Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

None

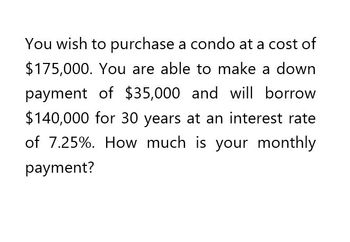

Transcribed Image Text:You wish to purchase a condo at a cost of

$175,000. You are able to make a down

payment of $35,000 and will borrow

$140,000 for 30 years at an interest rate

of 7.25%. How much is your monthly

payment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- You want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardUse the tables in Appendix B to answer the following questions. A. If you would like to accumulate $4,200 over the next 6 years when the interest rate is 8%, how much do you need to deposit in the account? B. If you place $8,700 in a savings account, how much will you have at the end of 12 years with an interest rate of 8%? C. You invest $2,000 per year, at the end of the year, for 20 years at 10% interest. How much will you have at the end of 20 years? D. You win the lottery and can either receive $500,000 as a lump sum or $60,000 per year for 20 years. Assuming you can earn 3% interest, which do you recommend and why?arrow_forwardHow much is your monthly payment?arrow_forward

- Need helparrow_forwardYou can afford to pay $15,000 at the end of each of the next 30 years to repay a home loan. If the interest rate is 7.50%, what is the most you can borrow?arrow_forwardYou want to purchase a house valued at $200,000. After a downpayment, you can finance the house with a 20 year mortgage at 4.2% APR, compounded monthly. What percentage of the house will you need to finance in order to have monthly payments of $1,000? Round to two decimal places. What is the downpayment?arrow_forward

- You wish to purchase a home for $500,000. You will make payments of $30,000 at the end of every year for 30 years. The current rate of interest is 6.5% convertibly quarterly. Find the down payment that will be necessary.arrow_forward????arrow_forwardSuppose you purchase a house using a 30-year fixed rate mortgage. The APR on the loan is 3.2% and you will be required to make monthly payments of $3,700 what is the price you paid for your home?arrow_forward

- You want to buy a house valued at $200,000. AFter a down payment, you can finance the house with a 20 year mortgage at 4.2% APR compounded monthly. If you have a monthly payment of $1000, how much of the second payment goes towards the blance on the loan?arrow_forwardIn order to purchase a home, you must take out a mortgage with a total loan amount $150000. If the nominal yearly interest rate for your 15 year mortage is 3.5% how much will your monthly payment be?arrow_forwardAfter making payments of $901.10 for 8 years on your 30 year loan at 8.3%, you decide to sell your home. What is the loan payoff?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT