Concept explainers

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future; Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follow,

Income Statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

Balance Sheet:

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three parts:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

1.

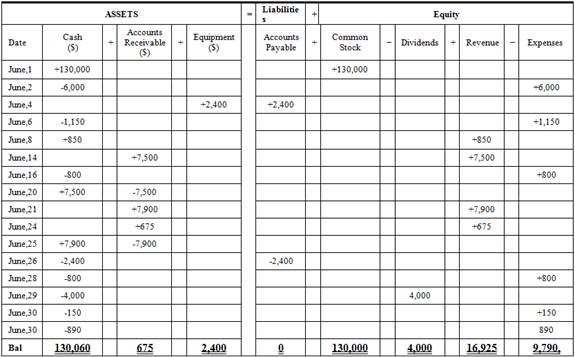

To identify: The effect of given transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $130,060,accounts receivables is$675 equipment is $2,400, common stock is $130,000, dividend is $4,000, revenue is $16,925 and expenses is $9,790.

2.

To prepare: The income statement, statement of retained earnings and balance sheet for the month of June 31,20XX.

2.

Explanation of Solution

Prepare income statement.

| N. Company | ||

| Income Statement | ||

| For the month ended June 30,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 16,925 | |

| Total Revenue | 16,925 | |

| Expenses: | ||

| Advertising Expenses | 1,150 | |

| Rent Expenses | 6,000 | |

| Salary Expenses | 1,600 | |

| Telephone Expenses | 150 | |

| Utilities Expenses | 890 | |

| Total Expense | 9,790 | |

| Net income | 7,135 | |

Table (2)

Hence, net income of .N Company as on June 30, 20XX is $7,135

Prepare statement of retained earnings

| N. Company | ||

| Retained Earnings Statement | ||

| For the month ended June 30,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 7,135 | |

| Total | 7,135 | |

| Dividends | (4,000) | |

| Retained earnings | 3,135 | |

Table (3)

Hence, the retained earnings of N Company as on June 30, 20XX are $3,135.

Prepare balance sheet

| N. Company | ||

| Balance sheet | ||

| As on June 30, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 130,060 | |

| Equipment | 2,400 | |

| Accounts Receivables | 675 | |

| Total Assets | 133,135 | |

| Liabilities and | ||

| Liabilities | ||

| Stockholder’s Equity | ||

| Common Stock | 130,000 | |

| Retained earnings | 3,135 | |

| Total stockholders’ equity | 133,135 | |

| Total Liabilities and Stockholder’s equity | 133,135 | |

Table (4)

Hence, the total of the balance sheet of the N Company as on June 30, 20XX is of $133,135.

3.

To prepare: The statement of cash flows of the M Company.

3.

Explanation of Solution

Prepare the cash flow statement:

| N. Company | ||

| Statement of Cash Flows | ||

| Month Ended June 30, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 16,250 | |

| Payments: | ||

| …Advertising Expense | (1,150) | |

| Rent Expenses | (6,000) | |

| Salary Expenses | (1,600) | |

| Telephone Expenses | (150) | |

| Utilities Expense | (890) | (9,790) |

| Net cash from operating activities | 6,460 | |

| Cash flow from investing activities | ||

| Purchase of equipment | (2,400) | |

| Net cash from investing activities | (2,400) | |

| Cash flow from financing activities | ||

| Issued common stock | 130,000 | |

| Less: Payment of cash dividends | (4,000) | |

| Net cash from financing activities | 126,000 | |

| Net increase in cash | 130,060 | |

| Cash balance, June 1,20XX | 0 | |

| Cash balance, June 30,20XX | 130,060 | |

Table (5)

Hence, the cash balance of the N Company as on June 30, 20XX is $130,060.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

- Sanyu Sony started a new business and completed these transactions during December.Dec. 1 Sanyu Sony transferred $65,000 cash from a personal savings account to a checking account inthe name of Sony Electric.2 The company rented office space and paid $1,000 cash for the December rent.3 The company purchased $13,000 of electrical equipment by paying $4,800 cash and agreeing topay the $8,200 balance in 30 days.5 The company purchased office supplies by paying $800 cash.6 The company completed electrical work and immediately collected $1,200 cash for these services.8 The company purchased $2,530 of office equipment on credit.15 The company completed electrical work on credit in the amount of $5,000.18 The company purchased $350 of office supplies on credit.20 The company paid $2,530 cash for the office equipment purchased on December 8.24 The company billed a client $900 for electrical work completed; the balance is due in 30 days.28 The company received $5,000 cash for the work completed…arrow_forwardSanyu Sony started a new business and completed these transactions during December. December 1 Sanyu Sony transferred $66,000 cash from a personal savings account to a checking account in the name of Sony Electric. December 2 The company paid $1,500 cash for the December rent. December 3 The company purchased $13,400 of electrical equipment by paying $5,200 cash and agreeing to pay the $8,200 balance in 30 days. December 5 The company purchased supplies by paying $900 cash. December 6 The company completed electrical work and immediately collected $1,600 cash for these services. December 8 The company purchased $2,950 of office equipment on credit. December 15 The company completed electrical work on credit in the amount of $5,900. December 18 The company purchased $500 of supplies on credit. December 20 The company paid $2,950 cash for the office equipment purchased on December 8. December 24 The company billed a client $1,000 for electrical work completed; the…arrow_forwardSanyu Sony started a new business and completed these transactions during December. December 1 Sanyu Sony transferred $66,000 cash from a personal savings account to a checking account in the name of Sony Electric. December 2 The company paid $1,500 cash for the December rent. December 3 The company purchased $13,400 of electrical equipment by paying $5,200 cash and agreeing to pay the $8,200 balance in 30 days. December 5 The company purchased supplies by paying $900 cash. December 6 The company completed electrical work and immediately collected $1,600 cash for these services. December 8 The company purchased $2,950 of office equipment on credit. December 15 The company completed electrical work on credit in the amount of $5,900. December 18 The company purchased $500 of supplies on credit. December 20 The company paid $2,950 cash for the office equipment purchased on December 8. December 24 The company billed a client $1,000 for electrical work completed; the…arrow_forward

- Ming Chen started a business and had the following transactions in June. Owner invested $66,000 cash in the company along with $10,000 of equipment. The company paid $1,100 cash for rent of office space for the month. The company purchased $10,000 of additional equipment on credit (payment due within 30 days). The company completed work for a client and immediately collected $1,700 cash. The company completed work for a client and sent a bill for $8,200 to be received within 30 days. The company purchased additional equipment for $6,300 cash. The company paid an assistant $2,900 cash as wages for the month. The company collected $4,500 cash as a partial payment for the amount owed by the client in transaction e. The company paid $10,000 cash to settle the liability created in transaction c. The owner withdrew $1,200 cash from the company for personal use. Required:Complete the table using additions and subtractions to show the dollar effects of the transactions on individual items of…arrow_forwardHarris Welding Company had the following transactions for June. June 1 Tyler Harris invested $9550 cash in a small welding business June 2 Bought used welding equipment on account for $3050 June 5 Hired an employee to start work on July 15. Agreed on a salary of $3390 per month June 17 Billed P. White $2230 for welding work done. June 27 Received $1220 cash from P.White for work billed on June 17. Journalize the transactionsarrow_forwardMing Chen started a business and had the following transactions in June. Owner invested $68,000 cash in the company along with $29,000 of equipment in exchange for its common stock. The company paid $2,100 cash for rent of office space for the month. The company purchased $10,000 of additional equipment on credit (payment due within 30 days). The company completed work for a client and immediately collected $1,600 cash. The company completed work for a client and sent a bill for $9,000 to be received within 30 days. The company purchased additional equipment for $6,100 cash. The company paid an assistant $3,000 cash as wages for the month. The company collected $5,300 cash as a partial payment for the amount owed by the client in transaction e. The company paid $10,000 cash to settle the liability created in transaction c. The company paid $1,100 cash in dividends to the owner (sole shareholder). Required:Complete the table using additions and subtractions to show the dollar effects…arrow_forward

- Harris Welding Company had the following transactions for June. June 1 Tyler Harris invested $9550 cash in a small welding business June 2 Bought used welding equipment on account for $3050 June 5 Hired an employee to start work on July 15. Agreed on a salary of $3390 per month June 17 Billed P. White $2230 for welding work done. June 27 Received $1220 cash from P.White for work billed on June 17. For each transaction, indicate the basic type of account debited/credited, specific account debited/credited on the account and the amountarrow_forwardMing Chen started a business and had the following transactions in June. a. Owner invested $61,000 cash in the company along with $25,000 of equipment. b. The company paid $1,900 cash for rent of office space for the month. c. The company purchased $15,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected $2,100 cash. b. e. The company completed work for a client and sent a bill for $7,000 to be received within 30 days. f. The company purchased additional equipment for $5,500 cash. Required: Complete the table using additions and subtractions to show the dollar effects of the transactions on individual items of the accounting equation. Note: Enter decreases to account balances with a minus sign. g. The company paid an assistant $3,000 cash as wages for the month. h. The company collected $5,200 cash as a partial payment for the amount owed by the client in transaction e. 1. The company paid $15,000 cash…arrow_forwardLita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of operations. May. 1 Lopez invested $90,000 cash along with office equipment valued at $28,000 in the company. May. 2 The Company prepaid $8,000 cash for 12 months’ rent for office space. May. 3 Company made credit purchases for $7,000 in office equipment and $3,600 in office supplies. Payment is due within 10 days. May. 6 The Company completed services for a client and immediately received $4,000 cash. May. 9 Company completed a $5,000 project for a client, who must pay within 30 days. May. 10 The Company paid a local newspaper $550 cash for printing an announcement of the office’s opening. May. 11 The Company paid $1,840 cash for the office secretary’s wages for this period. May. 12 Paid the following cash expenses: salaries, $4,000; rent, $2,500; and interest, $440 May. 13 The company paid $10,600 cash to settle the account payable created on April 3.…arrow_forward

- 1 Sanyu Sony transferred $65,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company paid $1,800 cash for the December rent. 3 The company purchased $14,200 of electrical equipment by paying $6,000 cash and agreeing to pay the $8,200 balance in 30 days. Dec.arrow_forwardThe transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $7,400. b. The firm borrowed $5,900 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $1,600 were purchased for cash. The original list price of the equipment was $1,930, but a discount was received because the seller was having a sale. d. A store location was rented, and $1,500 was paid for the first month's rent. e. Inventory of $14,700 was purchased; $8,500 cash was paid to the suppliers, and the balance will be paid within 60 days. f. During the first week of operations, merchandise that had cost $3,100 was sold for $5,100 cash. g. A newspaper ad costing $100 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $4,350 was purchased; cash of $1,100 was paid,…arrow_forwardThe transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the stockholders invested cash of $7,400. b. The firm borrowed $5,900 from the bank; a short-term note was signed. c. Display cases and other store equipment costing $1,600 were purchased for cash. The original list price of the equipment was $1,930, but a discount was received because the seller was having a sale. d. A store location was rented, and $1,500 was paid for the first month's rent. e. Inventory of $14,700 was purchased; $8,500 cash was paid to the suppliers, and the balance will be paid within 60 days. f. During the first week of operations, merchandise that had cost $3,100 was sold for $5,100 cash. g. A newspaper ad costing $100 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. h. Additional inventory costing $4,350 was purchased; cash of $1,100 was paid,…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,