Century 21 Accounting Multicolumn Journal

11th Edition

ISBN: 9781337679503

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Instructions

On February 14, Foster Associates Co. paid $2,400 to repair the transmission on one of its delivery vans. In addition, Foster paid $500 to install a GPS system in its van.

Required:

Journalize the entries for the transmission and GPS system expenditures. Refer to the chart of accounts for the exact wording of the account

titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will

automatically indent a credit entry when a credit amount is entered.

Journal

Chart of Accounts

ASSETS

110 Cash

111 Petty Cash

112 Accounts Receivable

114 Interest Receivable

115 Notes Receivable

116 Merchandise Inventory

117 Supplies

119 Prepaid Insurance

120 Land

123 Delivery Van

Shaded cells have feedback.

Journalize the entries for the transmission and GPS system expenditures. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not

use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount

is entered.

Question not attempted.

1

DESCRIPTION

JOURNAL

124 Accumulated Depreciation-Delivery Van

125 Equipment

126 Accumulated Depreciation-Equipment

130 Mineral Rights

131 Accumulated Depletion

132 Goodwill

133 Patents

PAGE 1

LIABILITIES

Score: 0/51

ACCOUNTING FOLIATION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

210 Accounts Payable

211 Salaries Payable

213 Sales Tax Payable

214 Interest Payable

REVENUE

410 Sales

610 Interest Revenue

620 Gain on Sale of Delivery Truck

621 Gain on Sale of Equipment

EXPENSES

510 Cost of Merchandise Sold

520 Salaries Expense

521 Advertising Expense

522 Depreciation Expense-Delivery Truck

523 Delivery Expense

524 Repairs and Maintenance Expense

529 Selling Expenses

531 Rent Expense

532 Depreciation Expense-Equipment

533 Depletion Expense

534 Amortization Expense-Patents

535 Insurance Expense

536 Supplies Expense

539 Miscellaneous Expense

710 Interest Expense

720 Loss on Sale of Delivery Truck

721 Loss on Sale of Equipment

3

4

215 Notes Payable

EQUITY

310 Owner's Capital

Points:

0/10

311 Owner's Drawing

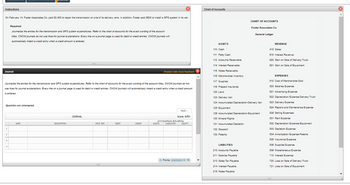

Transcribed Image Text:Instructions

On February 14, Foster Associates Co. paid $2,400 to repair the transmission on one of its delivery vans. In addition, Foster paid $500 to install a GPS system in its van.

Required:

Journalize the entries for the transmission and GPS system expenditures. Refer to the chart of accounts for the exact wording of the account

titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will

automatically indent a credit entry when a credit amount is entered.

Chart of Accounts

CHART OF ACCOUNTS

Foster Associates Co.

General Ledger

Journal

Shaded cells have feedback.

Journalize the entries for the transmission and GPS system expenditures. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not

use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount

is entered.

Question not attempted.

DATE

1

2

3

4

DESCRIPTION

PAGE 1

JOURNAL

Score: 0/51

ACCOUNTING FOLIATION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

Points:

0/10

ASSETS

110 Cash

111 Petty Cash

112 Accounts Receivable

114 Interest Receivable

115 Notes Receivable

116 Merchandise Inventory

117 Supplies

119 Prepaid Insurance

120 Land

123 Delivery Van

124 Accumulated Depreciation-Delivery Van

125 Equipment

126 Accumulated Depreciation-Equipment

130 Mineral Rights

131 Accumulated Depletion

132 Goodwill

133 Patents

LIABILITIES

210 Accounts Payable

211 Salaries Payable

213 Sales Tax Payable

214 Interest Payable

REVENUE

410 Sales

610 Interest Revenue

620 Gain on Sale of Delivery Truck

621 Gain on Sale of Equipment

EXPENSES

510 Cost of Merchandise Sold

520 Salaries Expense

521 Advertising Expense

522 Depreciation Expense-Delivery Truck

523 Delivery Expense

524 Repairs and Maintenance Expense

529 Selling Expenses

531 Rent Expense

532 Depreciation Expense-Equipment

533 Depletion Expense

534 Amortization Expense-Patents

535 Insurance Expense

536 Supplies Expense

539 Miscellaneous Expense

710 Interest Expense

720 Loss on Sale of Delivery Truck

721 Loss on Sale of Equipment

215 Notes Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please help mearrow_forwardI need help with the attached imagearrow_forwardOriole Company uses both special journals and a general journal as described in this chapter. On June 30, after all monthly postings had been completed, the Accounts Receivable control account in the general ledger had a debit balance of $307,200; the Accounts Payable control account had a credit balance of $85,300. The July transactions recorded in the special journals are summarized below. No entries affecting accounts receivable and accounts payable were recorded in the general journal for July. Sales journal Purchases journal Cash receipts journal Cash payments journal Total sales Total purchases Accounts receivable column total Accounts payable column total $156,000 $58,800 $144,500 $41,300arrow_forward

- Sunland Company uses both special journals and a general journal as described in this chapter. On June 30, after all monthly postings had been completed, the Accounts Receivable control account in the general ledger had a debit balance of $ 324,100; the Accounts Payable control account had a credit balance of $ 83,300.The July transactions recorded in the special journals are summarized below. No entries affecting accounts receivable and accounts payable were recorded in the general journal for July. Sales journal Total sales $ 158,000 Purchases journal Total purchases $ 51,400 Cash receipts journal Accounts receivable column total $ 137,100 Cash payments journal Accounts payable column total $ 48,600 (a) What is the balance of the Accounts Receivable control account after the monthly postings on July 31? The balance of the Accounts Receivable control account $ enter the balance of the accounts receivable control account in…arrow_forwardTo what account(s) is the column total of $174,100 in the sales journal posted?arrow_forwardSheridan Company uses both special journals and a general journal as described in this chapter. On June 30, after all monthly postings had been completed, the Accounts Receivable control account in the general ledger had a debit balance of $300,300; the Accounts Payable control account had a credit balance of $83,600.The July transactions recorded in the special journals are summarized below. No entries affecting accounts receivable and accounts payable were recorded in the general journal for July. Sales journal Total sales $169,300 Purchases journal Total purchases $57,000 Cash receipts journal Accounts receivable column total $141,600 Cash payments journal Accounts payable column total $46,700 What is the balance of the Accounts Receivable control account after the monthly postings on July 31? The balance of the Accounts Receivable control accounarrow_forward

- Gate City Cycles had trouble collecting its account receivable from Sue Ann Noel. On June 19, 2018, Gate City Cycles finally wrote off Noel's $750 account receivable. On December 31, Noel sent a $750 check to Gate City Cycles. Journalize the entries required for Gate City Cycles, assuming Gate City Cycles uses the direct write-off method. On June 19, 2018, Gate City Cycles wrote off Noel's $750 account receivable. Journalize the entry.(Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Jun. 19 On December 31, Noel sent a $750 check to Gate City Cycles. Start by journalizing the entry to reverse the earlier write-off. Date Accounts and Explanation Debit Credit Dec. 31arrow_forwardDon't give answer in image formatarrow_forwardPina Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 20 Feb. 10 15 Journalize the transactions for Pina Stores. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Jan. 15 Jan. 20 Feb. 10 Made Pina credit card sales totaling NT$35,500. (There were no balances prior to January 15.) Made Visa credit card sales (service charge fee 3%) totaling NT$6,300. Collected NT$12,100 on Pina credit card sales. Added finance charges of 2.5% to Pina credit card account balances. Feb. 15 Accounts Receivable Account Titles and Explanation Sales Revenue Cash Cash Accounts Receivable Accounts Receivable Debit 35500 6111 189 12100 585 Credit 35500 6300 12100 585arrow_forward

- Solstice Company determines on October 1 that it cannot collect $61,000 of its accounts receivable from its customer, P. Moore. Apply the direct write-off method to record this loss as of October 1. View transaction list Journal entry worksheet 1 Record the write-off an account. Note: Enter debits before credits. Date October 01 General Journal Debit Creditarrow_forwardA check drawn by a company in payment of a voucher for $965 was recorded in the journal as $695. What entry is required in the company's accounts?arrow_forwardPrepare journal entries for the following transactions, using the accounts in the order listed: PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. On June 1, Kellie Company had decided to initiate a petty cash fund in the amount of $1,200. DR CR On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. DR DR DR DR DR DR or CR? CR On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. DR DR DR DR DR DR or CR?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning