FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

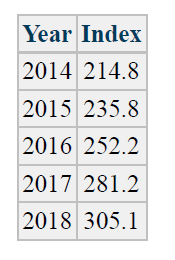

The Korean manufacturing output per hour index is given for years 2014–2018 as follows: a. For each year from 2015 to 2018 determine the rate of increase in Korean manufacturing output per hour to two decimal places. b. Because this index, like inflation, is compounded from period to period (e.g., year to year), estimate the overall annual rate of increase in Korean manufacturing output per hour from 2015 to 2018. Suggestion! Do not simply average the rates of part (a).

Transcribed Image Text:Year Index

2014 214.8

2015 235.8

2016 252.2

2017 281.2

2018 305.1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The average seling price of a new vehicle in the United States last year was $64, 470. If the average price ten years earlier was $54, 700, what was the annual increase/decrease in the selling price over this time period?arrow_forwardThe day point gain of the Dow Jones Industrial Average that occurred on November 13, 2016, was a gain of 319 points and closing at 7,165. What was the percent gain?arrow_forwardIn October 2017 a pound of apples cost $1.61, while oranges cost $1.25. Two years earlier the price of apples was only $1.40 a pound and that of oranges was $1.11 a pound. a. What was the annual compound rate of growth in the price of apples? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. What was the annual compound rate of growth in the price of oranges? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. If the same rates of growth persist in the future, what will be the price of apples in 2030? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. If the same rates of growth persist in the future, what will be the price of oranges in 2030? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Suppose the spot and three-month forward rates for the yen are ¥114.37 and ¥113.89, respectively. a. Is the yen expected to get stronger or weaker? b. What would you estimate is the difference between the inflation rates of the United States and Japan? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Yen expected to get strong or weaker b. Difference between the inflation rates %arrow_forwardCalculate the contribution to total performance from currency, country, and stock selection for the manager in the example below. All exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Input all amounts as positive values. Return on EAFE Weight Equity Index E1E0 Manager's Weight Manager's Return Europe Australasia Far East 0.2 19% 0.80 0.11 16% 0.6 15 1.10 0.40 19 0.2 24 1.00 0.49 19 Currency Selection Country Selection Stock Selection % % % Profit or Loss relative to EAFE relative to EAFE relative to EAFEarrow_forwardNonearrow_forward

- You are given the dollar value of a product in 2016 and the rate at which the value of the product is expected to change during the next 5 years. Use this information to write a linear equation that gives the dollar value V of the product in terms of the year t. (Let t = 16 represent 2016.) 2016 Value Rate $5000 $170 decrease per yeararrow_forwardCompute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable. 2024 2023 Sales Cost of goods sold Accounts receivable $ 553,119 290,122 26,882 $ 363,894 190,775 21,215 2022 $ 292,284 155,088 20,021 2021 $ 210,276 110,844 12,322 2020 $ 159,300 82,836 10,928 2024: 2023: 2022: 2021: 2020: Numerator: Trend Percent for Net Sales: 1 Is the trend percent for Net Sales favourable or unfavourable? 2024: 2023: 2022: 2021: 2020: Denominator: = Trend percent 0 % 0% 0% 0% 0 % Trend Percent for Cost of Goods Sold: Numerator: Denominator: Is the trend percent for Cost of Goods Sold favourable or unfavourable? = Trend percent 0% 0% 0% 0% 0%arrow_forwardA company manufactures a product in the United States and sells it in England. The unit cost of manufacturing is $52. The current exchange rate (dollars per pound) is 1.213. The demand function, which indicates how many units the company can sell in England as a function of price (in pounds) is of the power type, with constant 27556733 and exponent -2.5. A) Develop a model for the company's profit (in dollars) as a function of the price it charges (in pounds). Then use a data table to find the profit-maximizing price to the nearest pound. Assume that the price ranges from £45 to £100 in increments of £1. Round your answer for the maximum profit to the nearest dollar and your answer for the best price to the nearest pound. 1. Maximum profit: $______ 2. Best price: £ ______arrow_forward

- Using the income statement below, please compute the correct variance in total revenue (horizontal analysis) in Korean Won (Billion) and in percentage between the years ending 12/31/2023 and 12/31/2020 and chose the correct answer": yahoo/finance Search for news, symbols or companies a News Finance Sports More My Portfolio News Markets Research Personal Finance Videos Follow Compare News Research Chart Community Statistics Hyundai Motor Company (HYMTF) 60.50 -0.30 (-0.49%) At close: August 13 at 4:00 PM EDT Balance Sheet Cash Flow Dividends Historical Data All numbers in thousands יוויון Sustainability Breakdown Currency in KRW Annual Quarterly Download Collapse All 15 TTM 12/31/2023 12/31/2022 12/31/2021 12/31/2020 165,543,425,000 162,663,579,000 142,151,469,000 117,610,626,000 103,997,601,000 Total Revenue Operating Revenue Cost of Revenue Gross Profit Operating Expense 165,543,425,000 162,663,579,000 142,151,469,000 117,610,626,000 103,997,601,000 131.353,259,000 129.179.183.000…arrow_forwardSuppose a firm has had the following historic sales figures. Year: 2016 Sales $1,420,000 2017 $1,720,000 Next year's sales 2018 2019 2020 $1,600,000 $2,010,000 $1,770,000 What would be the forecast for next year's sales using FORECAST.ETS to estimate a trend? Note: Round your answer to the nearest whole dollar. 27arrow_forwardRequired: Calculate the contribution to total performance from currency, country, and stock selection for the manager in the example below. All exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places. Input all amounts as positive values.) Europe Australasia Far East EAFE Weight 0.60 0.10 0.30 Return on Equity Index 20% 18 25 Profit/Loss Currency Selection % relative to EAFE Country Selection % relative to EAFE Stock Selection % relative to EAFE E1/EØ 1.10 0.50 1.30 Manager's Weight Manager's Return 0.48 18% 0.20 16 0.32 16arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education