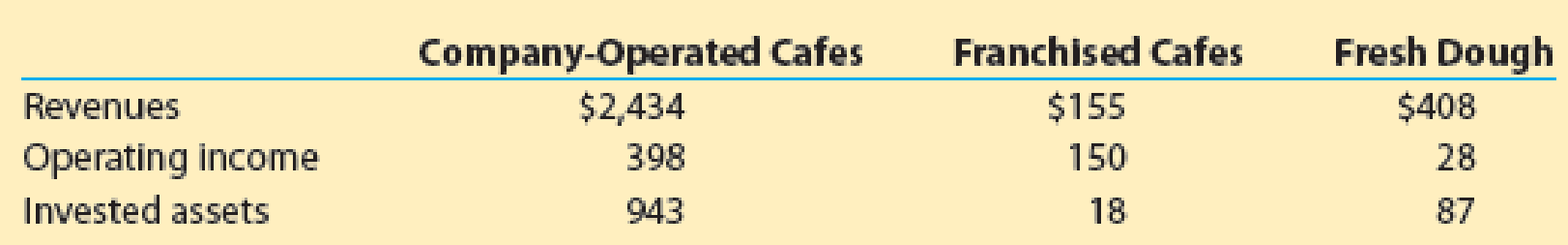

Panera Bread Company (PNRA) operates over 2,000 bakery-cafe locations throughout the United States and Canada and serves over 9 million customers per week. Panera’s operations are divided into the following segments:

- Company-Operated Bakery-Cafes

- Franchised Bakery-Cafes

- Fresh Dough and Other Products

The Fresh Dough and Other Products segment supplies fresh dough, produce, tuna, and other products to the company-operated and franchised cafes. Recent data (in millions) for each of these segments are as follows:

- a. Determine the profit margin for each segment. Round to one decimal place.

- b. Determine the investment turnover for each segment. Round to two decimal places.

- c. Use the DuPont formula to determine the

return on investment for each segment. Round to one decimal place. - d.

Which segment has the highest profit margin, investment turnover, and return on investment? Explain why.

Which segment has the highest profit margin, investment turnover, and return on investment? Explain why. - e.

If franchised cafes are more profitable, why would Panera operate company- owned cafes?

If franchised cafes are more profitable, why would Panera operate company- owned cafes?

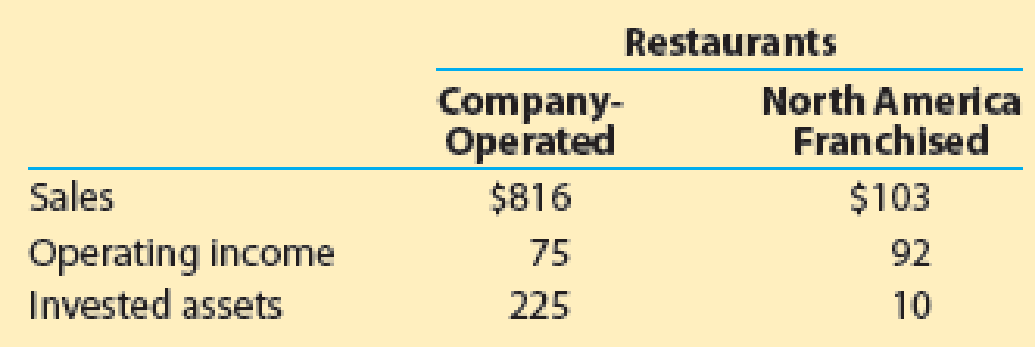

MAD 24-3 Analyze Papa John’s International, Inc. Obj. 6

Papa John’s International, Inc. (PZZA), operates over 5,000 restaurants in the United States and 45 countries. The company operates primarily as a franchisor with 4,353 franchised restaurants and 744 company-operated restaurants. Recent data (in millions) for the company-operated and North America franchised restaurants are as follows:

- a. Determine the profit margin for each segment. Round to one decimal place.

- b. Determine the investment turnover for each segment. Round to two decimal places.

- c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place.

- d.

Analyze and interpret the results of (a), (b), and (c).

Analyze and interpret the results of (a), (b), and (c).

MAD 24-4 Compare Panera Bread and Papa John’s Obj. 6

Compare Panera Bread (PNRA) and Papa John’s (PZZA) using your computations from MAD 24-2 and MAD 24-3.

Compare Panera Bread (PNRA) and Papa John’s (PZZA) using your computations from MAD 24-2 and MAD 24-3.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- Helparrow_forwardwhat is the total cost of the job when it is completed in October?arrow_forwardJordan Enterprises has inventory days of 52, accounts receivable days of 25, and accounts payable days of 34. What is its cash conversion cycle? A.) 43 days B.) 58 days C.) 65 days D.) 72 daysarrow_forward

- ??arrow_forwardMercury Inc. had 30,000 units of ending inventory recorded at $9.50 per unit using FIFO method. Current replacement cost is $5.25 per unit. Which amount should be reported as Ending Merchandise Inventory on the balance sheet using lower-of-cost-or-market rule?arrow_forwardWhat is the cost of goods sold?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub