EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

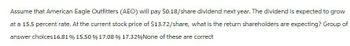

Transcribed Image Text:Assume that American Eagle Outfitters (AEO) will pay $0.18/share dividend next year. The dividend is expected to grow

at a 15.5 percent rate. At the current stock price of $13.72/share, what is the return shareholders are expecting? Group of

answer choices 16.81% 15.50% 17.08 % 17.32% None of these are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that IWT has completed its IPO and has a $112.5 million capital budget planned for the coming year. You have determined that its present capital structure (80% equity and 20% debt) is optimal, and its net income is forecasted at $140 million. Use the residual distribution approach to determine IWT’s total dollar distribution. Assume for now that the distribution is in the form of a dividend. Suppose IWT has 100 million shares of stock outstanding. What is the forecasted dividend payout ratio? What is the forecasted dividend per share? What would happen to the payout ratio and DPS if net income were forecasted to decrease to $90 million? To increase to $160 million? In general terms, how would a change in investment opportunities affect the payout ratio under the residual distribution policy? What are the advantages and disadvantages of the residual policy? (Hint: Don’t neglect signaling and clientele effects.)arrow_forwardCALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?arrow_forwardWhat is the current per-share value of JRM Corporation to an investor who requires a 0.17 annual rate of return, if JRM's current per-share dividend is $6 and is expected to remain at grow at 0.09 for the foreseeable future? what is the price of the stockarrow_forward

- Stoneheart Group is expected to pay a dividend of $3.23 next year. The company's dividend growth rate is expected to be 3.6 percent indefinitely and investors require a return of 12 percent on the company's stock. What is the stock price? Multiple Choice. $26.92 $38.45 $36.53 $39.84 49421arrow_forwardPlease answer the following multiple choicearrow_forwardAssume Evco, Inc. has a current stock price of $50.92 and will pay a $2.20 dividend in one year; its equity cost of capital is 18%. What price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? We can expect Evco stock to sell for $_____. (Round to the nearest cent.)arrow_forward

- The first answer is correct the other two are incorrectarrow_forward← Assume Evco, Inc. has a current stock price of $47.06 and will pay a $1.95 dividend in one year, its equity cost of capital is 10% What price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? We can expect Evco stock to sell for $ (Round to the nearest cent.) Carrow_forwardAssume Evco, Inc. has a current stock price of $50.86 and will pay a $2.15 dividend in one year; its equity cost of capital is 19%. What price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? We can expect Evco stock to sell for? (Round to the nearest cent.)arrow_forward

- Assume Evco, Inc. has a current stock price of $49. 11 and will pay a $2.25 dividend in one year, its equity cost of capital is 18%. What price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? We can expect Evco stock to sell for $ ( Round to the nearest cent.)arrow_forwardAssume Evco, Inc., has a current stock price of $39 and will pay a $1.80 dividend in one year; its equity cost of capital is 13%. What price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? The expected price is $_______. (Round to the nearest cent.)arrow_forwardA share of preferred stock pays a quarterly dividend of $2.1. If the price of this preferred stock is currently $96, what is the nominal annual rate of return? Group of answer choices 8.25% 7.75% 8.75% 9.25% 7.25%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning