Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

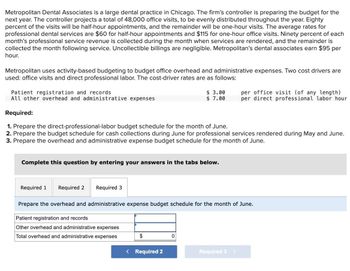

Transcribed Image Text:Metropolitan Dental Associates is a large dental practice in Chicago. The firm's controller is preparing the budget for the

next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty

percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for

professional dental services are $60 for half-hour appointments and $115 for one-hour office visits. Ninety percent of each

month's professional service revenue is collected during the month when services are rendered, and the remainder is

collected the month following service. Uncollectible billings are negligible. Metropolitan's dental associates earn $95 per

hour.

Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are

used: office visits and direct professional labor. The cost-driver rates are as follows:

Patient registration and records

All other overhead and administrative expenses

Required:

$ 3.00

$ 7.00

per office visit (of any length)

per direct professional labor hour

1. Prepare the direct-professional-labor budget schedule for the month of June.

2. Prepare the budget schedule for cash collections during June for professional services rendered during May and June.

3. Prepare the overhead and administrative expense budget schedule for the month of June.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Prepare the overhead and administrative expense budget schedule for the month of June.

Patient registration and records

Other overhead and administrative expenses

Total overhead and administrative expenses

$

0

< Required 2

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardMetropolitan Dental Associates is a large dental practice in Chicago. The firm’s controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Seventy percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for professional dental services are $50 for half-hour appointments and $110 for one-hour office visits. Ninety percent of each month’s professional service revenue is collected during the month when services are rendered, and the remainder is collected the month following service. Uncollectible billings are negligible. Metropolitan’s dental associates earn $80 per hour.Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows: Patient registration and records $ 4.00 per office…arrow_forwardMetropolitan Dental Associates is a large dental practice in Chicago. The firm’s controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for professional dental services are $40 for half-hour appointments and $70 for one-hour office visits. Ninety percent of each month’s professional service revenue is collected during the month when services are rendered, and the remainder is collected the month following service. Uncollectible billings are negligible. Metropolitan’s dental associates earn $60 per hour.Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows: Patient registration and records…arrow_forward

- Monroe Outpatient Surgery Center (MOSC) is developing an operating budget for the month ending June 30, 2024. MOSC expects to perform 80 surgical procedures during the month. MOSC’s average charge (price) per surgical procedure is $2,500. The cost of disposable surgical supplies is $300 per surgical procedure. MOSC also contracts with orthopedic surgeons at a fee of $1,500 per surgical procedure. The monthly salaries for MOSC’s receptionist, bookkeeper, and two surgical nurses total $10,500. MOSC’s occupancy costs, which include space rental, insurance, and all utilities, are $8,200 per month. Average monthly communication costs are $1,200. Office and operating room equipment was installed at a cost of $240,000. The equipment is expected to have a 5-year life and has no salvage value (Depreciation of $4,000 for every month). Prepare MOSC’s operating budget for the month of June 2024. My response: June 2024 Operating Budget for Monroe Outpatient Surgery Center June…arrow_forwardSthilaire Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.36 direct labor-hours. The direct labor rate is $7.60 per direct labor-hour. The production budget calls for producing 2,500 units in April and 2,400 units in May. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed to paying its direct labor work force for at least 960 hours in total each month even if there is not enough work to keep them busy. Required: Construct the direct labor budget for the next two months. (Round "labor-hours per unit" & "labor cost per hour" answers to 2 decimal places.) Required production in units. Direct labor-hours per unit Total direct labor-hours needed Total direct labor-hours paid Direct labor cost per hour Total direct labor cost April Mayarrow_forwardPooler Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.75 direct labor-hours. The direct labor rate is $10.10 per direct labor-hour. The production budget calls for producing 7,200 units in April and 7,000 units in May. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed to paying its direct labor work force for at least 5,480 hours in total each month even if there is not enough work to keep them busy. What would be the total combined direct labor cost for the two months? Multiple Choice $110,696.00 $108,373.00 $123,725.00 $107,565.00arrow_forward

- Veltri Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.77 direct labor-hours. The direct labor rate is $11.20 per direct labor-hour. The production budget calls for producing 7,100 units in October and 6,900 units in November. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed to paying its direct labor work force for at least 5,480 hours in total each month even if there is not enough work to keep them busy. What would be the total combined direct labor cost for the two months?arrow_forwardVargas Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.91 direct labor-hours. The direct labor rate is $12.60 per direct labor-hour. The production budget calls for producing 8,500 units in October and 8,300 units in November. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed to paying its direct labor work force for at least 7,770 hours in total each month even if there is not enough work to keep them busy. What would be the total combined direct labor cost for the two months? $195,363.00 $195,804.00 $193,069.80 $192,628.80arrow_forwardStriker Corporation is preparing its cash payments budget for next month. The following information pertains to the cash payments: How much cash will be paid out next month? a. Striker Corporation pays for 55% of its direct materials purchases in the month of purchase and the remainder the following month. Last month's direct material purchases were $73,000, while the company anticipates $85,000 of direct material purchases next month. b. Direct labor for the upcoming month is budgeted to be $37,000 and will be paid at the end of the upcoming month. c. Manufacturing overhead is estimated to be 150% of direct labor cost each month and is paid in the month in which it is incurred. This monthly estimate includes $18,000 of depreciation on the plant and equipment. d. Monthly operating expenses for next month are expected to be $45,000, which includes $2,800 of depreciation on office equipment and $1,200 of bad debt expense. These monthly operating…arrow_forward

- Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,780,000 Quarter 2 5,580,000 Quarter 3 3,150,000 Quarter 4 8,400,000 In Shalimar’s experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,450,000 and for the fourth quarter of the current year are $7,060,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year $fill in the blank $fill in the blank 4, current year fill in the blank fill in the blank 1, next year fill in the blank fill in the blank…arrow_forwardDon't use AI.arrow_forwardShalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,620,000 Quarter 2 5,150,000 Quarter 3 4,890,000 Quarter 4 8,480,000 In Shalimar’s experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,040,000 and for the fourth quarter of the current year are $7,680,000. Required: Question Content Area 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year $fill in the blank 1d3d12fb3fb1016_1 $fill in the blank 1d3d12fb3fb1016_2 4, current year fill in the blank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub