EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Haresh

Transcribed Image Text:-

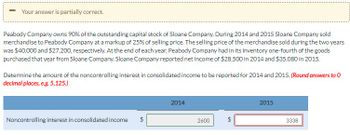

Your answer is partially correct.

Peabody Company owns 90% of the outstanding capital stock of Sloane Company. During 2014 and 2015 Sloane Company sold

merchandise to Peabody Company at a markup of 25% of selling price. The selling price of the merchandise sold during the two years

was $40,000 and $27,200, respectively. At the end of each year, Peabody Company had in its inventory one-fourth of the goods

purchased that year from Sloane Company. Sloane Company reported net income of $28,500 in 2014 and $35,080 in 2015.

Determine the amount of the noncontrolling interest in consolidated income to be reported for 2014 and 2015. (Round answers to O

decimal places, e.g. 5,125.)

Noncontrolling interest in consolidated income

2014

2600

2015

3338

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hardevarrow_forwardP Corporation owns 90% of the common stock of S Company. During 2013, S Company made intercompany sales of $500,000 with a markup of 20% of selling price. The ending inventory of P Corporation includes goods purchased in 2013 from S Company for $150,000. The unrealized profit in the ending inventory on hand by P in 2013 is: Select one: a. 30000 b. 120000 c. 25000 d. 125000arrow_forwardPine Company owns an 80% interest in Salad Company and a 90% interest in Tuna Company. During 2016 and 2017, intercompany sales of merchandise were made by all three companies. Total sales amounted to $2,400,000 in 2016, and $2,700,000 in 2017. The companies sold their merchandise at the following percentages above cost. Pine 15% Salad 20% Tuna 25% The amount of merchandise remaining in the 2017 beginning and ending inventories of the companies from these intercompany sales is shown below. Reported net incomes (from independent operations including sales to affiliates) of Pine, Salad, and Tuna for 2017 were $3,600,000, $1,500,000, and $2,400,000, respectively. Required: Calculate the amount noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2017. Calculate the controlling interest in consolidated net income for 2017.arrow_forward

- Pinky Company has 80% holdings over Silk Company. During 2018, Pinky Company sold merchandise to Silk Company for P120,000 and in turn, purchased P90,000 from Silk Company. Both sales were made on account. Intercompany sales of merchandise during 2018 were made at the following gross profit rates: Downstream intercompany sale Upstream intercompany sale 25% based on sales 20% based on cost As of December 31, 2018, 30% of all intercompany sales remain in ending inventory of the buying affiliate. The beginning inventory of Pinky includes P2,500 worth of merchandise acquired from Silk on which Silk reported a profit of P1,000 while the beginning inventory of Silk also includes P3,000 of merchandise acquired from Pinky at 35% mark- up. Using cost method, the following results of operations for 2018 are as follows: Pinky Company 198,000 60,000 Silk Company 75,000 10,000 Net income Dividends declared and paid 33. How much of the consolidated net income for 2018 is attributable to the…arrow_forwardSorel is an 80%-owned subsidiary of Pattern Company. The two affiliates had the following separate income statements for 2015 and 2016. (attached)Sorel sells at the same gross profit percentage to all customers. During 2015, Sorel sold goods to Pattern for the first time in the amount of $120,000. $30,000 of these sales remained in Pattern’s ending inventory. During 2016, sales to Pattern by Sorel were $150,000, of which $25,000 sales were still in Pattern’s December 31, 2016, inventory.Prepare consolidated income statements including the distribution of income to the controlling and noncontrolling interests for 2015 and 2016.arrow_forwardGive true answerarrow_forward

- What was parma's gross profit during 2012?arrow_forwardPepper bought 70% of Salt on 1 July 2016. The following are the statements of profit or loss of Pepper and Salt for the year ended 31 March 2017. Pepper Salt GHS’000 GHS’000 Revenue 31,200 10,400 Cost of sales (17,800) (5,600) Gross profit 13,400 4,800 Operating expenses (8,500) (3,200) Profit from operations 4,900 1,600 Investment income 2,000 Profit before tax 6,900 1,600 Tax…arrow_forwardPaige, Inc. owns 80% of Sigler, Inc. During 2011, Paige sold goods with a 40% gross profit to Sigler. Sigler sold all of these goods in 2011. For the 2011 consolidated financial statements, how should the summation of Paige and Sigler income statement items be adjusted? a. Sales and cost of goods sold should be reduced by the intercompany sales. b. Sales and cost of goods sold should be reduced by 80% of the intercompany sales. c. Net income should be reduced by 80% of the gross profit on intercompany sales. d. No adjustment is necessary.arrow_forward

- In Problem 5-5 if the numbers where changed to this. Top Company holds 90 percent of Bottom Company’s common stock. In the current year, Top reports sales of $820,000 and cost of goods sold of $615,000. For this same period, Bottom has sales of $320,000 and cost of goods sold of $192,000. During the current year, Top sold merchandise to Bottom for $120,000. The subsidiary still possesses 40 percent of this inventory at the current year-end. Top had established the transfer price based on its normal gross profit rate. What are the consolidated sales and cost of goods sold?arrow_forwardShaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille's cost of goods sold for the current year.arrow_forwardssarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning