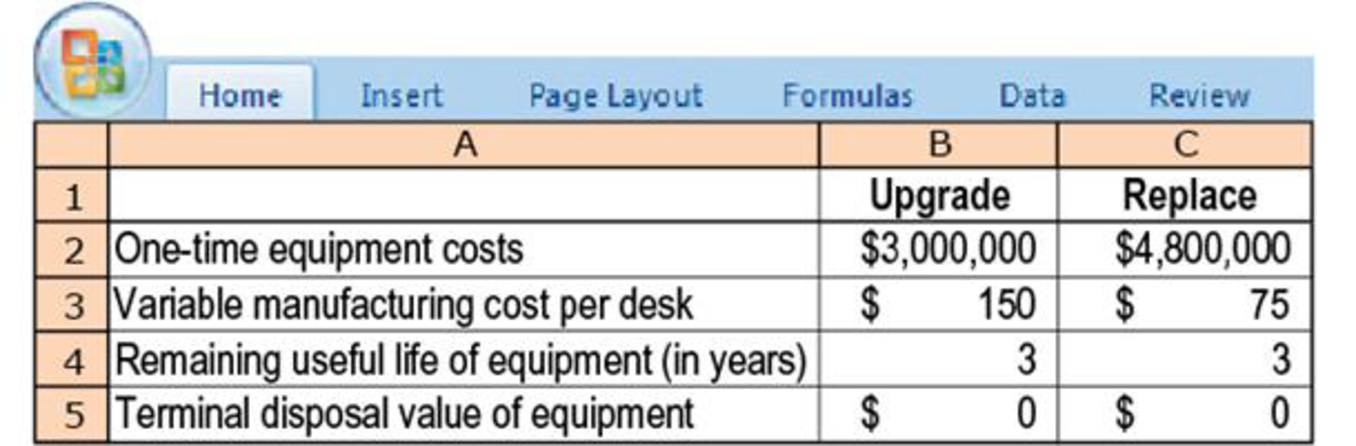

Equipment upgrade versus replacement. (A. Spero, adapted) The TechGuide Company produces and sells 7,500 modular computer desks per year at a selling price of $750 each. Its current production equipment, purchased for $1,800,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $450,000. However, the emergence of a new molding technology has led TechGuide to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives:

All equipment costs will continue to be depreciated on a straight-line basis. For simplicity, ignore income taxes and the time value of money.

- 1. Should TechGuide upgrade its production line or replace it? Show your calculations.

Required

- 2. Now suppose the one-time equipment cost to replace the production equipment is somewhat negotiable. All other data are as given previously. What is the maximum one-time equipment cost that TechGuide would be willing to pay to replace rather than upgrade the old equipment?

- 3. Assume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercise, but that the production and sales quantity is not known. For what production and sales quantity would TechGuide (i) upgrade the equipment or (ii) replace the equipment?

- 4. Assume that all data are as given in the original exercise. Dan Doria is TechGuide’s manager, and his bonus is based on operating income. Because he is likely to relocate after about a year, his current bonus is his primary concern. Which alternative would Doria choose? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)arrow_forwardNewmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?arrow_forwardCariTech (CT) Company produces and sells 7,000 Special purpose chairs per year at a selling price of $850 each. Its current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $500,000.However, the emergence of a new technology has led CT to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: A B c 1. Choice Upgrade Replace 2. One-time equipment costs $3,000,000 $4,800,000 3. Variable manufacturing cost per chair $150 $70 4. Remaining useful life of equipment (years) 3 3 5. Terminal disposal value of equipment 0 0 Required1) Should CT upgrade its production line or replace it? Show your calculations. 2) Suppose the one-time equipment cost to replace the…arrow_forward

- Cari Pump (CP) Company is considering either upgrading or replacing its production equipment. The company produces and sells annually 7,000 pumps at a selling price of $850 each. The current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old and is depreciated on a straight-line basis. Also, it has a terminal disposal value of $0 and a current disposal price of $500,000. The following table presents data for the two alternatives: A B C 1 Choice Upgrade Replace 2 One-time equipment costs $3,000,000 $4,800,000 3 Variable manufacturing cost per Pump $150 $70 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipment Required 0 0 A, Prepare a schedule, for the remaining 3 years, reflecting whether CP should upgrade its production line or replace it? Assume that the one-time equipment cost to replace the production equipment is negotiable and all…arrow_forwardCari Pump (CP) Company is considering either upgrading or replacing its production equipment. The company produces and sells annually 7,000 pumps at a selling price of $850 each. The current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old and is depreciated on a straight-line basis. Also, it has a terminal disposal value of $0 and a current disposal price of $500,000. The following table presents data for the two alternatives: A B C 1 Choice Upgrade Replace 2 One-time equipment costs $3,000,000 $4,800,000 3 Variable manufacturing cost per Pump $150 $70 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipment Required 0 0 PLEASE ONLY ANSWER PART 2 Prepare a schedule, for the remaining 3 years, reflecting whether CP should upgrade its production line or replace it? Assume that the one-time equipment cost to replace the production equipment…arrow_forwardDeCablo, Inc. owns a machine costing P105,000. This has an estimated useful life of 6 years with a scrap value of P15,000 depreciated using straight-line method. After using this for two (2) years the operating efficiency of the machine is decreasing. A repair cost amounting to P30,000 is needed to restore the machine to its normal capacity. The machine can be sold now to a ready buyer for P60,000. The management is contemplating to purchase a new machine now at a cost of P150,000 and can be depreciated over four (4) years with no salvage value using sum of year’s digit (SYD) method. After its economic life of 4 years its market value is P50,000. The company will incurs a shipping and installation of cost of P40,000 and an increase in working capital of P25,000. With this new machine, revenues is expected to increase by P125,000 and cash expenses due to this replacement will also increase by P60,000. Cost of capital is estimated to be 15% and corporate tax of 25% Required: Necessary…arrow_forward

- Sugar Sweet (SS) Company produces and sells 7,000 specialty Treats per year at a selling price of $850 each. Its current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $500,000. However, the emergence of a new technology has led SS to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: А В 1 Choice Upgrade Replace 2 One-time equipment costs $3,000,000 $4,800,000 3 Variable manufacturing cost per Treat $150 $70 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipmentarrow_forwardSugar Sweet (SS) Company produces and sells 7,000 specialty Treats per year at a selling price of $850 each. Its current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $500,000. However, the emergence of a new technology has led SS to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: A B C 1 Choice Upgrade Replace 2 One-time equipment costs $3,000,000 $4,800,000 3 Variable manufacturing cost per Treat $150 $70 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipment 0 0 4. Assume that all data are as given in the original exercise. Nick Son is SS’s manager, and his bonus is based on operating income. Because he is likely to relocate…arrow_forwardSugar Sweet (SS) Company produces and sells 7,000 specialty Treats per year at a selling price of $850 each. Its current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $500,000. However, the emergence of a new technology has led SS to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: A B C 1 Choice Upgrade Replace 2 One-time equipment costs $3,000,000 $4,800,000 3 Variable manufacturing cost per Treat $150 $70 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipment 0 0 Required (1) Should SS upgrade its production line or replace it? Show your calculations. (2) Suppose the one-time equipment cost to replace the production equipment…arrow_forward

- Sugar Sweet (SS) Company produces and sells 7,000 specialty Treats per year at a selling price of $850 each. Its current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $500,000. However, the emergence of a new technology has led SS to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: A B C 1 Choice Upgrade Replace 2 One-time equipment costs $3,000,000 $4,800,000 3 Variable manufacturing cost per Treat…arrow_forwardDeCablo, Inc. owns a machine costing P105,000. This has an estimated useful life of 6 years with a scrap value of P15,000 depreciated using straight line method. After using this for two (2) years the operating efficiency of the machine is decreasing. A repair cost amounting to P30,000 is needed to restore the machine to its normal capacity. The machine can be sold now to a ready buyer for P60,000. The management is contemplating to purchase a new machine now at a cost of P150,000 and can be depreciated over four (4) years with no salvage value using sum of year’s digit (SYD) method. After its economic life of 4 years its market value is P50,000. The company will incurs a shipping and installation of cost of P40,000 and an increase in working capital of P25,000. With this new machine, revenues is expected to increase by P125,000 and cash expenses due to this replacement will also increase by P60,000. Cost of capital is estimated to be 15% and corporate tax of 25% Required: Necessary…arrow_forwardAn assembly operation at a software company currently requires $100,000 per year in labor costs. A robot can be purchased and installed to automate this operation, and the robot will cost $200,000 with no MV at the end of its 10-year life. The robot, if acquired, will be depreciated using SL depreciation to a terminal BV of zero after 10 years. Maintenance and operation expenses of the robot are estimated to be $64,000 per year. Thecompany has an effective income tax rate of 40%. Invested capital must earn at least 8% after income taxes are taken into account. Solve, a. Use the IRR method to determine if the robot is a justifiable investment. b.If MACRS (seven-year recovery period) had been used in Part (a), would the after-tax IRR be lower or higher than your answer to Part (a)?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning