Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

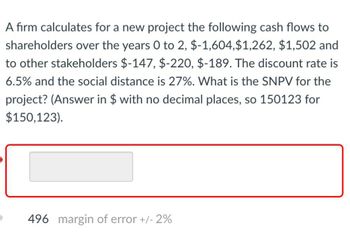

Transcribed Image Text:A firm calculates for a new project the following cash flows to

shareholders over the years 0 to 2, $-1,604,$1,262, $1,502 and

to other stakeholders $-147, $-220, $-189. The discount rate is

6.5% and the social distance is 27%. What is the SNPV for the

project? (Answer in $ with no decimal places, so 150123 for

$150,123).

496 margin of error +/- 2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A project has the following cash flows set out below. What is the profitability index of this project if the relevant discount rate is 2 percent? Enter your final answer to two decimal places. Year Cash flow 0 -1,745 1 537 2 2,066 3 3,912arrow_forwardConsider an investment project with the cash flows given in the table below. Compute the IRR for this investment. Is the project acceptable at MARR = 10%? The IRR for this project is %. (Round to one decimal place.) n 0 1 2 3 Cash Flow -$35,000 15,000 14,520 13,990arrow_forwardThe cash flows associated with an investment project are as follows: Project Y (200 000) Year 1 100 000 2 100 000 3 120 000 4 110 000 The discount rate is 8 percent. What's the discount payback period of the projects? (compile a spreadsheet) Calculate NPV, PI of a projects Calculate IRR of a projects Should the firm accept the project? a) b) c) d)arrow_forward

- Consider the cash flow of the two projects depicted in Table 3. If WiseGuy Inc. uses payback period rule to choose projects, which of the projects (Project A or Project B) will rank highest? TABLE 3 Project A Project B Time 0. -11,000. -10,000 Time 1. 3,000. 4,000 Time 2. 8,000. 3,000 Time 3. 3,000. 10,000 A) Project A B) Project B C) Project A and Project B have the same ranking. D) It cannot calculate a payback period without a discount rate. 7 Consider the cash flow of the two projects depicted in Table 3. If WiseGuy Inc. uses IRR rule to choose projects, which of the projects (Project A or Project B) will rank highest? A) Project A B) Project B C) Project A and Project B have the same ranking. D) It cannot calculate a payback period without a discount rate.arrow_forwardYou are given the following cash flow for a project, and told that PW(8%) = $8,300 for this project. What is the value of the unknown payment X for the second and third periods? n Cash Flow 0 -$36,000 1 $0 2 $X 3 $X O Cannot be determined. O $24,842.08 O $26,829.44 O $5,026.74arrow_forwardMAKE SURE YOU ANSWER THIS QUESTION IN EXCEL FORMULA, NOT ALGEBRAICALLY!!!!!arrow_forward

- A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: Year 0 Cash Flow -$ 27,800 1 11,800 -23 3 14,800 10,800 If the required return is 18 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %arrow_forward6. You are choosing between two projects. The cash flows for the projects are given in the following Data table ($ million): Project Year 0 Year 1 Year 2 Year 3 Year 4 A −$48 $27 $19 $22 $15 B −$100 $22 $39 $48 $62 The IRR for project A is __________________________%. (Round to one decimal place.) The IRR for project B is____________________________%.(Round to one decimal place.) If your discount rate is 5.4%, the NPV for project A is $_______________million.(Round to two decimal places.) If your discount rate is 5.4%, the NPV for project B is $______________ million.(Round to two decimal places.) NPV and IRR rank the two projects differently because they are measuring different things. ___________________is measuring value creation, while ___________________is measuring return on investment. Because returns do not scale with different levels of investment, the two measures may give different rankings when…arrow_forwardCompute the internal rate of return for the cash flows of the following two projects: (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Year Project A Project B 0 –$ 9,800 –$ 7,400 1 3,800 2,100 2 4,600 5,300 3 3,400 3,000 Internal rate of return Project A % Project B %arrow_forward

- Consider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardA project is being analyzed with the following set of cash flows. Calculate the internal rate of return (IRR). (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cash Year Flow 0 16,000 123 6,700 8,000 6,500 IRR %arrow_forwardYou've estimated the following cash flows (in $) for two mutually exclusive projects: Year Project A Project B 0 -5,400 -8,100 1 1,325 1,325 2 2,148 2,148 3 3,958 7,725 The required return for both projects is 8%. 1. What is the IRR for project A? 2. What is the IRR for project B? 3. Which project seems better according to the IRR method? 4. What is the NPV for project A? 5. What is the NPV for project B? 6. Which project seems better according to the NPV method? 7. Compare the answers to parts 3 and 6. If both projects are mutually exclusive, which one should you accept?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education