FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

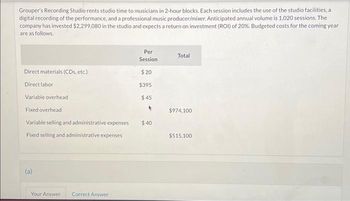

Grouper's Recording Studio rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,020 sessions. The company has invested $2,299,080 in the studio and expects a

Transcribed Image Text:Grouper's Recording Studio rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a

digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,020 sessions. The

company has invested $2.299,080 in the studio and expects a return on investment (ROI) of 20%. Budgeted costs for the coming year

are as follows.

Direct materials (CDs, etc.)

Direct labor

Variable overhead

Fixed overhead

Variable selling and administrative expenses

Fixed selling and administrative expenses

(a)

Your Answer Correct Answer

Per

Session

$20

$395

$45

*

$40

Total

$974,100

$515,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills- the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $311,100 per year, consisting of $0.23 per ton variable cost and $261,100 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 61% of the Transport Services Department's capacity and the Southern Plant requires 39%. During the year, the Transport Services Department actually hauled 118,000 tons of ore to the Northern Plant and 55,600 tons to the Southern Plant. The Transport Services Department incurred $355,000 in cost during the year, of which $53,100 was variable and $301,900 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forwardWilson Blossom is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: (a1) Direct materials $55.00 Direct labor 19.00 Manufacturing overhead 16.00 Selling and administrative 14.00 Total unit cost $104.00 The company's budget includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (a2) Your answer is partially correct. Your answer is correct. Calculate variable overhead per unit and variable selling and…arrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 18,700 nozzles in stock, although the latest estimate for August production indicates a requirement for only 18,800 nozzles. Total uses of the nozzle are expected to be 18,500 in September and 19,340 in October. Nozzles are purchased at a wholesale price of $27. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 40,000 parts in July. Required: Estimate purchases of the nozzle (in units) for August and September. Estimate the cash disbursements for nozzles in August and September.arrow_forward

- Please help me. Thankyou.arrow_forwardSilver Faces, Inc., has done a cost analysis for its production of reflectors. The following activities and cost drivers have been developed: Activity Cost Formula Maintenance $15,000 + $4 per machine hour Machining $35,000 + $1 per machine hour Inspection $60,000 + $750 per batch Setups $1,000 per batch Purchasing $50,000 + $10 per purchase order What is the budgeted maintenance cost if there was production of 50,000 reflectors that will require 8,000 machine hours, 25 batches, and 15,000 purchase orders?arrow_forwardPhoenix Management helps rental property owners find renters and charges the owners one-half of the first month’s rent for this service. For August 2022, Phoenix expects to find renters for 100 apartments with an average first month’s rent of $700. Budgeted cost data per tenant application for 2022 follow: Professional labor: 1.5 hours at $20.00 per hour Credit checks: $50.00 Phoenix expects other costs, including the lease payment for the building, secretarial help, and utilities, to be $3,000 per month. On average, Phoenix is successful in placing one tenant for every three applicants. Actual rental applications in August 2022 were 270. Phoenix paid $9,500 for 400 hours of professional labor. Credit checks went up to $55 per application. Other costs in August 2022 (lease, secretarial help, and utilities) were $3,600. The average first monthly rentals for August 2022 were $800 per apartment unit for 90 units. Part 1 (Static) Required: 1. (a) What is the master budget variance…arrow_forward

- Triton Company's copy department, which does almost all of the photocopying for the sales department and the administrative department, budgets the following costs for the year, based on the expected activity of copies: Salaries (fixed) $95,000 Employee benefits (fixed) 10,000 Depreciation of copy machines (fixed) 10,000 Utilities (fixed) 5,000 Paper (variable, 1 cent per copy) 50,000 Toner (variable, 1 cent per copy) 50,000 The costs are assigned to two cost pools, one for fixed and one for variable costs. The costs are then assigned to the sales department and the administrative department. Fixed costs are assigned on a lump-sum basis, 40 percent to sales and 60 percent to administration. The variable costs are assigned at a rate of 2 cents per copy. Assuming the following copies were made during the year, 2,788,250 for sales and 3,284,250 for administration, calculate the copy department costs allocated to sales. Round to two decimal places.arrow_forwardCamper's Edge Factory produces two products: canopies and tents. The total factory overhead is budgeted at $750,000 for the year, divided between two departments: Cutting, $350,000, and Sewing, $400,000. Each canopy requires 2 direct labor hours in Cutting and 1 direct labor hour in Sewing. Each tent requires 1 direct labor hour in Cutting and 6 direct labor hours in Sewing. Production for the year is budgeted for 20,000 canopies and 10,000 tents. a. Determine the total number of budgeted direct labor hours for the year in each department. Cutting fill in the blank 1 direct labor hours Sewing fill in the blank 2 direct labor hours b. Determine the departmental factory overhead rate for each department. Round your answers to two decimal places, if necessary. Cutting $fill in the blank 3 per direct labor hour Sewing $fill in the blank 4 per direct labor hour c. Determine the factory overhead allocated per unit of each product, using the departmental factory overhead…arrow_forwardSunland Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Sunland is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead, Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line (1) One mobile safe (2) Mobile Safes One walk-in safe 200 300 450 800 Walk-in Safes 435.2 50 The total estimated manufacturing overhead was $272,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) 200 350 1.700 per unit per unitarrow_forward

- Stupji Ltd uses activity based costing. The budgeted distribution costs for the next year are: Transport costs $2,631 Order processing $1,573 -------- Total distribution costs $4,204 It is estimated that in the next year, 325,000 orders will be processed, and that the delivery vehicles will travel 1,495,000 km. A customer has indicated that 138 orders, each of which will require a journey of 122 km for each order will be placed next year. To the nearest $, what is the distribution cost for this customer? a. $47,342 b. $38,891 c. $30,299 d. $1,785arrow_forwardMetropolitan Dental Associates is a large dental practice in Chicago. The firm's controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for professional dental services are $60 for half-hour appointments and $115 for one-hour office visits. Ninety percent of each month's professional service revenue is collected during the month when services are rendered, and the remainder is collected the month following service. Uncollectible billings are negligible. Metropolitan's dental associates earn $95 per hour. Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows: Patient registration and records All other overhead and…arrow_forwardGodoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education