Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please Write SteP by Step Answer

Otherwise I give you DISLIKES !

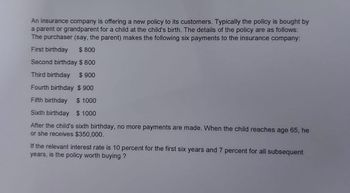

Transcribed Image Text:An insurance company is offering a new policy to its customers. Typically the policy is bought by

a parent or grandparent for a child at the child's birth. The details of the policy are as follows:

The purchaser (say, the parent) makes the following six payments to the insurance company:

First birthday $ 800

Second birthday $ 800

Third birthday $ 900

Fourth birthday $ 900

Fifth birthday

$ 1000

Sixth birthday $ 1000

After the child's sixth birthday, no more payments are made. When the child reaches age 65, he

or she receives $350,000.

If the relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent

years, is the policy worth buying?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: 910 $910 First birthday: Second birthday: Third birthday: Fourth birthday: $ 1,010 $ 1,010 Fifth birthday: $ 1,110 Sixth birthday: $ 1,110 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $420,000. If the relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years, what is the value of the policy at the child's 65th birthday? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Child's 65th birthdayarrow_forwardAn insurance company is offering a new policy to its customers. Typically the policy is bought by a parent or grandparent for a child at the child’s birth. For this policy, the purchaser (say, the parent) makes the following six payments to the insurance company: First birthday $ 910 Second birthday $ 910 Third birthday $ 1,010 Fourth birthday $ 850 Fifth birthday $ 1,110 Sixth birthday $ 950 After the child’s sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $410,000. If the relevant interest rate is 13 percent for the first six years and 7 percent for all subsequent years, what would the value of the deposits be when the policy matures? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardAn insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 890 $ 890 Future value $ 990 $ 850 $ 1,090 $ 950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $390,000. The relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child’s birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: $ 820 Second birthday: $ 820 Third birthday: $ 920 Fourth birthday: $ 850 Fifth birthday: $ 1,020 Sixth birthday: $ 950 After the child’s sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $320,000. The relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday.arrow_forwardAn insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: $950 Second birthday. $950 Third birthday: $1,050 Fourth birthday: $850 Fifth birthday: $1,150 Sixth birthday: $950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $450,000. The relevant interest rate is 15 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardAn Insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company First birthday: Second birthday Third birthday: Fourth birthday Fifth birthday: Sixth birthday. $ 800 $800 $ 900 $ 900 Future value $1,000 $ 1,000 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $350,000. The relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years. Calculate the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Hey there expert , need help with this one!arrow_forward3 An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: eBook First birthday: Second birthday: Third birthday: $ 860 $ 860 $ 960 $ 960 Fourth birthday: Fifth birthday: Sixth birthday: After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $120,000. If the relevant interest rate is 9 percent for the first six years and 5 percent for all subsequent years, what is the value of the policy at the child's 65th birthday? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Child's 65th birthday $ 1,060 $ 1,060arrow_forwardPlease do the following question with full workingarrow_forward

- Insurance underwriting relies heavily on statistics to determine the amount of insurance premium to charge. The probability that a 25-year-old female will live another year is 0.99786 based on data from the national registry agency. Calculate the insurance premium an insurance company would charge to break even on a 1 year $0.5million term-life insurance policy?arrow_forwardAssume that you have calculated: (a) premiums for life insurance policies and (b) payments to annuitants based upon an assumption that everybody dies before attaining age 101. Now you discover that a significant number of your policy owners are likely to live beyond age 101 and some will live to age 121. How will that affect your business?arrow_forwardA patient's insurance policy states: Annual deductible: $300.00 Coinsurance: 70-30 This year the patient has made payments totaling $533 to all providers. Today the patient has an office visit (fee: $80). The patient presents a credit card for payment of today's bit. What is the amount that the patient should pay?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning