EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Nikul

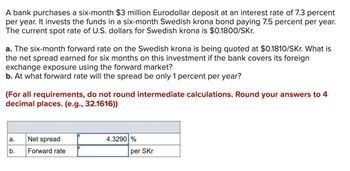

Transcribed Image Text:A bank purchases a six-month $3 million Eurodollar deposit at an interest rate of 7.3 percent

per year. It invests the funds in a six-month Swedish krona bond paying 7.5 percent per year.

The current spot rate of U.S. dollars for Swedish krona is $0.1800/SKr.

a. The six-month forward rate on the Swedish krona is being quoted at $0.1810/SKr. What is

the net spread earned for six months on this investment if the bank covers its foreign

exchange exposure using the forward market?

b. At what forward rate will the spread be only 1 percent per year?

(For all requirements, do not round intermediate calculations. Round your answers to 4

decimal places. (e.g., 32.1616))

a.

Net spread

b.

Forward rate

4.3290 %

per SKr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The forward rate of the Swiss franc is $0.50. The spot rate of the Swiss franc is $0.48. The following interest rates exist: U.S. Switzerland 360-day borrowing rate 7% 5% 360-day deposit rate 6% 4% You need to purchase SF200,000 in 360 days. If you use a money market hedge, the amount of dollars you need in 360 days is ______. A. $101,904 B. $101,923 C. $96,914 D. $98,770arrow_forwardSuppose that the U.S. interest rate on one year Treasury notes was 4.5%. We will use this as the annual interest rate in the U.S. And suppose that the interest rate on the one-year German Treasury note was 4.1%. The spot rate is 1.0162 EUR/USD.. And the 3-month forward rate is 1.0188 Eur/USD. Is there an opportunity for covered interest arbitrage? If so, what would be the total profit if we borrowed $20 million for 3 months? A. YES- $27,395.21 would be the profit B. YES- $29,385.41 would be the profit C. YES- $31,695.53 would be the profit D. YES- $33,875.42 would be the profit E. NO- there is no opportunity for a profitarrow_forwardAn investor in England purchased a 91-day $1,000 par T-bill for $987.65. At that time, the exchange rate was $1.75 per pound. At maturity, the exchange rate was $1.83 per pound. What was the investor’s holding period return in pounds?arrow_forward

- Sun Bank USA has purchased a 24 million one-year Australian dollar loan that pays 15 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.625/A$1. It has funded this loan by accepting a British pound (BP)-denominated deposit for the equivalent amount and maturity at an annual rate of 13 percent. The current spot rate of U.S. dollars for British pounds (GBP/USD) is $1.60/£1. a. What is the net interest income earned in dollars on this one-year transaction if the spot rate of U.S. dollars for Australian dollars and U.S. dollars for BPs at the end of the year are $0.588/A$1 and $1.848/£1, respectively? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your final answer to the nearest whole number. (e.g., 32)) b. What should the spot rate of U.S. dollars for BPs be at the end of the year in order for the bank to earn a net interest income of $180,000 (disregarding any change in principal values)?…arrow_forwardHeidi Høi Jensen, a foreign exchange trader at J.P. Morgan Chase, can invest $5 million, or the foreign currency equivalent of the bank's short term funds, in a covered interest arbitrage with Denmark. Assumptions Arbitrage funds available Spot exchange rate (kr/$) 3-month forward rate (kr/S) US dollar 3-month interest rate Danish kroner 3-month interest rate Value $5,000,000 6.1720 6.1980 4.000% a) 5.000% a) kr Equivalent kr 30,860,000 Heidi Høi Jensen generates a covered interest arbitrage profit because, although U.S. dollar interest rates are lower, the U.S. dollar is selling forward at a premium against the Danish krone. What is the amount of that profit? kr21,102 kr34,750 kr24,250 kr54,150arrow_forward(14)arrow_forward

- Sun Bank USA has purchased a 8 million one-year Australian dollar loan that pays 12 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.625/A$1. It has funded this loan by accepting a British pound (BP)-denominated deposit for the equivalent amount and maturity at an annual rate of 10 percent. The current spot rate of U.S. dollars for British pounds (GBP/USD) is $1.60/£1. a. What is the net interest income earned in dollars on this one-year transaction if the spot rate of U.S. dollars for Australian dollars and U.S. dollars for BPs at the end of the year are $0.588/A$1 and $1.848/£1, respectively? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your final answer to the nearest whole number. (e.g., 32)) b. What should the spot rate of U.S. dollars for BPs be at the end of the year in order for the bank to earn a net interest income of $200,000 (disregarding any change in principal values)?…arrow_forwardSun Bank USA has purchased a 16 million one-year Australian dollar loan that pays 12 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.757/A$1. It has funded this loan by accepting a British pound (BP)–denominated deposit for the equivalent amount and maturity at an annual rate of 10 percent. The current spot rate of U.S. dollars for British pounds (GBP/USD) is $1.320/£1. What is the net interest income earned in dollars on this one-year transaction if the spot rate of U.S. dollars for Australian dollars and U.S. dollars for BPs at the end of the year are $0.715/A$1 and $1.520/£1, respectively?arrow_forwardSun Bank USA has purchased a 16 million one-year Australian dollar loan that pays 12 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.757/A$1. It has funded this loan by accepting a British pound (BP)–denominated deposit for the equivalent amount and maturity at an annual rate of 10%. The current spot rate of U.S. dollars for British pounds (GBP/USD) is $1.320/£1. What should the spot rate of U.S. dollars for BPs be at the end of the year in order for the bank to earn a net interest income of $200,000?arrow_forward

- Sun Bank USA has purchased a 16 million one-year Australian dollar loan that pays 12 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.757/A$1. It has funded this loan by accepting a British pound (BP)-denominated deposit for the equivalent amount and maturity at an annual rate of 10 percent. The current spot rate of U.S. dollars for British pounds (GBP/USD) is $1.320/£1. a. What is the net interest income earned in dollars on this one-year transaction if the spot rate of U.S. dollars for Australian dollars and U.S. dollars for BPs at the end of the year are $0.715/A$1 and $1.520/£1, respectively? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in dollars, rather than in millions of dollars. Round your final answer to the nearest whole dollar. (e.g., 32)) b. What should the spot rate of U.S. dollars for BPs be at the end of the year in order for the bank to earn a net interest…arrow_forwardCurrently, the GBP/USD rate is 1.5011 and the six-month forward exchange rate is 1.5261. The six-month interest rate is 7.6% per annum in the U.S. and 5.7% per annum in the U.K. Assume that you can borrow £1,000,000 or its equivalent in USD. How much do you make/lose if you borrow the foreign currency and invest locally? (USD, no cents)arrow_forwardAssume that a bank has assets located in Germany worth €150 million earning an average of 8 percent. It also holds €100 in liabilities and pays an average of 6 percent per year. The current spot rate is €1.50 for $1. If the exchange rate at the end of the year is €2.00 for $1, ( LG 19-1) a. What happened to the dollar? Did it appreciate or depreciate against the euro (€)? b. What is the effect of the exchange rate change on the net interest margin (interest received minus interest paid) in dollars from its foreign assets and liabilities? c. What is the effect of the exchange rate change on the value of the assets and liabilities in dollars?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT