Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

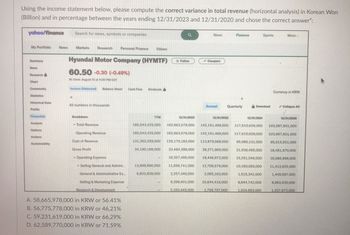

Transcribed Image Text:Using the income statement below, please compute the correct variance in total revenue (horizontal analysis) in Korean Won

(Billion) and in percentage between the years ending 12/31/2023 and 12/31/2020 and chose the correct answer":

yahoo/finance

Search for news, symbols or companies

a

News

Finance

Sports

More

My Portfolio

News

Markets Research Personal Finance Videos

Follow

Compare

News

Research

Chart

Community

Statistics

Hyundai Motor Company (HYMTF)

60.50 -0.30 (-0.49%)

At close: August 13 at 4:00 PM EDT

Balance Sheet Cash Flow Dividends

Historical Data

All numbers in thousands

יוויון

Sustainability

Breakdown

Currency in KRW

Annual

Quarterly

Download

Collapse All

15

TTM

12/31/2023

12/31/2022

12/31/2021

12/31/2020

165,543,425,000

162,663,579,000

142,151,469,000

117,610,626,000 103,997,601,000

Total Revenue

Operating Revenue

Cost of Revenue

Gross Profit

Operating Expense

165,543,425,000 162,663,579,000 142,151,469,000 117,610,626,000 103,997,601,000

131.353,259,000 129.179.183.000 113,879,569,000 95,680,131,000 85,515,931,000

34,190,166,000 33,484,396,000 28,271,900,000 21,930,495,000 18,481,670,000

18,357,495,000 18,446,972,000 15,251,546,000 16,086,999,000

Selling General and Admini

General & Administrative Ex...

Selling & Marketing Expense

Research & Development

13,899,690,000

6,603,839,000

11,656,741,000

2.257,340,000

9.399,401,000

2.163.445.000

12,709,579,000

2.065,163,000

10,160,083,000 11,412,632,000

10,644,416,000

1.759.707.000

1.515,341,000

8,644,742,000

1,449,597,000

9,963,035,000

1.534.993.000

1.337872.000

A. 58,665,978,000 in KRW or 56.41%

B. 56,775,778,000 in KRW or 46,21%

C. 59,231,619,000 in KRW or 66,29%

D. 62,589,770,000 in KRW or 71.59%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What summary of financial performance can you conclude based on data given?arrow_forwardThe image uploaded is the calculation of Socite Generale Bank, Ghana, Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardPlease I need fast answer please use math tools and no plagiarism i request plzarrow_forward

- Requirements 1. Prepare a comparative common-size income statement for Mariner Designs, Inc. using the 2024 and 2023 data. Round percentages to one-tenth percent. 2. To an investor, how does 2024 compare with 2023 ? Explain your reasoningarrow_forwardFundamental Analysis:arrow_forwardPerform horizontal analysis of the business’s income statement. Is the trend becoming more favorable, unfavorable or remaining constant? Explain your answer.arrow_forward

- Please use the attached images as well... Compute the following: For fiscal 2019 and 2020: Current Ratio, Quick Ratio, Long Term Debt Ratio For fiscal 2019 and 2020: Gross Profit Margin, Net Profit Margin, EBITDA For fiscal 2019 and 2020: Return on Assets, Return on Equity, Return on Sales For fiscal 2020: Free Cash Flow to Equity Market Capitalization, Market to Book Value and the Price-Earnings Ratio as of year-end 2020 Stock Prices in 2018 = $68.98 2019 = $84.15 2020 = $107.82arrow_forwardThe image uploaded is the calculation of Access Bank's Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardWe have all heard of Return on Investment or (ROI). Please research anddescribe five other business metrics that you may use in your analysis withyour business plan.Also, please describe how these ratios are calculated for example...Quick Ratio or Acid Test, Cash + Accounts Receivable ÷ Current Liabilities.arrow_forward

- The image uploaded is the calculation of Societe Generale Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardProjecting NOPAT and NOA Using Parsimonious Forecasting Method Following are Logitech's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) for its fiscal year ended March 31, 2019 ($ thousands). Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Financial information Net sales Net operating profit after tax (NOPAT) Net operating assets (NOA) $2,788,322 211,362 571,823 Use the parsimonious method to forecast Logitech's sales, NOPAT, and NOA for fiscal years ended March 31, 2020 through 2023 using the following assumptions. Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places_. Note: When completing the question…arrow_forwardProjecting NOPAT and NOA Using Parsimonious Forecasting Method Following are Logitech's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) for its fiscal year ended March 31, 2019 ($ thousands). Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Financial information Net sales Net operating profit after tax (NOPAT) Net operating assets (NOA) $2,091,242 158,522 428,867 Use the parsimonious method to forecast Logitech's sales, NOPAT, and NOA for fiscal years ended March 31, 2020 through 2023 using the following assumptions. Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places_. Note: When completing the question…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT