FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

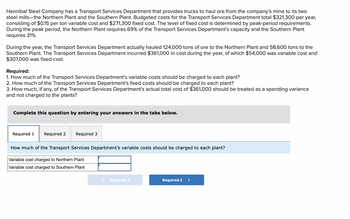

Transcribed Image Text:Hannibal Steel Company has a Transport Services Department that provides trucks to haul ore from the company's mine to its two

steel mills-the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $321,300 per year,

consisting of $0.15 per ton variable cost and $271,300 fixed cost. The level of fixed cost is determined by peak-period requirements.

During the peak period, the Northern Plant requires 69% of the Transport Services Department's capacity and the Southern Plant

requires 31%.

During the year, the Transport Services Department actually hauled 124,000 tons of ore to the Northern Plant and 58,600 tons to the

Southern Plant. The Transport Services Department incurred $361,000 in cost during the year, of which $54,000 was variable cost and

$307,000 was fixed cost.

Required:

1. How much of the Transport Services Department's variable costs should be charged to each plant?

2. How much of the Transport Services Department's fixed costs should be charged to each plant?

3. How much, if any, of the Transport Services Department's actual total cost of $361,000 should be treated as a spending variance

and not charged to the plants?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

How much of the Transport Services Department's variable costs should be charged to each plant?

Variable cost charged to Northern Plant

Variable cost charged to Southern Plant

< Required 1

Required 2

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stupji Ltd uses activity based costing. The budgeted distribution costs for the next year are: Transport costs $2,631 Order processing $1,573 -------- Total distribution costs $4,204 It is estimated that in the next year, 325,000 orders will be processed, and that the delivery vehicles will travel 1,495,000 km. A customer has indicated that 138 orders, each of which will require a journey of 122 km for each order will be placed next year. To the nearest $, what is the distribution cost for this customer? a. $47,342 b. $38,891 c. $30,299 d. $1,785arrow_forwardA company has a Trucking Services Department that provides transportation to haul a rare mineral from the company's mine to its two mills-the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department consists of $0.32 per ton variable cost and $355,000 of fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 70% of the Trucking Services Department's capacity and the Southern Plant requires 30%. During the year, the Trucking Services Department actually hauled 120,000 tons of mineral to the Northern Plant and 60,000 tons to the Southern Plant. The Trucking Services Department incurred $384,000 in cost during the year, of which $54,000 was variable cost and $330,000 was fixed cost. How much of the Trucking Services Department's variable costs should be charged to the Northern plant? O $36,000 O $38,400 O $57,600 O None of the listed answers O $28,800 How much of the Trucking…arrow_forwardGodoarrow_forward

- Tannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 14,000 hours for production: Variable overhead cost: Indirect factory labor $44,800 Power and light 10,360 Indirect materials 21,000 Total variable overhead cost $ 76,160 Fixed overhead cost: Supervisory salaries $54,380 Depreciation of plant and equipment 14,310 Insurance and property taxes 26,710 Total fixed overhead cost 95,400 Total factory overhead cost $171,560 Tannin has available 18,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 13,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Actual variable factory overhead cost: Indirect factory labor $40,560…arrow_forwardJamison Company has two service departments and two producing departments. Square footage of space occupied by each department follows: Custodial services 1,700 feet General administration 3,700 feet Producing Department A 8,700 feet Producing Department B 8,700 feet 22,800 feet The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $45,000, the amount of cost allocated to General Administration under the direct method would be: Multiple Choice $7,400. $9,432. $7,303. $0.arrow_forwardSubject : Accountingarrow_forward

- rever Ready Company expects to operate at 85% of productive capacity during May. The total manufacturing costs for May for the production of 3,900 batteries are budgeted as follows: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total manufacturing costs The company has an opportunity to submit a bid for 2,000 batteries to be delivered by May 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during May or increase the selling or administrative expenses. $324,300 119,200 33,350 67,000 $543,850 What is the unit cost below which Forever Ready Company should not go in bidding on the government contract? Round your answer to two decimal places. per unitarrow_forwardTiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 7,700 hours. Variable costs: Indirect factory wages $22,330 Power and light 15,862 Indirect materials 13,552 Total variable cost $51,744 Fixed costs: Supervisory salaries $14,700 Depreciation of plant and equipment 37,710 Insurance and property taxes 11,500 Total fixed cost 63,910 Total factory overhead cost $115,654 During May, the department operated at 8,200 standard hours. The factory overhead costs incurred were indirect factory wages, $24,020; power and light, $16,590; indirect materials, $14,700; supervisory salaries, $14,700; depreciation of plant and equipment, $37,710; and insurance and property taxes, $11,500. Required: Prepare a factory overhead cost…arrow_forwardThe total factory overhead for Magnum Corporation is budgeted for the year at $500,000. This is divided into three activity pools: fabrication, $246,000; assembly, $144,000, and setup, $110,000. Magnum manufactures two types of kayaks: Basic and Deluxe. The activity-based usage quantities for each project by activity are as follows: Fabrication Assembly Setup Basic 2,000 dlh 8,000 dlh 5 setups Deluxe 10,000 dlh 24,000 dlh 15 setups Total activity-base usage 12,000 dlh 32,000 dlh 20 setups Each product is budgeted for 2,500 units of production for the year.What is the activity-based factory overhead per unit for the Deluxe kayak? a.$41.80 b.$158.20 c.$100.00 d.$154.54arrow_forward

- Jamison Company has two service departments and two producing departments. Square footage of space occupied by each department follows: Custodial services 2,700 feet General administration 4,700 feet Producing Department A 9,700 feet Producing Department B 9,700 feet 26,800 feet The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $55,000, the amount of cost allocated to General Administration under the direct method would be:arrow_forwardHannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills-the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $283,800 per year, consisting of $0.17 per ton variable cost and $233,800 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 58% of the Transport Services Department's capacity and the Southern Plant requires 42%. During the year, the Transport Services Department actually hauled 127,000 tons of ore to the Northern Plant and 61,200 tons to the Southern Plant. The Transport Services Department incurred $356,000 in cost during the year, of which $53,200 was variable and $302,800 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forwardFlounder Company estimates that it will produce 6,000 units of product IOA during the current month. Budgeted variable manufacturing costs per unit are direct materials $8, direct labor $13, and overhead $19. Monthly budgeted fixed manufacturing overhead costs are $7,700 for depreciation and $3,700 for supervision. In the current month, Flounder actually produced 6,500 units and incurred the following costs: direct materials $44,976, direct labor $76,400, variable overhead $122,094, depreciation $7,700, and supervision $3,959. Prepare a static budget report. Hint: The Budget column is based on estimated production while the Actual column is the actual cost incurred during the period. (List variable costs before fixed costs.) FLOUNDER COMPANY Static Budget Report ÷ Budget Actual $ +A Difference Favorable Unfavorablarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education