Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

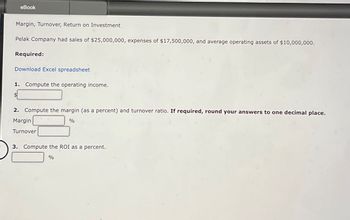

Transcribed Image Text:eBook

Margin, Turnover, Return on Investment

Pelak Company had sales of $25,000,000, expenses of $17,500,000, and average operating assets of $10,000,000.

Required:

Download Excel spreadsheet

1. Compute the operating income.

$

2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place.

Margin

Turnover

%

3. Compute the ROI as a percent.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Margin, Turnover, Return on Investment Pelak Company had sales of $5,003,000, expenses of $4,607,000, and average operating assets of $4,840,000. Required: 1. Compute the operating income.$ 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin % Turnover 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.%arrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $19,754, invested assets of $83,000, and sales of $282,200. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $55,704, invested assets of $211,000, and sales of $506,400. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin b. Investment turnover c. Return on investmentarrow_forward

- Margin, Turnover, Return on Investment Pelak Company had sales of $4,974,000, expenses of $4,566,000, and average operating assets of $4,380,000. Required: 1. Compute the operating income.$fill in the blank 1 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin fill in the blank 2 % Turnover fill in the blank 3 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.fill in the blank 4 %arrow_forwardPerform a vertical analysis of the P&L (FS Company). "Formula: Vertical Analysis % Each income statement items / Revenues (or Net sales) Fill in each Blank. Round your answers to the nearest tenth percent, i.e. 4.5%. PLEASE SUBMIT YOUR ANSWERS IN % and include the % symbol. Do not leave any blank. If the answer is 0, be sure to put 0. Cost of goods sold Gross profit Net sales $858,000 Select] Other expenses Interest revenue Income from operations Interest expense 2018 Income before income taxes Income tax expense Net income 513,000 345,000 244,000 101,000 4,000 24,000 81,000 33,000 FS Company Comparative P&L statement Years Ended December 31, 2018 and 2017 48,000 % of sales Select J [Select] | Select | [Select] [Select] [Select] [ Select] Select] Select > >arrow_forwardHi expart Provide correct calculationarrow_forward

- Excel Online Structured Activity: Balance Sheet Analysis Consider the following financial data for J. White Industries: Total assets turnover: 1.2Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 27%Total liabilities-to-assets ratio: 45%Quick ratio: 0.90Days sales outstanding (based on 365-day year): 29.5 daysInventory turnover ratio: 4.0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Complete the balance sheet and sales information in the table that follows for J. White Industries. Do not round intermediate calculations. Round your answers to the nearest whole dollar. Partial Income StatementInformation Sales $ fill in the blank 2 Cost of goods sold $ fill in the blank 3 Balance Sheet Cash $ fill in the blank 4 Accounts payable $ fill in the blank 5 Accounts receivable $ fill in the blank 6 Long-term debt $…arrow_forwardProfit Margin, Investment Turnover, and ROI Briggs Company has operating income of $108,955, invested assets of $283,000, and sales of $990,500. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardBriggs Company has income from operations of $24,255, invested assets of $99,000, and sales of $346,500. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1 % b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3 %arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardProfit Margin, Investment Turnover, and ROI Briggs Company has income from operations of $132,756, invested assets of $299,000, and sales of $1,106,300. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardBriggs Company has operating income of $45,760, invested assets of $143,000, and sales of $457,600. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning