FINANCIAL ACCT.FUND.(LOOSELEAF)

7th Edition

ISBN: 9781260482867

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 11E

Identifying effects of transactions on the

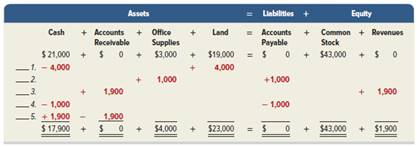

The following table shows the effects of transactions 1 through 5 on the assets, liabilities, and equity of Mulan's Boutique.

Identify the explanation from a through j below that best describes each transaction 1 through 5 and enter it in the blank space in front of each numbered transaction.

- The company purchased $1,000 of office supplies on credit.

- The company collected $1,900 cash from an account receivable.

- The company sold land for $4,000 cash.

- The company paid $1,000 cash in dividends to shareholders.

- The company purchased office supplies for $1,000 cash.

- The company purchased land for $4,000 cash.

- The company billed a client $1,900 for services provided.

- The company paid $1,000 cash toward an account payable.

- The owner invested $1,900 cash in the business in exchange for its common stock.

- The company sold office supplies for $1,900 on credit.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Windsor, Inc. had the following transactions.

1.

Borrowed $ 6,184 from the bank by signing a note.

2.

Paid $ 3,092 cash for a computer.

3.

Purchased $ 557 of supplies on account.

(a)

Indicate what accounts are increased and decreased by each transaction.

Debit Analysis

Account Names

Credit Analysis

Account Names

1.

select an effect on a basic account type

enter a debit account title to record the first transaction

select an effect on a basic account type

enter a credit account title to record the first transaction

2.

select an effect on a basic account type

enter a debit account title to record the second transaction

select an effect on a basic account type

enter a credit account title to record the second transaction

3.

select an effect on a basic account type

enter a debit account title to record the third transaction

select an effect on a basic…

3

Broadmor Industries collected $7,500 from a customer on account. What journal entry will be prepared by Broadmor to record this transaction?

Multiple Choice

Debit Cash and credit Accounts Receivable.

Debit Cash and credit Service Revenue.

Debit Accounts Receivable and credit Service Revenue.

Debit Accounts Receivable and credit Cash.

QUESTION 1

a)

You are the accounts executive for BFC Enterprise. You are responsible to prepare the monthly receivables and payables control accounts for the business. Following are balances from the company’s record at 1 February 2020.

Dr RM Cr RM

Debtor ledger control account 54,000 1,000

Creditor ledger control account 200 43,000

The following information is extracted in February 2020 from the company’s records:

RM

Credit sales 251,000

Cash sales 34,000

Credit purchases…

Chapter 1 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

Ch. 1 - Prob. 1MCQCh. 1 - Prob. 2MCQCh. 1 - If the assets of a company increase by $100,000...Ch. 1 - Brunswick borrows $50,000 cash from Third National...Ch. 1 - Geek Squad performs services for a customer and...Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Identify four kinds of external users and describe...Ch. 1 - Prob. 4DQCh. 1 - Prob. 5DQ

Ch. 1 - Prob. 6DQCh. 1 - Prob. 7DQCh. 1 - Prob. 8DQCh. 1 - Prob. 9DQCh. 1 - Prob. 10DQCh. 1 - Prob. 11DQCh. 1 - Prob. 12DQCh. 1 - Prob. 13DQCh. 1 - Prob. 14DQCh. 1 - Why is the revenue recognition principle needed?...Ch. 1 - Prob. 16DQCh. 1 - Prob. 17DQCh. 1 - Prob. 18DQCh. 1 - Prob. 19DQCh. 1 - Prob. 20DQCh. 1 - Prob. 21DQCh. 1 - Prob. 22DQCh. 1 - Prob. 23DQCh. 1 - Prob. 24DQCh. 1 - Prob. 25DQCh. 1 - Prob. 26DQCh. 1 - Prob. 27DQCh. 1 - Prob. 28DQCh. 1 - Prob. 29DQCh. 1 - Prob. 30DQCh. 1 - Prob. 31DQCh. 1 - Prob. 32DQCh. 1 - Prob. 33DQCh. 1 - Prob. 1QSCh. 1 - Prob. 2QSCh. 1 - Prob. 3QSCh. 1 - Prob. 4QSCh. 1 - Prob. 5QSCh. 1 - Prob. 6QSCh. 1 - Prob. 7QSCh. 1 - Prob. 8QSCh. 1 - Prob. 9QSCh. 1 - Prob. 10QSCh. 1 - Prob. 11QSCh. 1 - Identifying items with financial statements P2...Ch. 1 - Prob. 13QSCh. 1 - Prob. 14QSCh. 1 - Prob. 15QSCh. 1 - Computing and interpreting return on assets A2 In...Ch. 1 - Prob. 17QSCh. 1 - Prob. 1ECh. 1 - Prob. 2ECh. 1 - Prob. 3ECh. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Prob. 6ECh. 1 - Prob. 7ECh. 1 - Prob. 8ECh. 1 - Prob. 9ECh. 1 - Prob. 10ECh. 1 - Identifying effects of transactions on the...Ch. 1 - Prob. 12ECh. 1 - Prob. 13ECh. 1 - Prob. 14ECh. 1 - Prob. 15ECh. 1 - Prob. 16ECh. 1 - Prob. 17ECh. 1 - Prob. 18ECh. 1 - Prob. 19ECh. 1 - Prob. 20ECh. 1 - Prob. 21ECh. 1 - Prob. 22ECh. 1 - Using the accounting equation A1 Answer the...Ch. 1 - Prob. 1PSACh. 1 - Prob. 2PSACh. 1 - Prob. 3PSACh. 1 - Prob. 4PSACh. 1 - Prob. 5PSACh. 1 - Prob. 6PSACh. 1 - Prob. 7PSACh. 1 - Prob. 8PSACh. 1 - Prob. 9PSACh. 1 - Prob. 10PSACh. 1 - Prob. 11PSACh. 1 - Prob. 12PSACh. 1 - Prob. 13PSACh. 1 - Prob. 14PSACh. 1 - Identifying effects of transactions on financial...Ch. 1 - Prob. 2PSBCh. 1 - Prob. 3PSBCh. 1 - Prob. 4PSBCh. 1 - Prob. 5PSBCh. 1 - Prob. 6PSBCh. 1 - Prob. 7PSBCh. 1 - Prob. 8PSBCh. 1 - Analyzing transactions and preparing financial...Ch. 1 - Prob. 10PSBCh. 1 - Prob. 11PSBCh. 1 - Prob. 12PSBCh. 1 - Prob. 13PSBCh. 1 - Prob. 14PSBCh. 1 - Prob. 1SPCh. 1 - Prob. 1AACh. 1 - Prob. 2AACh. 1 - Prob. 3AACh. 1 - Prob. 1BTNCh. 1 - Prob. 2BTNCh. 1 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardMaddie Inc. has the following transactions for its first month of business. A. What are the individual account balances, and the total balance, in the accounts receivable subsidiary ledger? B. What is the balance in the accounts receivable general ledger (control) account?arrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was 38,200. REQUIRED Prepare the following financial ratios: (a)Working capital (b)Current ratio (c)Quick ratio (d)Return on owners equity (e)Accounts receivable turnover and the average number of days required to collect receivables (f)Inventory turnover and the average number of days required to sell inventoryarrow_forward

- Pina Colada Corp. had the following transactions. 1. Borrowed $5,065 from the bank by signing a note. 2. Paid $2,533 cash for a computer. 3. Purchased $456 of supplies on account. (a) Indicate what accounts are increased and decreased by each transaction. Debit Analysis Account Names Credit Analysis Account Names 1. select an effect on a basic account type enter a debit account title to record the first transaction select an effect on a basic account type enter a credit account title to record the first transaction 2. select an effect on a basic account type enter a debit account title to record the second transaction select an effect on a basic account type…arrow_forwardPrepare a journal entry for the purchase of office equipment on February 19 for $14,800 paying $3,600 cash and the remainder on account. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. CHART OF ACCOUNTSGeneral Ledger ASSETS 11 Cash 12 Accounts Receivable 13 Office Supplies 14 Prepaid Insurance 15 Land 16 Office Equipment 17 Automobiles LIABILITIES 21 Accounts Payable 22 Unearned Rent 23 Notes Payable 24 Salaries Payable EQUITY 31 Owner's Capital 32 Owner's Drawing REVENUE 41 Fees Earned 42 Sales Commission EXPENSES 51 Advertising Expense 52 Automobile Expense 53 Insurance Expense 54 Rent Expense 55 Salary Expense 56 Supplies Expense 57 Utilities Expense…arrow_forwardThe chart of accounts for the Miguel Company includes the following: Account Name Account Number Cash 11 Accounts Receivable 13 Prepaid Insurance 15 Accounts Payable 21 Unearned Revenue 24 Common Stock 31 Dividends 32 Fees Earned 41 Salaries Expense 54 Rent Expense 56 Page 3 of the journal contains the following transaction: Description Post. Ref. Debit Credit Cash 640 Fees Earned 640 What posting references will be found in the journal entry? a.11, 41 b.41, 3 c.11, 3 d.3, 11arrow_forward

- Prepare a journal entry for the purchase of office equipment on February 19 for $14,800 paying $3,600 cash and the remainder on account. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. CHART OF ACCOUNTSGeneral Ledger ASSETS 11 Cash 12 Accounts Receivable 13 Office Supplies 14 Prepaid Insurance 15 Land 16 Office Equipment 17 Automobiles LIABILITIES 21 Accounts Payable 22 Unearned Rent 23 Notes Payable 24 Salaries Payable EQUITY 31 Owner's Capital 32 Owner's Drawing REVENUE 41 Fees Earned 42 Sales Commission EXPENSES 51 Advertising Expense 52 Automobile Expense 53 Insurance Expense 54 Rent Expense 55 Salary Expense 56 Supplies Expense 57 Utilities Expense…arrow_forwardes Identify the source document for NDX Company in each of the following accounting processes. Accounting processes a. A customer purchases merchandise with a credit card. NDX uses the electronic sales receipt to record transaction details in its accounting system. b. NDX purchases goods and receives a bill from the supplier. Details from the bill are captured and entered in the accounting database, which is stored in the cloud. c. An NDX employee receives a bank statement each month on her company e-mail. The statement is used to record bank fees incurred for that month. Source documents Credit card Bill from supplier Bank statementarrow_forwardView transaction list Journal entry worksheet 1 2 3 4 5 6 8 9 > Kacy Spade, owner, invested $17,500 cash in the company. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journalarrow_forward

- From the accounts of DELTACOR Company, you are required to properly arrange the following accounts according to their group of accounts then: 1. Prepare the statement of financial position using the report form. 2. Prepare the supporting notes 3. Compute the ending capital of DELTA Office supplies Accounts Receivable Notes Receivable 30, 000 59,400 39,600 172,600 5,000 5, 000 247,500 6, 000 180, 000 225, 000 67, 500 72, 000 Cash Interest Receivable Allowance for bad debts Merchandise inventory Prepaid insurance Furniture and Fixtures Delivery equipment Accumulated depreciation- Fur. & Fixtures Accumulated Depreciation – Delivery Eqpt. Accrued expenses Accounts payable Notes payable (due in 2 yrs) DELTA, capital DELTA, drawing 8, 000 45, 000 105, 000 ? 50, 000 During the year, the owner made an additional investment of P20, 000 and withdrawals amounting of 50, 000. DELTA capital, beginning is 617, 600. Net income for the year is 75, 000.arrow_forwardActivity: Following are the accounting transactions relating to Mr. P’s business. Use the accounting equation to show their effect on his assets, liabilities and capital. Purchased goods from A on credit 5,000 Sold goods for cash 10,000 Paid to A 2,000 Sold goods to B on credit 3,000 Paid into Bank 6,000 Paid to A by cheque 1,000 Received from B a cheque for 2,000arrow_forwardQuestion 1. From the following transactions, classify Debit and Credit and record Journal Entries. prepare the given ledger accounting in T format. The transactions for the month of March 2020 are given hereunder. Mar 1. Meeza started a business investing RO 12,500. Out of which she deposited RO 5,000 in the bank account the same day. Mar 2. She purchased tools and equipment for RO 4,750. She paid 60% of the amount by cheque. Remaining amount (RO 1900) recorded in ‘Other liabilities account’ to be paid next 30 days. Mar 6. She produced 600 units of product for RO 20,000 on credit and sold all of them on credit to Mr. John for RO 24,000. Mar 9. Purchased Raw-Material for RO 6,200 on 15 days credit for Aesha. Mar 11 She paid off the outstanding amount on tools and equipment account purchased on 2nd March through Bank account. Mar 13. Mr. John paid RO 15,000 by Cheque. Mar 16. Paid the supplier of Raw material (March 9) by cheque no 132613, RO 5,325. Reminder as a cash discount and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License