FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

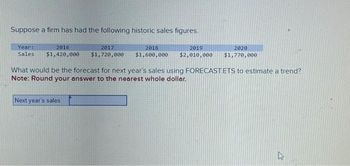

Transcribed Image Text:Suppose a firm has had the following historic sales figures.

Year:

2016

Sales $1,420,000

2017

$1,720,000

Next year's sales

2018

2019

2020

$1,600,000 $2,010,000 $1,770,000

What would be the forecast for next year's sales using FORECAST.ETS to estimate a trend?

Note: Round your answer to the nearest whole dollar.

27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The table lists future concentrations of CFC 12 in parts per billion (ppb), if current trends continue. Year 2000 2005 2010 2015 2020 CFC 12 (ppb) 0.72 1.01 1.42 1.99 2.79 a. Let x=0 correspond to 2000 and x = 20 correspond to 2020. Find values for C and a so that f(x) = Cax models the data. b. Estimate the CFC 12 concentration in 2013. a. C= a≈ (Simplify your answer. Round to the nearest hundredth as needed)arrow_forwardCompute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable. 2024 2023 2022 2021 2020 Sales $ 521,076 $ 338,361 $ 275,090 $ 187,136 $ 137,600 Cost of goods sold 273,410 177,598 146,097 98,861 71,552 Accounts receivable 25,324 19,760 18,871 10,985 9,412arrow_forwardSuppose a firm has had the following historic sales figures. Year: 2009 2010 2011 2012 2013 Sales $1,420,000 $1,720,000 $1,600,000 $2,010,000 $1,770,000 What would be the forecast for next year's sales using regression to estimate a trend? Next year's salesarrow_forward

- Returns for the Cabell's Company over the last 3 years are shown below. What's the standard deviation of Cabell's returns? (Hint: this is a historical data problem, not a probability distribution.) Return 25% Year 2019 2018 -10 2017 30 23.87% 22.97% 21.79% 25.18%arrow_forwardCurrently, a firm has an EPS of $2.13 and a benchmark PE of 18.64. Earnings are expected to grow by 3.8 percent annually. What is the estimated current stock price?arrow_forwardCalculate Average Annual Growth rate (AAGR) of Oman Cement which has the following returns. 2020-21 Beginning value OMR 1550 End of Year 1 OMR 1850 End of Year 2 OMR 1990 End of Year 3 OMR 2290 End of Year 4 OMR 2560arrow_forward

- The following table presents forecasted financial and other information for Scandinavian Furniture: Projected EBIT Earnings after tax Free cash flow Havasham's WACC Expected growth rate in FCFs after 2014 Warranted MV firm/FCF in 2014 Warranted P/E in 2014 O $3,628 million O $363 million O $3,833 million 2012 $317 197 135 O $161 million 8.2% 4.0% What is an appropriate estimate of Scandinavian Furniture's terminal value as of the end of 2014, using the perpetual-growth equation as your estimate? 19.4 18.7 2013 $339 210 144 2014 $363 225 155arrow_forwardIf a company's sales are $650,000 in 2021, and this represents an 5% increase over sales in 2020, what were sales in 2020? (Round your answer to the nearest dollar amount.) Salesarrow_forwardNet Income for Company A is $200,000 in 2014, $300,000 in 2015, $400,000 in 2016, $500,000 in 2017, and $600,000 in 2018. The expected growth for all years after 2018 is 5%, the 90-Day T-Bill Rate is 20%, and the appropriate percentage above risk-free rate is 12%. Using this information, what is the appropriate discount rate? A. O.32 B. 0.02arrow_forward

- Trend Analysis: Sales: 2012 = $180,000; 2013 = $250,000; 2014 = $400,000; 2015 = $150,000. Prepare a trend analysis for year 2012.arrow_forwardSuppose a firm has had the following historic sales figures. What would be the forecast for next year's sales using the average approach? You must use the built-in Excel function to answer this question. Input area: Year Sales 2016 2017 2018 es es e $ 1,500,000 $ 1,750,000 $ 1,400,000 2019 $ 2,000,000 2020 $ 1,600,000 Output area: Next year's salesarrow_forwardEstimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Texas Roadhouse for 2016 through 2019. a. Forecast the terminal period values assuming a 1% terminal period growth rate for all three model inputs: Sales, NOPAT, and NOA. Round your answers to the nearest dollar. Reported Forecast Horizon Terminal $ thousands 2015 2016 2017 2018 2019 Period Sales $1,807,368 $2,078,473 $2,390,244 $2,581,464 $2,787,981 Answer NOPAT 102,495 170,435 196,000 211,680 228,614 Answer NOA 662,502 761,904 876,189 946,284 1,021,987 Answer b. Estimate the value of a share of TXRH common stock using the discounted cash flow (DCF) model as of December 29, 2015; assume a discount rate (WACC) of 7%, common shares outstanding of 70,091 thousand, net nonoperating obligations (NNO) of $(14,680) thousand, and noncontrolling interest (NCI) from the balance sheet of $7,520 thousand. Note that NNO is negative because the company’s cash exceeds its…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education