FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

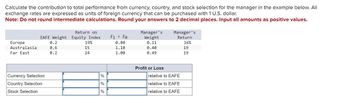

Transcribed Image Text:Calculate the contribution to total performance from currency, country, and stock selection for the manager in the example below. All

exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Input all amounts as positive values.

Return on

EAFE Weight Equity Index

E1E0

Manager's

Weight

Manager's

Return

Europe

Australasia

Far East

0.2

19%

0.80

0.11

16%

0.6

15

1.10

0.40

19

0.2

24

1.00

0.49

19

Currency Selection

Country Selection

Stock Selection

%

%

%

Profit or Loss

relative to EAFE

relative to EAFE

relative to EAFE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Imports and ExportsNow we allow for international trade. Use the following information from problem 1: C = 400 + (8/9)*DI I = 300G = 800T = (1/2)*Y. Suppose that exports are constant at X = 300.Let imports be a fraction of real income: M = (1/9) * Y. a. Give intuition for why imports M are positively related to national income Y in the equation above.b. Suppose that national income increases by $1. How much will spending on imports increase (the marginal propensity to import) in this case? c. Compute the equilibrium level of national income under international trade. d. Suppose that government spending increases by $120. i) Compute the new equilibrium national income. ii) Based on your numerical answer to (i), calculate the change in national income from a one dollar increase in government spending. iii) Derive the new fiscal multiplier from an increase in government spending using an algebraic equation. Compare to Problem 2.d.(ii). Compare to Problem 1.c.(v).e. Trade…arrow_forwardRequired: Calculate the contribution to total performance from currency, country, and stock selection for the manager in the example below. All exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places. Input all amounts as positive values.) Europe Australasia Far East EAFE Weight 0.60 0.10 0.30 Return on Equity Index 20% 18 25 Profit/Loss Currency Selection % relative to EAFE Country Selection % relative to EAFE Stock Selection % relative to EAFE E1/E 1.10 0.50 1.30 Manager's Weight Manager's Return 0.48 18% 0.20 16 0.32 16arrow_forwardYou have the following quotations for the Chinese yuan (CNY) and the Australian dollar (A$) at the HSBC Bank in China and National Australia Bank in Australia. Can you make a locational arbitrage profit? If yes, calculate the arbitrage profit if you have A$1.76 million or CNY3.42 million. (enter the whole number without sign or symbol) Currency HSBC in China National Australia Bank in Australia Bid Ask Bid Ask Chinese yuan A$0.2010 A$0.2230 A$0.2420 A$0.2673 Australian dollar CNY4.4221 CNY4.9632 CNY3.8255 CNY4.1641arrow_forward

- Question 3 Assuming the following quotes, calculate how a market trader at Citibank with $1,000,000 can make an intermarket arbitrage profit.: Citibank quotes U.S. dollar per pound: National Westminster quotes euros per pound: Deut $1.5900/£ €1.2000/£ quotes U.S. dollar per euro: $0.7550/€ Question 4 The Venezuelan government officially floated the Venezuelan bolivar (Bs) in February of 2002. Within weeks, its value had moved from the pre-float fix of BS774/S to Bs1028/S. a. Is this a devaluation or depreciation? b. By what percentage did its value change?arrow_forwardWhat is the expected percentage change in the value of the foreign currency (e) if you combine all three techniques, which are equally weighted? Method Technical forecasting Fundamental forecasting Market-based forecasting O 0.3% O 4.6% O 4.7% 2.0% Forecasted e 2% -4% 8%arrow_forwardH3. The Central Bank of the Bahamas pegs the Bahamian Dollar to the United States Dollar at a price of 1 BSD per USD. As an analyst for XYZ Consulting Inc., you have been asked to predict the behavior of key macroeconomic variables in the Bahamas for different policy scenarios. Using all the appropriate diagrams, your analysis must describe the Bahamian money and output markets, as well as the foreign exchange market. To perform this task, you must assume that prices are sticky: fixed in the short-run and flexible in the long-run. The scenarios are: a) A temporary restrictive monetary policy in the Bahamas. b) A temporary restrictive fiscal policy in the Bahamas.arrow_forward

- You Answered Correct Answer Samuel Samosir works for Peregrine Investments in Jakarta, Indonesia. He focuses his time and attention on the U.S. dollar/Singapore dollar ($/S$) cross- rate. The current spot rate is $1.39/S$. After considerable study, he has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $1.44/S$. He is considering trading options to profit and has the following options on the Singapore dollar to choose from Option choices on the Singapore dollar: Strike price (US$/Singapore dollar) Premium (US$/Singapore dollar) -0.132 Call on S$ -0.047 $1.371 $0.047 Put on S$ $1.37 Samuel decides to buy call options in Singapore dollars. What will be Samuel's profit/loss if the ending spot rate is $1.286/S$ in 90 days? Keep all decimal places. $0.006arrow_forwardThe table below contains the average returns, standard deviation of returns and correlation of returns with US indexfor different countries. All data are in US dollar terms. The US T-Bill rate is 3%. Determine which of thesecountries are suitable for a US based investor to diversifv into. Show the necessarv calculationsUS T-Bill Rate %3arrow_forwardQuantitative Problem: In the spot market, 4.04 Brazilian reals can be exchanged for 1 U.S. dollar. An Apple iPad Air costs $500 in the United States. If purchasing power parity (PPP) holds, what should be the price of the same iPad Air in Brazil? Do not round intermediate calculations. Round your answer to the nearest whole number. ___ realsarrow_forward

- International financial management : MCQ Assume the Canadian dollar is equal to £0.51 and the Peruvian Sol is equal to £0.16. The value of the Peruvian Sol in Canadian dollar is: (a) about 3.1875 Canadian dollars. (b) about .3137 Canadian dollars. (c) about 2.36 Canadian dollars. (d) about .3137 British pound (e) about .3137 Peruvian Sol. 2. Assume that a bank’s bid rate on Swiss francs is £0.25 and its ask rate is £0.26. Its bid-ask percentage spread is: (a) about 3.85 (b) about 4.00% (c) about 3.55% (d) about 4.15%arrow_forwardsubject:international finance Most foreign currencies in the world are stated in terms of the number of units of foreign currency needed to buy one dollar Required a)Convert the following indirect quotes to direct quotes. I. Euro: €1.22/$ (indirect quote) II. Russia: Rub 30/$ (indirect quote) III. Canada: C$ 1.39/$ (indirect quote) IV. Denmark: DKr6.08/$ (indirect quote) b)Convert the following direct quotes to indirect quotes. I. Euro: $ 0.865/€ (direct quote) II. Russia: $ 0.050/ Rub (direct quote) III. Canada: $ 0.85/C$ (direct quote) IV. Denmark: $ 0.608/ DKr (direct quote) c)Define the spot transaction and outright forward transaction.arrow_forwardQuestion 12 Given the following cross currency rates, identify an arbitrage trade and show the profit if you start with $1,000. (USD = U.S. dollar, SGD = Singapore dollar, CHF = Swiss franc) SGD:USD CHF:USD SGD:CHF 1,045.46 3.00 1.50 2.20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education