FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

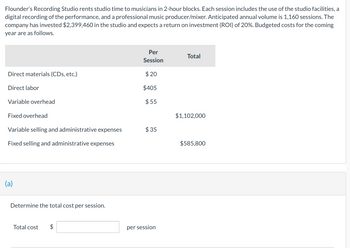

Transcribed Image Text:Flounder’s Recording Studio rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. The anticipated annual volume is 1,160 sessions. The company has invested $2,399,460 in the studio and expects a return on investment (ROI) of 20%. Budgeted costs for the coming year are as follows:

| Cost Item | Per Session | Total |

|---------------------------------------------|-------------|-------------|

| Direct materials (CDs, etc.) | $20 | |

| Direct labor | $405 | |

| Variable overhead | $55 | |

| Fixed overhead | | $1,102,000 |

| Variable selling and administrative expenses| $35 | |

| Fixed selling and administrative expenses | | $585,800 |

---

(a)

Determine the total cost per session.

Total cost $ ______ per session

Expert Solution

arrow_forward

Step 1

Total cost is the cost incurred including both the product cost and the period cost . Thus it is the sum of all the expenses which were incurred in the production and sale of units.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills- the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $311,100 per year, consisting of $0.23 per ton variable cost and $261,100 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 61% of the Transport Services Department's capacity and the Southern Plant requires 39%. During the year, the Transport Services Department actually hauled 118,000 tons of ore to the Northern Plant and 55,600 tons to the Southern Plant. The Transport Services Department incurred $355,000 in cost during the year, of which $53,100 was variable and $301,900 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forwardWilson Blossom is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: (a1) Direct materials $55.00 Direct labor 19.00 Manufacturing overhead 16.00 Selling and administrative 14.00 Total unit cost $104.00 The company's budget includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (a2) Your answer is partially correct. Your answer is correct. Calculate variable overhead per unit and variable selling and…arrow_forwardAlyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost drivers—the number of cruises and the number of passengers—that it uses in its budgeting and performance reports. The company publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 81 passengers can be accommodated on the tour boat. Data concerning the company’s cost formulas appear below: Fixed Cost per Month Cost per Cruise Cost per Passenger Vessel operating costs $ 6,200 $ 474.00 $ 3.30 Advertising $ 2,400 Administrative costs $ 5,200 $ 31.00 $ 1.50 Insurance $ 3,700 For example, vessel operating costs should be $6,200 per month plus $474.00 per cruise plus $3.30 per passenger. The company’s sales should average $31.00 per passenger. In July, the company provided 57 cruises for a total of 3,100 passengers. Required: Prepare the company’s flexible budget for July.arrow_forward

- Camper's Edge Factory produces two products: canopies and tents. The total factory overhead is budgeted at $750,000 for the year, divided between two departments: Cutting, $350,000, and Sewing, $400,000. Each canopy requires 2 direct labor hours in Cutting and 1 direct labor hour in Sewing. Each tent requires 1 direct labor hour in Cutting and 6 direct labor hours in Sewing. Production for the year is budgeted for 20,000 canopies and 10,000 tents. a. Determine the total number of budgeted direct labor hours for the year in each department. Cutting fill in the blank 1 direct labor hours Sewing fill in the blank 2 direct labor hours b. Determine the departmental factory overhead rate for each department. Round your answers to two decimal places, if necessary. Cutting $fill in the blank 3 per direct labor hour Sewing $fill in the blank 4 per direct labor hour c. Determine the factory overhead allocated per unit of each product, using the departmental factory overhead…arrow_forwardWildhorse's Classic Cars restores classic automobiles to showroom status. Budgeted data for the current year are as follows: Restorers' wages and benefits Purchasing agent's salary and benefits Administrative salaries and benefits Other overhead costs Total budgeted costs (a1) Your answer is correct. Profit margin $ eTextbook and Media (a2) The company anticipated that the restorers would work a total of 10,000 hours this year. Expected parts and materials were $1,200,000. In late January, the company experienced a fire in its facilities that destroyed most of the accounting records. The accountant remembers that the hourly labor rate was $60.00 and that the material loading charge was 83.80%. Your answer is correct. Time Charges Material Loading Charges Profit margin (a3) $329,400 Determine the profit margin per hour on labor. (Round answer to 2 decimal places, e.g. 15.25.) eTextbook and Media 73,200 24,400 $427,000 Total price of labor and materials $ Determine the profit margin on…arrow_forwardCartwright Ltd. manufactures two models of saddles, the Jordan and the Shenandoah. The Jordan is a more basic model and sells for $900. The Shenandoah is a professional- model saddle and sells for $1,500. At the beginning of the year, the following budgeted data were available: Expected production (units) Machine time (hours) Direct materials unit cost Direct labour-hours Receiving (number of orders processed) Setups (number of setups) Direct labour average wage rate (per hour) Purchasing (number of requisitions) Inspection (% of units inspected) Maintenance hours Design and production support (hours) Jordan 15,000 2,000 $ 100 30,000 150 15 20 50 10% $ 450 100 The following are the budgeted indirect costs for the year. Equipment maintenance Utilities Purchasing materials Indirect materials Receiving goods Factory rental Setting up equipment Inspection costs Design Production support Facility-level costs are allocated on the basis of machine-hours. Shenandoah 5,000 2,000 $ 200 30,000…arrow_forward

- Godoarrow_forwardAlyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost drivers-the number of cruises and the number of passengers-that it uses in its budgeting and performance reports. The company publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 86 passengers can be accommodated on the tour boat. Data concerning the company's cost formulas appear below: Fixed Cost per Month $ 6,400 $ 2,500 $ 5,600 $ 3,300 Cost per Cruise $ 480.00 Cost per Passenger $ 3.30 Vessel operating costs Advertising Administrative costs $ 38.00 $ 1.50 Insurance For example, vessel operating costs should be $6,400 per month plus $480.00 per cruise plus $3.30 per passenger. The company's sales should average $30.00 per passenger. In July, the company provided 58 cruises for a total of 3,200 passengers. Required: Prepare the company's flexible budget for July. Alyeski Tours Flexible…arrow_forwardHannibal Steel Company has a Transport Services Department that provides trucks to haul ore from the company's mine to its two steel mills-the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $321,300 per year, consisting of $0.15 per ton variable cost and $271,300 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 69% of the Transport Services Department's capacity and the Southern Plant requires 31%. During the year, the Transport Services Department actually hauled 124,000 tons of ore to the Northern Plant and 58,600 tons to the Southern Plant. The Transport Services Department incurred $361,000 in cost during the year, of which $54,000 was variable cost and $307,000 was fixed cost. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs…arrow_forward

- Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost drivers-the number of cruises and the number of passengers-that it uses in its budgeting and performance reports. The company publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 85 passengers can be accommodated on the tour boat. Data concerning the company's cost formulas appear below: Fixed Cost per Month $ 6,100 $ 2,400 $ 5,300 $ 3,900 Cost per Cruise $ 472.00 Cost per Passenger $ 3.30 Vessel operating costs Advertising Administrative costs $ 38.00 $ 1.50 Insurance For example, vessel operating costs should be $6,100 per month plus $472.00 per cruise plus $3.30 per passenger. The company's sales should average $30.00 per passenger. In July, the company provided 60 cruises for a total of 3,050 passengers. Required: Prepare the company's flexible budget for July. Alyeski Tours Flexible…arrow_forwardKata Systems allocates manufacturing overhead based on machine hours. Each connector should require 10 machine hours. According to the static budget, Kata expected to incur the following: 1,000 machine hours per month (100 connectors × 10 machine hours per connector) $8,500 in variable manufacturing overhead costs $9,450 in fixed manufacturing overhead costs During August, Kata actually used 800 machine hours to make 130 connectors and spent $5,200 in variable manufacturing costs and $7,800 in fixed manufacturing overhead costs. Kata's standard variable manufacturing overhead allocation rate is A. $17.95 per machine hour. B. $9.45 per machine hour. C. $10.63 per machine hour. D. $8.50 per machine hour.arrow_forwardWetherbee Tech Services (WTS) is a chain of computer maintenance technicians for households and small businesses. The following data are available for last year's services: • WTS recorded 120,300 tech calls last year. It had budgeted 125,600 calls, averaging 90 minutes each. • Standard variable labor and support costs per tech call were as follows: Direct IT specialist services: 90 minutes at $54 per hour Variable support staff, supplies, and overhead: 30 minutes at $24 per hour . Fixed overhead costs: Annual budget $4,140,600 Fixed overhead is applied at the rate of $36.00 per call. • Actual tech service call costs: Direct IT specialist services: 120,300 calls averaging 84 minutes at $56.00 per hour Variable support staff, supplies, and overhead: averaging 48 minutes per call at $22.50 per hour x 120, 300 calls Fixed overhead Required: a. Prepare a cost variance analysis for each variable cost for last year. b. Prepare a fixed overhead cost variance analysis. Complete this question by…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education