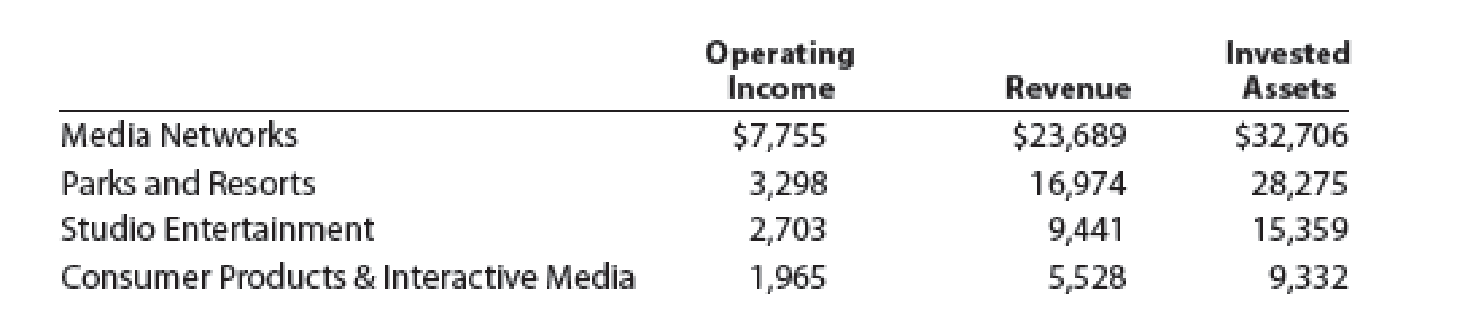

The Walt Disney Company (DIS) has four business segments, described as follows:

• Media Networks: Television and radio

• Parks and Resorts: Resorts, including Disneyland

• Studio Entertainment: Motion pictures, musical recordings, and stage plays

• Consumer Products & Interactive Media: Character merchandising, Disney stores, books, and games

Disney recently reported segment operating income, revenue, and invested assets (in millions) as follows:

a. Use the DuPont formula to determine the

b. How do the four segments differ in their profit margin, investment turnover, and return on investment?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Managerial Accounting

- Required information [The following information applies to the questions displayed below] The managers of the XYZ clubs, who have the authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's X Club reported the following results for the past year: Sales $ 840,000 Net operating income $ 24,360 Average operating assets $ 100,000 The following questions are to be considered independently. 2. Assume that the manager of the club is able to increase sales by $84,000 and that, as a result, net operating income increases by $7,056. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI)arrow_forwardReturn on investment Commodore Entertainment has four profitable business segments, described as follows: • Media Networks: Television and radio• Parks and Resorts: Resorts, including Commodore land• Studio Entertainment: Motion pictures, musical recordings, and stage plays• Consumer Products: Character merchandising, Commodore stores, books, and magazines Commodore Entertainment recently reported sector income from operations, revenue, and invested assets as follows: Income from Operations Revenue Invested Assets Media Networks $163,582 $735,200 $919,000 Parks and Resorts 73,625 353,400 589,000 Studio Entertainment 16,668 324,100 463,000 Consumer Products 80,164 352,800 196,000 a. Use the DuPont formula to determine the return on investment for the four Commodore Entertainment sectors. Round Profit Margin and ROI to one decimal place and Investment Turnover to two decimal places. Profit Margin Investment Turnover ROI…arrow_forwardGame-On Sports operates in two distinct segments: athletic equipment and accessories. The income statement for each operating segment is presented below. Required: 1. Complete the "%" columns to be used in a vertical analysis of Game-On Sports' two operating segments. Express each amount as a percentage of sales. 2. Use vertical analysis to compare the profitability of the two operating segments. Which segment is more profitable? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the "%" columns to be used in a vertical analysis of Game-On Sports' two operating segments. Express each amount as a percentage of sales. (Round your answers to 1 decimal place.) Net sales Cost of goods sold Gross profit Operating expenses Operating income Other income (expense) Income before tax Income tax expense Net income GAME-ON SPORTS Income Statements For the Year Ended December 31, 2024 Athletic Equipment Amount $ 3,225,000 1,420,000 1,805,000 820,000…arrow_forward

- Segment Revenue Vertical Analysis Newton Corporation is one of the world's largest entertainment companies that includes Gravity films, Apple Broadcasting, Gravity News, the GR, and various satellite properties. The company provided revenue disclosures by its major product segments in the notes to its financial statements as follows: a. Using the revenue disclosures by major product segment listed below, provide a vertical analysis of the product segment revenues. Round all percents to one decimal place. For a Recent Year Major Product Segments (in millions) Percent (%) Cable Network Programming $23,925 Television 8,338 Filmed Entertainment 5,154 Direct Broadcast Satellite Television 4,483 Total revenues of major segments $41,900 %arrow_forwardReturn on investment Commodore Entertainment has four profitable business segments, described as follows: • Media Networks: Television and radio• Parks and Resorts: Resorts, including Commodore land• Studio Entertainment: Motion pictures, musical recordings, and stage plays• Consumer Products: Character merchandising, Commodore stores, books, and magazines Commodore Entertainment recently reported sector income from operations, revenue, and invested assets as follows: Income from Operations Revenue Invested Assets Media Networks $193,644 $586,800 $978,000 Parks and Resorts 63,954 392,700 561,000 Studio Entertainment 12,927 333,600 417,000 Consumer Products 118,233 469,800 261,000 a. Use the DuPont formula to determine the return on investment for the four Commodore Entertainment sectors. Round Profit Margin and ROI to one decimal place and Investment Turnover to two decimal places. Profit Margin Investment Turnover ROI…arrow_forwardDisney started inthe 1920sasan animation studio.How has the company diversified its offering since then?Analyze the company’smost current“FiscalAnnual Report†to find out its primary revenue streams. What are the primary businesses that Disney operates today?arrow_forward

- Commodore Entertainment has four profitable business segments, described as follows: • Media Networks: Television and radio • Parks and Resorts: Resorts, including Commodore land • Studio Entertainment: Motion pictures, musical recordings, and stage plays • Consumer Products: Character merchandising, Commodore stores, books, and magazines Commodore Entertainment recently reported sector income from operations, revenue, and invested assets as follows: Income from Operations Revenue Invested Assets Media Networks $146,640 $624,000 $780,000 Parks and Resorts 41,756 343,200 572,000 Studio Entertainment 13,392 260,400 372,000 Consumer Products 94,163 324,700 191,000 a. Use the DuPont formula to determine the return on investment for the four Commodore Entertainment sectors. Round Profit Margin and ROI to one decimal place and Investment Turnover to two decimal places. Profit Margin Investment Turnover ROI Media Networks fill…arrow_forwardMacon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $40 million. Total assets were $470 million, non-interest-bearing current liabilities were $72,000,000. What are the invested capital and ROI for Macon? Solution What is the invested capital (Total Assets – Non-Interest-Bearing Current Liabilities)? What is the ROI (Net Income/Invested Capital)?arrow_forwardThe majority of company valuations today are based on multiples of revenues or EBITDA. Using the following data please state the company valuation for each of the scenarios below. [SaaS Revenue 4x multiple: Tech Enabled Service Revenue 1.5x multiple: Maintenance Revenue 2x multiple: Traditional Service Revenue 1x multiple: Positive EBITDA 15x multiple.] Company B has high growth SaaS revenue of $10,000,000.00 and Maintenance Revenue of $4,500,000.00. It also has annual operating EBITDA of -$350,000.00. Based on these facts would an offer of $31,000,000.00 for the company be acceptable? Please explain your answer. Company C is a pure Traditional Services company with $3,500,000.00 in annual revenue but $1,000,000.00 in EBITDA. Based on this should the owner accept a lower than standard 10x EBITDA multiple or $10,000,000.00? Please explain your answer.arrow_forward

- The 2024 income statement of Adrian Express reports sales of $20,310,000, cost of goods sold of $12,500,000, and net income of $1,900,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory ADRIAN EXPRESS Balance Sheets December 31, 2024 and 2023 Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term Liabilities Common stock Retained earnings Total liabilities and stockholders' equity Industry averages for the following four risk ratios are as follows: Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 6.5 35% tines 2024 2023 $800,000 $910,000 1,725,000 1,175,000 2,175,000 1,625,000 5,000,000 4,390,000 $9,700,000 $8,100,000 $2,030,000 $1,820,000 2,490,000 2,560,000 2,025,000 1,975,000 3,155,000 1,745,000 $9,700,000 $8,100,000arrow_forwardAnalyze Comcast Corporation by segment Comcast Corporation (CMCSA) is a global media and entertainment company with operations divided into five major segments: Cable Communications (XFINITY) Cable Networks (USA Network, Syfy, E!, CNBC, others) Broadcast Television (NBC) Filmed Entertainment (Universal Pictures) Theme Parks (Universal) Revenue, operating income, and depreciation and amortization information for these segments for a recent year are as follows (in millions): Segment Revenue OperatingIncome Depreciationand Amortization Cable Communications $50,048 $12,439 $7,670 Cable Networks 10,464 2,964 745 Broadcast Television 10,147 1,195 125 Filmed Entertainment 6,360 650 47 Theme Parks 4,946 1,678 512 Total $81,965 $18,926 $9,099 a. Prepare a vertical analysis of the segment revenues to total revenues. Round to nearest whole percent. Enter amounts in millions.…arrow_forwardJef Doyle is evaluating results for two separate business segments under his control. Selected financial information for each segment follows: Segment A Segment B Sales $100,000 $138,000 Net Operating Income (loss) 5,000 (2,000) Average Assets $200,000 $200,000 Calculate return on investment for Segment A. A. 0.5 B. -0.01 C. 0.025 D. 0.125 E. none of the abovearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,