FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

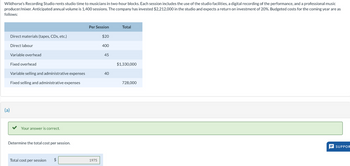

Transcribed Image Text:Wildhorse's Recording Studio rents studio time to musicians in two-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music

producer/mixer. Anticipated annual volume is 1,400 sessions. The company has invested $2,212,000 in the studio and expects a return on investment of 20%. Budgeted costs for the coming year are as

follows:

(a)

Per Session

Total

Direct materials (tapes, CDs, etc.)

$20

Direct labour

400

Variable overhead

45

Fixed overhead

$1,330,000

Variable selling and administrative expenses

40

Fixed selling and administrative expenses

728,000

Your answer is correct.

Determine the total cost per session.

Total cost per session $

1975

SUPPOR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Eliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 16,800 nozzles in stock, although the latest estimate for August production indicates a requirement for only 15,000 nozzles. Total uses of the nozzle are expected to be 14,700 in September and 15,540 in October. Nozzles are purchased at a wholesale price of $8. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 21,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September.arrow_forwardThe Charmatz Corporation has a central copying facility. Its offices can supply up to 800,000 copies per year. The copying facility has only two users, Department A and Department B. The following data apply to the coming budget year: Budgeted costs of Copy Support Department are: Fixed costs per year $70,000 per year Variable costs $0.02 per copy The operating departments have estimated their usage as follows: Department A 120,000 copies Department B 480,000 copies Actual usage for the year was: Department A 150,000 copies Department B 450,000 copies Budgeted amounts are used to calculate the allocation rates. Actual usage is used to allocate costs under the single-rate method. Actual usage is used to allocate variable costs and budgeted usage is used to allocate fixed costs under the dual-rate method. How will…arrow_forwardSandhill's Recording Studio rents studio time to musicians in two-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1.400 sessions. The company has invested $2,073,750 in the studio and expects a return on investment of 20%. Budgeted costs for the coming year are as -follows: Direct materials (tapes, CDs, etc.) Direct labour Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses (a) Determine the total cost per session. Total cost per session Per Session $25 380 60 35 Total $1,358,000 707,000arrow_forward

- Radom Manufacturing produces various products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to five tons of trash in a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (i.e., for each load). The budget for the landfill for next year follows: Volume of trash Preparation costs (varies by loads) Other variable costs (varies by tons) Fixed costs Total budgeted costs 2,450 tons (490 loads) $ 166,600 166,600 245,000 $ 578, 200 Radom plans to make the landfill a profit center and charge the manufacturing plants for disposal of the trash. The landfill has sufficient capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and both Radom manufacturing plants would be free to decide which landfill to use. Required: a. Compute the optimal…arrow_forwardThe Document Creation Center (DCC) for Arlington Corp. provides photocopying and document services for three departments in the Minneapolis office. The following budget has been prepared for the year. Available capacity 8,030,000 pages Budgeted usage: Software Development 1,630,000 pages Training 3,333,000 pages Management 2,127,000 pages Cost equation $310,000 + $0.02 per page If DCC uses a dual-rate for allocating its costs, how much cost will be allocated to the Management Department, assuming the Management Department actually made 2,130,000 copies during the year? Multiple Choice $84,670. $86,790. $86,275. $135,600.arrow_forwardKaja Kallas produces luxury collection of dolls. She is preparing her budget for the coming year. The budgeted selling price for each doll is $30 and the budgeted materials cost for each doll is 50% of selling price while the budgeted labour cost is 20% of selling price. Each doll is expected to incur direct expenses of $1 on top of the budgeted materials and labour costs. Equipment depreciation is budgeted to be $9,000 per annum and Ms. Kallas budgeted administration expenses are $1,200 per month. Demand in September is budgeted to be 10,000 dolls with demand rising to 10,500 dolls in October and 11,025 in November. What is Ms. Kallas budgeted gross profit for November? $86,250 $87,450 $88,200 $99,225arrow_forward

- Wilson Sandhill is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: Direct materials $45.00 Direct labor 18.00 Manufacturing overhead 18.00 Selling and administrative 14.00 Total unit cost $95.00 The company's budget includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (a2) Your answer is partially correct. Monty, Finland's second largest homebuilder, has approached Wilson with an offer to buy…arrow_forwardBlossom's Recording Studio rents studio time to musicians in two-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,000 sessions. The company has invested $1,963,500 in the studio and expects a return on investment of 20%. Budgeted costs for the coming year are as follows: Per Session Total Direct materials (tapes, CDs, etc.) $20 Direct labour. 380 Variable overhead 40 Fixed overhead $925,000 Variable selling and administrative expenses 30 Fixed selling and administrative expenses 475,000arrow_forwardCrane, Inc. makes and sells a single product, buckets. It takes 20 ounces of plastic to make one bucket. Budgeted production of buckets for the next three months is as follows: August 85000 units, September 70000 units, October 60000 units. The company wants to maintain monthly ending inventories of plastic equal to 10% of the following month's production needs. On August 31, 190000 ounces of plastic were on hand. The cost of plastic is $0.02 per gram. How much is the ending inventory of plastic to be reported on the company’s balance sheet at September 30? $2400 $120000 $7000 $2800arrow_forward

- The Hudson Block Company has a trucking department that delivers stones to two plants. The budgeted costs for the trucking department are $340,000 per year in fixed costs and $0.30 per ton variable cost. Last year, 70,000 tons of crushed stone were budgeted to be delivered to the West Plant and 100,000 tons of crushed stone to the East Plant. During the year, the trucking department actually delivered 75,000 tons of crushed stone to the West Plant and 90,000 tons to the East Plant. Its actual costs for the year were $65,000 variable and $350,000 fixed. The company allocates fixed and variable costs separately. The level of budgeted fixed costs is determined by the peak-period requirements. The West Plant requires 40% of the peak-period capacity and the East Plant requires 60%. 10. The amount of fixed trucking department cost that should be allocated to the West Plant at the end of the year for performance evaluation purposes is: a.$160,000. b.$204,000. c.$140,000. d.$136,000 e.$158,500…arrow_forwardFlounder's Recording Studio rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,160 sessions. The company has invested $2,399,460 in the studio and expects a return on investment (ROI) of 20%. Budgeted costs for the coming year are as follows. Direct materials (CDs, etc.) Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses (a) Your answer is correct. Determine the total cost per session. Total cost $ (b) eTextbook and Media 1970 ROI $ Per Session $ 20 $405 $55 $35 per session Total per session $1,102,000 $585,800 Determine the desired ROI per session. (Round answer to 2 decimal places, e.g. 10.50.) Attempts: 1 of 5 usedarrow_forwardThe Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 4,640 kayaks during 2022. Each kayak will require 56 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). The polyethylene powder used in these kayaks costs $1.20 per pound, and the finishing kits cost $210 each. Each kayak will use two kinds of labor-2 hours of type I labor from people who run the oven and trim the plastic, and 3 hours of work from type II workers who attach the hatches and seat and other hardware. The type I employees are paid $17 per hour, and the type II are paid $14 per hour. Manufacturing overhead is budgeted at $414,840 for 2022, broken down as follows. Variable costs Indirect materials $46,400 Manufacturing supplies 64,960 Maintenance and utilities 102,080 213,440 Fixed costs Supervision 78,000 Insurance 13,200 Depreciation 110,200 201,400 Total $414,840 During the first quarter, ended March 31,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education