Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

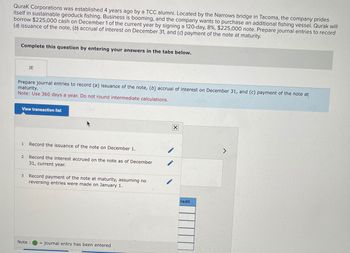

Transcribed Image Text:Qurak Corporations was established 4 years ago by a TCC alumni. Located by the Narrows bridge in Tacoma, the company prides

itself in sustainable geoduck fishing. Business is booming, and the company wants to purchase an additional fishing vessel. Qurak will

borrow $225,000 cash on December 1 of the current year by signing a 120-day, 8%, $225,000 note. Prepare journal entries to record

(a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity.

Complete this question by entering your answers in the tabs below.

JE

Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at

maturity.

Note: Use 360 days a year. Do not round intermediate calculations.

View transaction list

1

Record the issuance of the note on December 1.

2

Record the interest accrued on the note as of December

31, current year.

3

Record payment of the note at maturity, assuming no

reversing entries were made on January 1.

Note:

= journal entry has been entered

☑

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In an effort to raise some cash for operating activities, Swifty Corporation approached Blue Spruce Ltd. and asked to borrow$119 ,000 (the Presidents of Swifty and Blue Spruce were cousins). Blue Spruce agreed to loan $119,000 to Swifty for three monthsat 6% interest. On August 1, Swifty signed a promissory note for the amount, promising to repay the funds plus interest onNovember 1. Prepare the journal entry for the repayment of the note receivable plus interest on November 1.arrow_forwardCould you help me solve this accounting homework problem for me? and please show all your work so I can understand it On January 1, 2020, TPM Inc. acquires a piece of equipment for a list price of $300,000. It pays$20,000 immediately and writes a note for the remainder. Annual interest of 3% is due everyDecember 31st, and the principal of the note is payable in 6 years.TPM’s incremental borrowing rate is 6%, while the seller’s incremental borrowing rate is 7%.TPM is a public company. It depreciates its equipment using the diminishing balance method at15%. The equipment’s residual value is $40,000 at the end of its useful life. 1) Prepare all required journal entries for the years 2020 and 2021.2) Determine the Asset’s net book value on January 1, 2024.3) Determine the note payable carrying value on January 1, 2024.arrow_forwardThe owner of Alpine Golf Course Ltd., a local golf course, has just approached a bank for financing for its new business venture, the development of another course. On April 1, 2020, the bank lent the company $200,000 at an interest rate of 8%. The bank loan is payable over four years with annual payments of $60,384. The first payment is due March 31, 2021. The golf course’s year end is March 31. Instructions a)Prepare an instalment payment schedule for the four-year loan period. Round all amounts to the nearest dollar.b)Record the receipt of the bank loan on April 1, 2020.c)Record the first two instalment payments, on March 31, 2021, and March 31, 2022.d)Show the statement of financial position presentation of the bank loan payable as at March 31, 2021.e)Show the statement of financial position presentation for all accounts relating to the bank loan assuming that the company’s year end was on April 30, 2021, instead of March 31, 2021.Classify liabilities. please show workingsarrow_forward

- Kelly Jones and Tami Crawford borrowed $26,000 on a 7-month, 6% note from Gem State Bank to open their business, Pharoah’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. what is the entry required on January 1, 2023, when the loan is paid back?arrow_forwardSnowboarding company has a $5 000 000 note payable outstanding. the terms of the note require repayment of principle on June 30 20X2. the company is now finalizing financial statements for year ending, December 31 20X1. On January 25, 20X2, before the financial statements are released, the company reaches an agreement with e lender to refinance the liability with a new date June 30, 20X5. snowboarding company also has committed to donate $200 000. No donation agreement has yet been signed, but a public announcement has been made and the company and snowboarding association have met and agreed to the races the funding will support for the reason ad promotion of the snowboarding company through its website. QUESTIONS 1) if snowboarding company complies with IFRS will the note payable be classified as a current or long-term liability on December 31, 20X1? 2) if snowboarding company complies with ASPE will the note payable be classified as a current or long-term liability on December 31,…arrow_forwardOn January 1, 2024, Evanston Corporation borrowed $7 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $2,570,460 on December 31 of each year. The payments include interest at a rate of 5%. Required: 1. Record the cash received when the note is issued. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions (i.e., $5.5 million should be entered as 5,500,000).) View transaction list Journal entry worksheet < 1 Record the receipt of cash from the issue of the note payable. Note: Enter debits before credits. Date January 01, 2024 Cash Notos Davahin General Journal Debit Creditarrow_forward

- 2. The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program’s bank account for the year. At the beginning of 2024, the program had unrestricted cash of $28,000. Cash Basis 12 months Cash receipts: Registration fees $ 132,000 Borrowing from bank 58,000 Total deposits 190,000 Cash disbursements: Wages 72,400 Payroll taxes and employee benefits 9,700 Insurance (paid monthly) 6,700 Purchase of bus 80,000 Interest on bank note 1,740 Total checks 170,540 Excess of receipts over disbursements $ 19,460 The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of each year, beginning October 1, 2024. The bus was purchased on April 1 with the…arrow_forwardShamrock Corporation was formed 5 years ago through a public subscription of common stock. Daniel Brown, who owns 15% of the common stock, was one of the organizers of Shamrock and is its current president. The company has been successful, but it currently is experiencing a shortage of funds. On June 10, 2018, Daniel Brown approached the Topeka National Bank, asking for a 24-month extension on two $35,150 notes, which are due on June 30, 2018, and September 30, 2018. Another note of $5,990 is due on March 31, 2019, but he expects no difficulty in paying this note on its due date. Brown explained that Shamrock’s cash flow problems are due primarily to the company’s desire to finance a $302,830 plant expansion over the next 2 fiscal years through internally generated funds.The commercial loan officer of Topeka National Bank requested the following financial reports for the last 2 fiscal years. SHAMROCK CORPORATIONBALANCE SHEETMARCH 31 Assets 2018 2017 Cash $18,160…arrow_forwardbroadband service company borrowed $ 2 mil lion for new equipment and repaid the loan in amounts of $ 200,000 in years 1 and 2 plus a lump sum amount of $ 2.2 million at the end of year 3 . What was the interest rate on the loan ? 6.17 A permanent endowment at the University of Alabama is to award scholarships to engineering students two times per year ( end of June and end of December ) . The first awards are to be made beginning 5-1 / 2 years after the $ 20 million lump sum donation is made . If the interest from the endowment is to fund 100 students each semester ( i.e. , twice a year ) in the amount of $ 5000 each semester , what semiannual rate of return must the endowment fund earn ? Identify three possible difficulties with rate of return analyses compared to PW , AW , or FW analyses .arrow_forward

- On September 1, 2024, Triton Entertainment borrowed $24 million cash to fund a new Fun Park. The loan was made by Nevada Bank under a noncommitted short-term financing arrangement. Triton issued a 9-month, 12% promissory note. Interest was payable at maturity. Triton's fiscal period is the calendar year. Required: 1. Prepare the journal entry for the issuance of the note by Triton. 2. Prepare the appropriate adjusting entry for the note by Triton on December 31, 2024. 3. Prepare the journal entry for the payment of the note at maturity. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars and not in millions. No 1 Transaction 1 Cash Notes payable 2 2 Interest expense Notes payable 3 3 General Journal > > × Debit Credit 24,000,000 24,000,000 960,000 960,000arrow_forwardKelly Jones and Tami Crawford borrowed $26,000 on a 7-month, 6% note from Gem State Bank to open their business, Pharoah’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. what is the entry to record the receipt of the funds from the loan? what is the entry to accrue the interest on June 30?arrow_forwardCan you solve these accounting problem?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning