Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Bhupatbhai

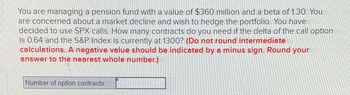

Transcribed Image Text:You are managing a pension fund with a value of $360 million and a beta of 1.30. You

are concerned about a market decline and wish to hedge the portfolio. You have

decided to use SPX calls. How many contracts do you need if the delta of the call option

is 0.64 and the S&P Index is currently at 1300? (Do not round intermediate

calculations. A negative value should be indicated by a minus sign. Round your

answer to the nearest whole number.)

Number of option contracts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are managing a pension fund with a value of $300 million and a beta of 1.07. You are concerned about a market decline and wish to hedge the portfolio. You have decided to use SPX calls. How many contracts do you need if the delta of the call option is .62 and the S&P index is currently at 2,030?arrow_forwardAm. 289.arrow_forwardSuppose you have a stock market portfolio with a beta of 0.83 that is currently worth $725 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of 0.30, and the S&P 500 index is at 3,270. Note: Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number. Number of option contractsarrow_forward

- Suppose you have a stock market portfolio with a beta of .90 that is currently worth $783 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of .50, and the S&P 500 index is at 1,270. (Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.) Number of option contracts 11,098arrow_forwardSuppose you have a stock market portfolio with a beta of 81 that is currently worth $580 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of 30, and the S&P 500 Index is at 1,270. (Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.) Answer is complete but not entirely correct. Number of option contracts 12,331arrow_forwardYou want to use S&P 500 index options to hedge your portfolio. • Portfolio has a beta of -1.0. • It is currently worth $500,000 and index stands at 1000. • The risk-free rate is 0% per annum. • There is no dividend yield on both the portfolio and the index. 1) What option contracts would you consider? 2) How many option contracts should be purchased? 3) What strike price should we consider for insurance against the portfolio value falling below $450,000 in three months? 4) What happens if index level turns out to be 1200 after three months?arrow_forward

- By looking at the sensivities of your portfolio to ds = -$2 and So = -1%, you decide to hedge delta, gamma and Vega risk of your portfolio with the underlying stock and two different options on the same asset with below data. Calculate the units of stock you need to trade to hedge away all delta, gamma and Vega risks of your portfolio.(Note that here you have to calculate the units of stock, Option A and Option B, but you will only submit the units of stock.) Variable Option A Option B Delta (A) -0.5 0.2 Gamma (T) 0.2 0.1 Vega (v) 8arrow_forwardRaghuarrow_forwardYou want to create a portfolio equally as risky as the market, and you have $1,200,000 to invest. Consider the following information: Asset Investment Beta Stock A $300,000 0.70 Stock B $360,000 1.25 Stock C 1.55 Risk-free asset Required: (a) What is the investment in Stock C? (Do not round your intermediate calculations.) (b) What is the investment in risk-free asset? (Do not round your intermediate calculations.)arrow_forward

- Assume that you manage a $10.00 million mutual fund that has a beta of 1.25 and a 9.50% required return. The risk-free rate is 2.20%. You now receive another $15.00 million, which you invest in stocks with an average beta of 0.80. What is the required rate of return on the new portfolio? (Hint: You must first find the market risk premium, then find the new portfolio beta.) Do not round your intermediate calculations. a. 9.17% b. 8.71% c. 7.92% d. 7.45% e. 9.65%arrow_forwardYou have been provided the following data about the securities of three firms, the market portfolio, and the risk-free asset: a. Fill in the missing values in the table. (Leave no cells blank - be certain to enter 0 wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) * With the market portfolio b-1. What is the expected return of Firm A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-2. What is your investment recommendation regarding Firm A for someone with a well-diversified portfolio? multiple choice 1 Buy Sell b-3. What is the expected return of Firm B? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-4. What is your investment recommendation regarding Firm B for someone with a well-diversified portfolio? multiple choice 2 Sell Buy b-5. What is the expected return of Firm C?…arrow_forwardTwo call options, A and B, are on the same stock. Their hedge ratios are 0.4 and 0.6, respectively. If a riskfree portfolio of the two calls contains one Call A, then the portfolio needs to contain _______ Call Bs (use negative numbers to mean short positions. Keep 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education