Concept explainers

Analyzing transactions and preparing financial statements C4 P1 P2

Rivera Roofing Company, owned by Reyna Rivera, began operations in July and completed these transactions during that first month of operations.

July 1 Reyna Rivera invested $80,000 cash in the company in exchange for its common stock.

2 The company rented office space and paid $700 cash for the July rent.

3 The company purchased roofing equipment for $5,000 by paying $1,000 cash and agreeing to pay the $4,000 balance in 30 days.

6 The company purchased office supplies for $600 cash.

8 The company completed work for a customer and immediately collected $7,600 cash for the work.

10 The company purchased $2,300 of office equipment on credit.

15 The company completed work for a customer on credit in the amount of $8,200.

17 The company purchased $3,100 of office supplies on credit.

23 The company paid $2,300 cash for the office equipment purchased on July 10.

25 The company billed a customer $5,000 for work completed; the balance is due in 30 days.

28 The company received $8,200 cash for the work completed on July 15.

30 The company paid an assistant's salary of $1,560 cash for this month.

31 The company paid $295 cash for this month's utility bill.

31 The company paid $1,800 cash in dividends to the owner (sole shareholder).

Required

Create the following table similar to the one in Exhibit 1.9.

Use additions and subtractions within the table to show the dollar effects of each transaction on individual items of theaccounting equation. Show new balances after each transaction.

Check (1) Ending balances: Cash, $87,545; Accounts Payable, $7,100- Prepare the income statement and the statement of

retained earnings for the month of July, and the balance sheet as of July 31.

(2) Net income, $18,245;Total assets, $103,545 - Prepare the statement of

cash flows for the month of July. - Assume that the $5,000 purchase of roofing equipment on July 3 was financed from an owner investment of another $5,000 cash in the business in exchange for more common stock (instead of the purchase conditions described in the transaction above). Compute the dollar effect of this change on the month-end amounts for(a) total assets,(b) total liabilities, and(c) total equity.

Analysis Component

Accounting Equation:

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future; Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follow,

Income statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of Retained Earnings:

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

Balance Sheet:

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of Cash Flows:

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three parts:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

1.

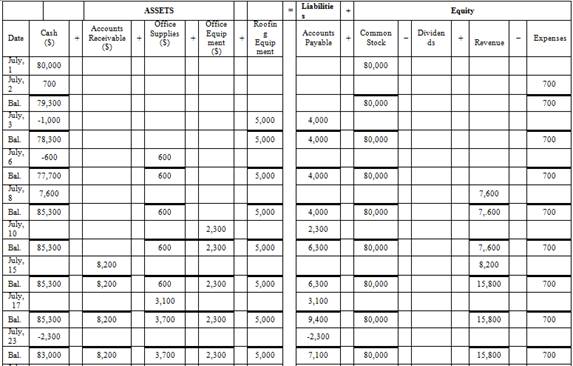

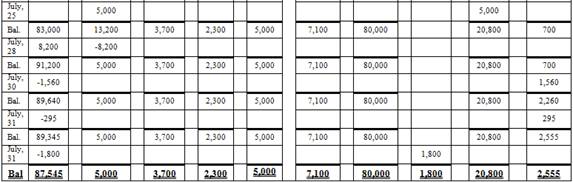

To identify: The effect of transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $87,545,accounts receivables is $5,000, office supplies is $3,700 office equipment is $2,300,roofing equipment is$5,000 accounts payable is $7,100, common stock is $80,000, dividend is $1,800, revenue is $20,800 and expenses is $2,555.

2.

To prepare: The income statement, statement of retained earnings and balance sheet for the month of July 31,20XX.

Explanation of Solution

Prepare income statement.

| R. Company | ||

| Income Statement | ||

| For the month ended July 31,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 20,800 | |

| Total Revenue | 20,800 | |

| Expenses: | ||

| Rent Expenses | 700 | |

| Salary Expenses | 1,560 | |

| Utilities Expenses | 295 | |

| Total Expense | 2,555 | |

| Net income | 18,245 | |

Table (2)

Hence, net income of .R Company as on July 31, 20XX is $18,245

Prepare statement of retained earnings

| R. Company | ||

| Retained Earnings Statement | ||

| For the month ended July 31,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 18,245 | |

| Total | 18,245 | |

| Dividends | (1,800) | |

| Retained earnings | 16,445 | |

Table (3)

Hence, the retained earnings of .R Company as on July 31, 20XX are $16,445.

Prepare balance sheet

| R. Company | ||

| Balance sheet | ||

| As on July 31, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 87,545 | |

| Accounts Receivables | 5,000 | |

| Office Supplies | 3,700 | |

| Office Equipment | 2,300 | |

| Roofing Equipment | 5,000 | |

| Total Assets | 103,545 | |

| Liabilities and Stockholder’s Equity | ||

| Liabilities | ||

| Accounts Payable | 7,100 | |

| Stockholder’s Equity | ||

| Common Stock | 80,000 | |

| Retained earnings | 16,445 | |

| Total stockholders’ equity | 96,445 | |

| Total Liabilities and Stockholder’s equity | 103,545 | |

Table (4)

Hence, the total of the balance sheet of the R Company as on July 31, 20XX is of $103,545.

3.

To prepare: The statement of cash flows of the S Electric.

Explanation of Solution

Prepare the cash flow statement.

| R. Company | ||

| Statement of Cash Flows | ||

| Month Ended July 31, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 15,800 | |

| Payments: | ||

| Supplies | (600) | |

| Rent Expenses | (700) | |

| Salary Expenses | (1,560) | |

| Utilities | (295) | (3,155) |

| Net cash from operating activities | 12,645 | |

| Cash flow from investing activities | ||

| Purchase of office equipment | (2,300) | |

| Purchase of Roofing equipment | (1,000) | |

| Net cash from investing activities | (3,300) | |

| Cash flow from financing activities | ||

| Issued common stock | 80,000 | |

| Less: Payment of cash dividends | (1,800) | |

| Net cash from financing activities | 78,200 | |

| Net increase in cash | 87,545 | |

| Cash balance, July 1,20XX | 0 | |

| Cash balance, July 31,20XX | 87,545 | |

Table (5)

Hence, the cash balance of the R Company as on July 31, 20XX is $87,545.

4.

To identify: The changes on (a) total assets, (b) total liabilities, and (c) total equity.

Explanation of Solution

If the company purchase roofing equipment by owner investment instead of cash as mention in question.

- On assets- The asset of the company increases by $1,000.

- On liabilities- The liability of the company decreases by $4,000.

- On equity- The common stock is increased by $5,000 and common stock is the part of equity so equity increases by $5,000.

Thus, assets and equity will increase and liability will decrease.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardInner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.arrow_forwardJournal Entries Castle Consulting Agency began business in February. The transactions entered into by Castle during its first month of operations are as follows: Acquired articles of incorporation from the state and issued 10,000 shares of capital stock in exchange for $150,000 in cash. Paid monthly rent of $400. Signed a five-year promissory note for $100,000 at the bank. Purchased software to be used on future jobs. The software costs $950 and is expected to be used on five to eight jobs over the next two years. Billed customers $12,500 for work performed during the month. Paid office personnel $3,000 for the month of February. Received a utility bill of $100. The total amount is due in 30 days. Required Prepare in journal form, the entry to record each transaction.arrow_forward

- Journal Entries Overnight Delivery Inc. is incorporated on February 1 and enters into the following transactions during its first month of operations: February 15: Received $8,000 cash from customer accounts. February 26: Provided $16,800 of services on account during the month. February 27: Received a $3,400 bill from the local service station for gas and oil used during February. February 28: Paid $400 for wages earned by employees for the month. February 28: Paid $3,230 for February advertising. February 28: Declared and paid $2,000 cash dividends to stockholders. Required Prepare journal entries on the books of Overnight to record the transactions entered into during February. Explain why you agree or disagree with the following: The transactions on February 28 all represent expenses for the month of February because cash was paid. The transaction on February 27 does not represent an expense in February because cash has not yet been paid.arrow_forwardTransaction Analysis and Financial Statements Just Rolling Along Inc. was organized on May 1 by two college students who recognized an opportunity to make money while spending their days at a beach along Lake Michigan. The two entrepreneurs plan to rent bicycles and in-line skates to weekend visitors to the lakefront. The following transactions occurred during the first month of operations: May 1: Received contribution of $9,000 from each of the two principal owners of the new business in exchange for shares of stock. May 1: Purchased ten bicycles for $300 each on an open account. The company has 30 days to pay for the bicycles. May 5: Registered as a vendor with the city and paid the $15 monthly fee. May 9: Purchased 20 pairs of in-line skates at $125 per pair, 20 helmets at $50 each, and 20 sets of protective gear (knee and elbow pads and wrist guards) at $45 per set for cash. May 10: Purchased $100 in miscellaneous supplies on account. The company has 30 days to pay for the supplies. May 15: Paid $125 bill from local radio station for advertising for the last two weeks of May. May 17: Customers rented in-line skates and bicycles for cash of $1,800. May 24: Billed the local park district $1,200 for in-line skating lessons provided to neighborhood children. The park district is to pay one-half of the bill within five working days and the rest within 30 days. May 29: Received 50% of the amount billed to the park district. May 30: Customers rented in-line skates and bicycles for cash of $3,000. May 30: Paid wages of $160 to a friend who helped over the weekend. May 31: Paid the balance due on the bicycles. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with the date. Prepare an income statement for the month of May. Prepare a classified balance sheet at May 31. Why do you think the two college students decided to incorporate their business rather than operate it as a partnership?arrow_forwardAnalyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.arrow_forward

- Transaction Analysis and Financial Statements Expert Consulting Services Inc. was organized on March 1 by two former college roommates. The corporation provides computer consulting services to small businesses. The following transactions occurred during the first month of operations: March 2: Received contributions of $20,000 from each of the two principal owners of the new business in exchange for shares of stock. March 7: Signed a two-year promissory note at the bank and received cash of $15,000. Interest, along with the $15,000, will be repaid at the end of the two years. March 12: Purchased $700 in miscellaneous supplies on account. The company has 30 days to pay for the supplies. March 19: Billed a client $4,000 for services rendered by Expert in helping to install a new computer system. The client is to pay 25% of the bill upon its receipt and the remaining balance within 30 days. March 20: Paid $1,300 bill from the local newspaper for advertising for the month of March. March 22: Received 25% of the amount billed to the client on March 19. March 26: Received cash of $2,800 for services provided in assisting a client in selecting software for its computer. March 29: Purchased a computer system for $8,000 in cash. March 30: Paid $3,300 of salaries and wages for March. March 31: Received and paid $1,400 in gas, electric, and water bills. Required Prepare a table to summarize the preceding transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Identify each transaction with the date. Prepare an income statement for the month of March. Prepare a classified balance sheet at March 31. From reading the balance sheet you prepared in part (3), what events would you expect to take place in April? Explain your answer.arrow_forwardGreen Wave Company plans to own and operate a storage rental facility. For the first month of operations, the company had the following transactions. 1. Issue 10,000 shares of common stock in exchange for $32,000 in cash. 2. Purchase land for $19,000. A note payable is signed for the full amount. 3. Purchase storage container equipment for $8,000 cash. 4. Hire three employees for $2,000 per month. 5. Receive cash of $12,000 in rental fees for the current month. 6. Purchase office supplies for $2,000 on account. 7. Pay employees $6,000 for the first month’s salaries. Required: For each transaction, describe the dual effect on the accounting equation. For example, in the first transaction, (1) assets increase and (2) stockholders’ equity increases.arrow_forwardHarris Welding Company had the following transactions for June. June 1 Tyler Harris invested $9550 cash in a small welding business June 2 Bought used welding equipment on account for $3050 June 5 Hired an employee to start work on July 15. Agreed on a salary of $3390 per month June 17 Billed P. White $2230 for welding work done. June 27 Received $1220 cash from P.White for work billed on June 17. Journalize the transactionsarrow_forward

- Harris Welding Company had the following transactions for June. June 1 Tyler Harris invested $9550 cash in a small welding business June 2 Bought used welding equipment on account for $3050 June 5 Hired an employee to start work on July 15. Agreed on a salary of $3390 per month June 17 Billed P. White $2230 for welding work done. June 27 Received $1220 cash from P.White for work billed on June 17. For each transaction, indicate the basic type of account debited/credited, specific account debited/credited on the account and the amountarrow_forward1 Sanyu Sony transferred $65,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company paid $1,800 cash for the December rent. 3 The company purchased $14,200 of electrical equipment by paying $6,000 cash and agreeing to pay the $8,200 balance in 30 days. Dec.arrow_forwardRequired Information [The following information applies to the questions displayed below.] During January. Central Storage Company has the following transactions. 1. January 1 Issue 10,000 shares of common stock in exchange for $39,ee0 in cash. 2. January 5 Purchase land for $22,508. A note payable is signed for the full amount. 3. January 9 Purchase storage container equipment for $8,780 cash. 4. January 12 Hire three employees for $2,700 per month. 5. January 18 Receive cash of $12,700 in rental fees for the current nonth. 6. January 23 Purchase office supplies for $2,780 on account. 7. January 31 Pay employees $8,100 for the first month's salaries. 3. Prepare a trial balance. CENTRAL STORAGE COMPANY Trial Balance Accounts Debit Credit Cash Supplies Land Equipment Accounts Payable Notes Payable Common Stock Service Revenue Salaries Expense Totalsarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning