Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give correct answer

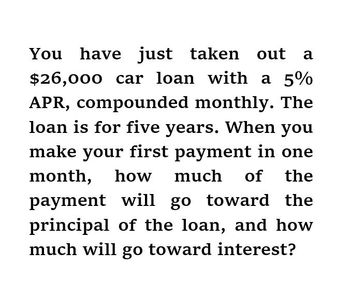

Transcribed Image Text:You have just taken out a

$26,000 car loan with a 5%

APR, compounded monthly. The

loan is for five years. When you

make your first payment in one

month, how much of the

payment will go toward the

principal of the loan, and how

much will go toward interest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- You want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardUse the tables in Appendix B to answer the following questions. A. If you would like to accumulate $4,200 over the next 6 years when the interest rate is 8%, how much do you need to deposit in the account? B. If you place $8,700 in a savings account, how much will you have at the end of 12 years with an interest rate of 8%? C. You invest $2,000 per year, at the end of the year, for 20 years at 10% interest. How much will you have at the end of 20 years? D. You win the lottery and can either receive $500,000 as a lump sum or $60,000 per year for 20 years. Assuming you can earn 3% interest, which do you recommend and why?arrow_forwardYou have just taken out a $15,000 car loan with a 7% APR, compounded monthly. The loan is for 5 years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? The amount of your first payment that will go toward the interest of the loan is The amount of your first payment that will go toward the principal of the loan isarrow_forward

- You have just taken out a $23,000 car loan with a 7% APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest?arrow_forwardYou have just taken out a $16,000 car loan with a 8% APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? (Note: Be careful not to round any intermediate steps less than six decimal places.) When you make your first payment, $____ will go toward the principal of the loan and $______ will go toward the interest. (Round to the nearest cent.)arrow_forwardYou have just taken out a $24,000 car loan with a 7% APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? (Note: Be careful not to round any intermediate steps less than six decimal places.) will go When you make your first payment, $ will go toward the principal of the loan and $ toward the interest. (Round to the nearest cent.)arrow_forward

- You have just taken out a $24,000car loan with a 4%APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest?(Note: Be careful not to round any intermediate steps less than six decimal places.) When you make your first payment,$.... will go toward the principal of the loan and $......will go toward the interest. (Round to the nearest cent.)arrow_forwardyou have 23,000 car loan with 6% apr, compounded monthly. the loan is for five years. when you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? ( note: be careful not to round an intermediate step less than six) when you make your first payment $____ will go toward the principal of loan and $____ will go toward the interest ( round to the nearest cent)arrow_forwardYou can afford to pay $15,000 at the end of each of the next 30 years to repay a home loan. If the interest rate is 7.50%, what is the most you can borrow?arrow_forward

- You are offered an add-on loan for $4,500 at 18% for 5 years. What is the monthly payment? What is the amount of interest? What is the true interest rate cost of this loan? If you could pay the same loan above at a compound rate: What would the monthly payment be? What would the amount of interest be? Prepare a monthly payment schedule for each loan above using Excel, and submit it. Suppose that you are only allowed to make a balloon payment to the principal of the compound interest loan. You have $1,000 to put down at the beginning of year three. How many payments will you save?arrow_forwardNeed helparrow_forwardYou've been offered a loan of $20000, which you will have to repay in 5 equal annual payments of $6000, with the first payment due one year from now. What interest rate would you pay on that loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College