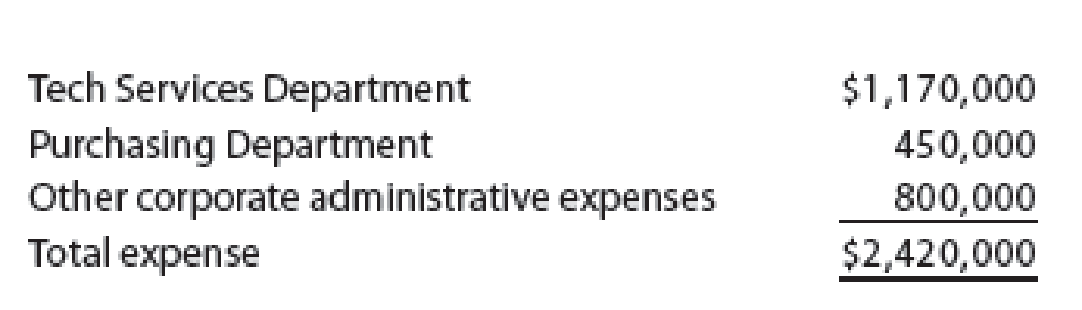

Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows:

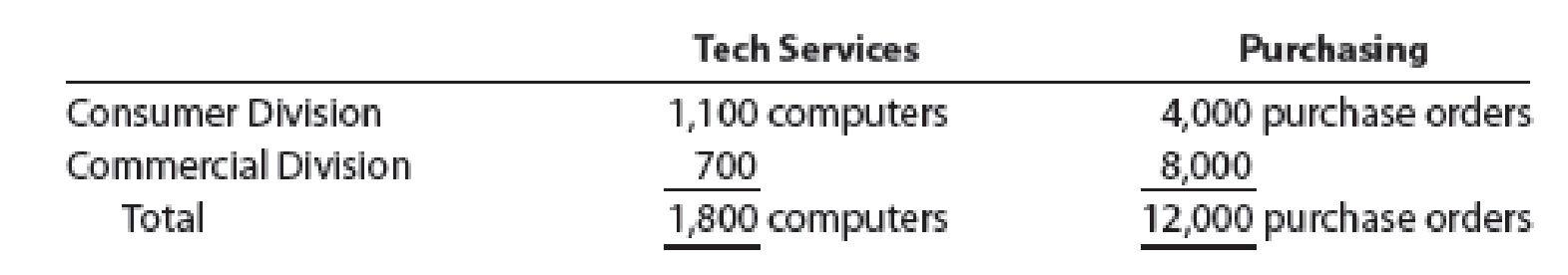

The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows:

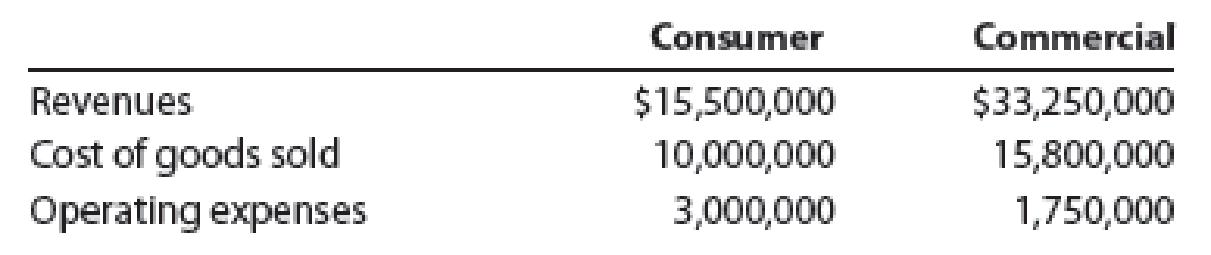

The support department allocations of the Tech Services Department and the Purchasing Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows:

Prepare the divisional income statements for the two divisions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- Varney Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services Department (CCS) costs to profit centers. The following table lists the types of services and cost drivers for each service. The table also includes the budgeted cost and quantity for each service for August. One of the profit centers for Varney Corporation is the Communication Systems (COMM) division. Assume the following information for COMM: COMM has 2,500 employees, of whom 20% are office employees. All of the office employees have been issued a smartphone, and 95% of them have a computer on the network. One hundred percent of the employees with a computer also have an email account. The average number of help desk calls for August was 0.6 call per individual with a computer. There are 400 additional printers, servers, and peripherals on the network beyond the personal computers. a. Compute the service allocation rate for each of CCSs services for August. b. Compute the allocation of CCSs services to COMM for August.arrow_forwardHorton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 2017, are as follows: Tech Services Department Purchasing Department $951,600 462,000 Other corporate administrative expenses Total expense 608,000 $2,021,600 The other corporate administrative expenses include officers' salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows: Consumer Division Commercial Division Total Tech Services 480 computers 300 780 computers Purchasing 5,400 purchase orders 10,000 15,400 purchase orders The support department allocations of the Tech Services Department and the Purchasing…arrow_forwardIn divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $64,560, and the Purchasing Department had expenses of $40,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial Government Contract Sales $2,000,000 $3,250,000 $2,900,000 Number of employees: Weekly payroll (52 weeks a year) 410 210 160 Monthly Payroll 75 35 15 Number of purchase requisitions per year 7,400 3,000 2,000 Determine the total dollar amount of payroll checks and purchase requisitions processed per year by the company and each division. Using the activity base…arrow_forward

- In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $90,784, and the Purchasing Department had expenses of $31,270 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $ 654,000 $ 866,000 $ 1,989,000 Number of employees: Weekly payroll (52 weeks per year) 250 80 85 Monthly payroll 28 39 26 Number of purchase requisitions per year 2,200 1,600 1,500 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial Government Contract…arrow_forwardIn divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $48,024, and the Purchasing Department had expenses of $22,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Line Item Description Residential Commercial Government Contract Sales $460,000 $609,000 $1,399,000 Number of employees: Weekly payroll (52 weeks per year) 110 85 90 Monthly payroll 30 41 28 Number of purchase requisitions per year 2,100 1,500 1,400 Required: a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Line Item Description Residential Commercial…arrow_forwardIn divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $63,568, and the Purchasing Department had expenses of $25,370 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $530,000 $703,000 $1,614,000 Number of employees: Weekly payroll (52 weeks per year) 145 65 70 Monthly payroll 34 45 32 Number of purchase requisitions per year 1,800 1,300 1,200 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial Government Contract Total…arrow_forward

- In divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $63,568, and the Purchasing Department had expenses of $25,370 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Government Residential Commercial Contract Sales $530,000 $703,000 $1,614,000 Number of employees: Weekly payroll (52 weeks per year) 145 65 70 Monthly payroll 34 45 32 Number of purchase requisitions per year 1,800 1,300 1,200 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Government Residential Commercial Total Contract Number of payroll checks: Weekly payroll Monthly payroll Total…arrow_forwardIn divisional income statements prepared for Lemons Company, the Payroll Department costs are allocated to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are allocated on the basis of the number of purchase requisitions. The Payroll Department had costs of $126,550 and the Purchasing Department had costs of $68,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $1,100,000 $1,760,000 $3,520,000 Number of employees: Weekly payroll (52 weeks per year) 410 190 280 Monthly payroll 95 200 110 Number of purchase requisitions per year 5,200 4,600 3,800 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial GovernmentContract Total Number of payroll…arrow_forwardService Department Charges In divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $75,400 and the Purchasing Department had expenses of $42,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial Government Contract Sales $1,000,000 $1,600,000 $3,200,000 Number of employees: Weekly payroll (52 weeks per year) 300 150 200 Monthly payroll 75 160 90 Number of purchase requisitions per year 4,000 3,500 3,000 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial…arrow_forward

- Service Department Charges In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $45,900, and the Purchasing Department had expenses of $19,360 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $ 405,000 $ 536,000 $ 1,231,000 Number of employees: Weekly payroll (52 weeks per year) 145 60 65 Monthly payroll 32 43 30 Number of purchase requisitions per year 1,900 1,300 1,200 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential…arrow_forwardService Department Charges In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $45,336, and the Purchasing Department had expenses of $23,320 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $ 487,000 $ 646,000 $ 1,483,000 Number of employees: Weekly payroll (52 weeks per year) 140 60 65 Monthly payroll 34 45 32 Number of purchase requisitions per year 2,200 1,600 1,500 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential…arrow_forwardService Department Charges In divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $53,344, and the Purchasing Department had expenses of $25,370 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $530,000 $703,000 $1,614,000 Number of employees: Weekly payroll (52 weeks per year) 110 60 65 Monthly payroll 28 39 26 Number of purchase requisitions per year 1,800 1,300 1,200arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub