued, the company's overall net operating

income would: Oa. decrease by $15,000 per year. Ob. decrease by $10,000 per year. c. increase by $10,000

per year. Od. increase by $15,000 per year.

The South Division of Wiig Company reported the following data for the current year.

Sales

Variable costs

Controllable fixed costs

Average operating assets

$2,950,000

1,947,000

2.

595,000

Top management is unhappy with the investment center's return on investment (ROI). It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager

believes it is feasible to consider the following independent courses of action.

3.

5,000,000

1. Increase sales by $300,000 with no change in the contribution margin percentage.

Reduce variable costs by $155,000.

Reduce average operating assets by 4%.

(a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places, e.g. 1.57%)

Chapter 11 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 11 - Prob. 11.1QCh. 11 - Define relevant costs. Why are historical costs...Ch. 11 - All future costs are relevant. Do you agree? Why?Ch. 11 - Distinguish between quantitative and qualitative...Ch. 11 - Describe two potential problems that should be...Ch. 11 - Variable costs are always relevant, and fixed...Ch. 11 - A component part should be purchased whenever the...Ch. 11 - Prob. 11.8QCh. 11 - Managers should always buy inventory in quantities...Ch. 11 - Management should always maximize sales of the...

Ch. 11 - Prob. 11.11QCh. 11 - Cost written off as depreciation on equipment...Ch. 11 - Managers will always choose the alternative that...Ch. 11 - Prob. 11.14QCh. 11 - Prob. 11.15QCh. 11 - Qualitative and quantitative factors. Which of the...Ch. 11 - Special order, opportunity cost. Chade Corp. is...Ch. 11 - Prob. 11.18MCQCh. 11 - Keep or drop a business segment. Lees Corp. is...Ch. 11 - Relevant costs. Ace Cleaning Service is...Ch. 11 - Disposal of assets. Answer the following...Ch. 11 - Relevant and irrelevant costs. Answer the...Ch. 11 - Multiple choice. (CPA) Choose the best answer. 1....Ch. 11 - Special order, activity-based costing. (CMA,...Ch. 11 - Make versus buy, activity-based costing. The...Ch. 11 - Inventory decision, opportunity costs. Best Trim,...Ch. 11 - Relevant costs, contribution margin, product...Ch. 11 - Selection of most profitable product. Body Image,...Ch. 11 - Theory of constraints, throughput margin, relevant...Ch. 11 - Closing and opening stores. Sanchez Corporation...Ch. 11 - Prob. 11.31ECh. 11 - Relevance of equipment costs. Janets Bakery is...Ch. 11 - Equipment upgrade versus replacement. (A. Spero,...Ch. 11 - Special order, short-run pricing. Diamond...Ch. 11 - Short-run pricing, capacity constraints. Fashion...Ch. 11 - International outsourcing. Riverside Clippers Corp...Ch. 11 - Relevant costs, opportunity costs. Gavin Martin,...Ch. 11 - Opportunity costs and relevant costs. Jason Wu...Ch. 11 - Opportunity costs. (H. Schaefer, adapted) The Wild...Ch. 11 - Make or buy, unknown level of volume. (A....Ch. 11 - Make versus buy, activity-based costing,...Ch. 11 - Prob. 11.42PCh. 11 - Product mix, special order. (N. Melumad, adapted)...Ch. 11 - Theory of constraints, throughput margin, and...Ch. 11 - Theory of constraints, contribution margin,...Ch. 11 - Closing down divisions. Ainsley Corporation has...Ch. 11 - Dropping a product line, selling more tours....Ch. 11 - Prob. 11.48PCh. 11 - Dropping a customer, activity-based costing,...Ch. 11 - Equipment replacement decisions and performance...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- st ↑ Ainsley Corporation has four operating divisions. The budgeted revenues and expenses for each division for 2020 follows: Closing down any division would result in savings of 40% of the fixed costs of that division. Top management is very concerned about the unprofitable divisions (A and B) and is considering closing them for the year. (Click to view the results of each division.) Read the requirements. Requirement 1. Calculate the increase or decrease in operating income if Ainsley closes division A. Begin by calculating Division A's contribution margin. Sales Contribution margin Requirements 1. Calculate the increase or decrease in operating income if Ainsley closes division A. Division A 2. Calculate the increase or decrease in operating income if Ainsley closes division B. 3. What other factors should the top management of Ainsley consider before making a decision? Print Done X Data table Sales Cost of goods sold Selling, general, and administrative expenses Operating…arrow_forwardThe background info is provided in the image attached. Solve the following: e) Recompute the break-even point in units, assuming that variable costs increased by 20% and fixed costs are reduced by $50,625. How will this impact the margin of safety ratio? f) The President of Buggs-Off is under pressure from shareholders to increase operating income by 20% in 2021. Management expects per unit data and total fixed costs to remain the same in 2021. Using the equation method, compute the number of units that would have to be sold in 2021 to reach the shareholder's desired profit level. Is this a realistic goal?arrow_forwardKatayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forward

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardThe Deluxe Division, a profit center of Riley Manufacturing Company, reported the following data for the first quarter of 2016:Sales $9,000,000Variable costs 6,300,000Controllable direct fixed costs 1,200,000Noncontrollable direct fixed costs 530,000Indirect fixed costs 300,000Instructions(a) Prepare a performance report for the manager of the Deluxe Division.(b) What is the best measure of the manager’s performance? Why?(c) How would the responsibility report differ if the division was an investment center?arrow_forwardThe Custodial Division of Clark's Corporate Services (CCS) has assets of $1.2 million. During the past year, the division had profits of $228,000. CCS has a cost of capital of 7.5 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Custodial Division. b. Compute the divisional RI for the Custodial Division. Complete this question by entering your answers in the tabs below. Required A Required B Compute the divisional ROI for the Custodial Division. Divisional ROI % Required A Required B >arrow_forward

- GGX is the general manager of the Jung Division, and his performance is measured using the residual income method. GGX is reviewing the following forecasted information for the division for next year. Category Amount (thousands) Working capital P 1,800 Revenue 30,000 Plant and equipment 17,200 To establish a standard of performance for the division’s manager using the residual income approach, four scenarios are being considered. Scenario 1 assumes an imputed interest charge of 12% and a target residual income of P1,500,000. Scenario 2 assumes an imputed interest charge of 15% and a target residual income of P2,000,000. Scenario 3 assumes an imputed interest charge of 18% and a target residual income of P1,250,000. Scenario 4 assumes an imputed interest charge of 10% and a target residual income of P2,500,000. What is the residual income for scenario 2?arrow_forwardf) The President of Buggs-Off is under pressure from shareholders to increase operating income by 20% in 2021. Management expects per unit data and total fixed costs to remain the same in 2021. Using the equation method, compute the number of units that would have to be sold in 2021 to reach the shareholders desired profit level. Is this a realistic goal? g) Briefly explain the impact of each of the following scenarios on the contribution margin per unit and the break-even point: (i) Sales volume increases (ii) Total fixed cost decreases (iii) Selling price per unit increases (iv) Variable cost per unit increasesarrow_forwardCost-plus, target pricing, working backward. The new CEO of Rusty Manufacturing has asked for a variety of information about the operations of the firm from last year. The CEO is given the following information, but with some data missing: Find (a) total sales revenue, (b) selling price, (c) rate of return on investment, and (d) markup percentage on full cost for this product. The new CEO has a plan to reduce fixed costs by $225,000 and variable costs by $0.30 per unit while continuing to produce and sell 500,000 units. Using the same markup percentage as in requirement 1, calculate the new selling price. Assume the CEO institutes the changes in requirement 2 including the new selling price. However, the reduction in variable cost has resulted in lower product quality resulting in 5% fewer units being sold compared with before the change. Calculate operating income (loss). What concerns, if any, other than the quality problem described in requirement 3, do you see in implementing the…arrow_forward

- Conner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows: Division 1: Sales: Expenses: Asset investment: $200,000 $150,000 $1,000,000 Division 2: Sales: $45,000 Expenses: $35,000 Asset investment: $200,000 Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"? Select one: O a. Division 1 O b. Division 2 O c. Both divisions have the same return on investment ratioarrow_forwardhe Pacific Division of Cullumber Industries reported the following data for the current year. Sales $4,179,930 Variable costs 2,625,000 Controllable fixed costs 825,000 Average operating assets 5,034,000 Top management is unhappy with the investment center’s return on investment. It asks the manager of the Pacific Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. 1. Increase sales by $425,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $145,986. 3. Reduce average operating assets by 4% (a) Compute the return on investment for the current year. (Round answers to 1 decimal place, e.g. 52.7%.) Return on investment enter the return on investment in percentages %arrow_forwardThe Hydride Division of Murdoch Corporation is an investment center. It has $1,000,000 of operating assets. During 2015, the Hydride Division earned operating income of $400,000 on $6,000,000 of sales. Murdoch's companywide return on investment or desired rate of return is approximately 10%. (Show work.) c. What is the turnover? d. What is the residual income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License