FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

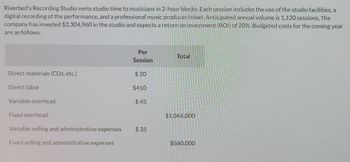

Transcribed Image Text:Riverbed's Recording Studio rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a

digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,120 sessions. The

company has invested $2,304,960 in the studio and expects a return on investment (ROI) of 20%. Budgeted costs for the coming year

are as follows.

Direct materials (CDs, etc.)

Direct labor

Variable overhead

Fixed overhead

Variable selling and administrative expenses

Fixed selling and administrative expenses

Per

Session

$20

$410

$45

$35

Total

$1,064,000

$560,000

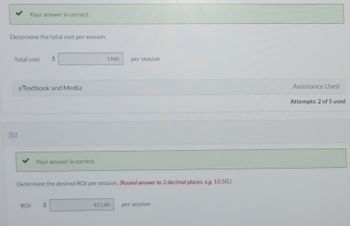

Transcribed Image Text:Your answer is correct.

Determine the total cost per session.

Total cost $

(b)

eTextbook and Media

Your answer is correct.

ROI

1960

Determine the desired ROI per session. (Round answer to 2 decimal places, eg. 10.50.)

per session

411.60

per session

Assistance Used

Attempts: 2 of 5 used

Expert Solution

arrow_forward

Step 1

ROI represents the return the company earns from the investment. It is represented as a percentage of how much the company is able to earn from investment.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hannibal Steel Company has a Transport Services Department that provides trucks to haul ore from the company’s mine to its two steel mills—the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $188,400 per year, consisting of $0.19 per ton variable cost and $138,400 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 56% of the Transport Services Department’s capacity and the Southern Plant requires 44%. During the year, the Transport Services Department actually hauled 129,000 tons of ore to the Northern Plant and 59,800 tons to the Southern Plant. The Transport Services Department incurred $371,000 in cost during the year, of which $52,500 was variable cost and $318,500 was fixed cost. Required: How much of the Transport Services Department’s variable costs should be charged to each plant? How much of the Transport Services Department’s fixed costs should…arrow_forwardHannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills- the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $311,100 per year, consisting of $0.23 per ton variable cost and $261,100 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 61% of the Transport Services Department's capacity and the Southern Plant requires 39%. During the year, the Transport Services Department actually hauled 118,000 tons of ore to the Northern Plant and 55,600 tons to the Southern Plant. The Transport Services Department incurred $355,000 in cost during the year, of which $53,100 was variable and $301,900 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forwardTioga Company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information. Units produced Material moves per product line Lenses 30 Mirrors 30 21 11 220 220 Direct-labor hours per unit The total budgeted material-handling cost is $94,200. Required: 1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one mirror would be what amount? 3. Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling…arrow_forward

- Eliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 18,700 nozzles in stock, although the latest estimate for August production indicates a requirement for only 18,800 nozzles. Total uses of the nozzle are expected to be 18,500 in September and 19,340 in October. Nozzles are purchased at a wholesale price of $27. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 40,000 parts in July. Required: Estimate purchases of the nozzle (in units) for August and September. Estimate the cash disbursements for nozzles in August and September.arrow_forwardPlease help me. Thankyou.arrow_forwardPhoenix Management helps rental property owners find renters and charges the owners one-half of the first month’s rent for this service. For August 2022, Phoenix expects to find renters for 100 apartments with an average first month’s rent of $700. Budgeted cost data per tenant application for 2022 follow: Professional labor: 1.5 hours at $20.00 per hour Credit checks: $50.00 Phoenix expects other costs, including the lease payment for the building, secretarial help, and utilities, to be $3,000 per month. On average, Phoenix is successful in placing one tenant for every three applicants. Actual rental applications in August 2022 were 270. Phoenix paid $9,500 for 400 hours of professional labor. Credit checks went up to $55 per application. Other costs in August 2022 (lease, secretarial help, and utilities) were $3,600. The average first monthly rentals for August 2022 were $800 per apartment unit for 90 units. Part 1 (Static) Required: 1. (a) What is the master budget variance…arrow_forward

- Anderson Labs performs a specialty lab test for local companies for $50 per test. For the upcoming quarter, Anderson Labs is projecting the following sales: The budgeted cost of performing each test is $24. Operating expenses are projected to be $57,000 in January, $52,000 in February, and $61,000 in March. Anderson Labs is subject to a corporate tax rate of 30%. Requirement Prepare a budgeted income statement for the first quarter, with a column for each month and for the quarter. January February March Number of lab tests 5,900 4,700 5,200 ..... Prepare the budgeted income statement by first calculating the operating income, then calculate the net income. Anderson Labs Budgeted Income Statement For the Quarter Ended March 31 January February March Quarter Sales Less: Cost of goods sold Gross profit Less: Operating expenses Operating income Less: Income tax expense Net income .....arrow_forwardCamper's Edge Factory produces two products: canopies and tents. The total factory overhead is budgeted at $750,000 for the year, divided between two departments: Cutting, $350,000, and Sewing, $400,000. Each canopy requires 2 direct labor hours in Cutting and 1 direct labor hour in Sewing. Each tent requires 1 direct labor hour in Cutting and 6 direct labor hours in Sewing. Production for the year is budgeted for 20,000 canopies and 10,000 tents. a. Determine the total number of budgeted direct labor hours for the year in each department. Cutting fill in the blank 1 direct labor hours Sewing fill in the blank 2 direct labor hours b. Determine the departmental factory overhead rate for each department. Round your answers to two decimal places, if necessary. Cutting $fill in the blank 3 per direct labor hour Sewing $fill in the blank 4 per direct labor hour c. Determine the factory overhead allocated per unit of each product, using the departmental factory overhead…arrow_forwardThe Document Creation Center (DCC) for Arlington Corp. provides photocopying and document services for three departments in the Minneapolis office. The following budget has been prepared for the year. Available capacity 9,400,000 pages Budgeted usage: Software Development 2,460,000 pages Training 3,600,000 pages Management 2,940,000 pages Cost equation $307,000 + $0.06 per page If DCC uses a dual-rate for allocating its costs based on usage, how much cost will be allocated to the Management Department? Multiple Choice $247,887. $276,687. $256,878. $130,829.arrow_forward

- Metropolitan Dental Associates is a large dental practice in Chicago. The firm's controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for professional dental services are $60 for half-hour appointments and $115 for one-hour office visits. Ninety percent of each month's professional service revenue is collected during the month when services are rendered, and the remainder is collected the month following service. Uncollectible billings are negligible. Metropolitan's dental associates earn $95 per hour. Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows: Patient registration and records All other overhead and…arrow_forwardGodoarrow_forwardAlyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost drivers-the number of cruises and the number of passengers-that it uses in its budgeting and performance reports. The company publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 86 passengers can be accommodated on the tour boat. Data concerning the company's cost formulas appear below: Fixed Cost per Month $ 6,400 $ 2,500 $ 5,600 $ 3,300 Cost per Cruise $ 480.00 Cost per Passenger $ 3.30 Vessel operating costs Advertising Administrative costs $ 38.00 $ 1.50 Insurance For example, vessel operating costs should be $6,400 per month plus $480.00 per cruise plus $3.30 per passenger. The company's sales should average $30.00 per passenger. In July, the company provided 58 cruises for a total of 3,200 passengers. Required: Prepare the company's flexible budget for July. Alyeski Tours Flexible…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education