SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

not use ai please

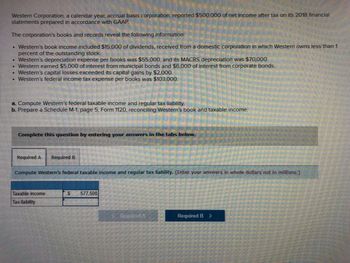

Transcribed Image Text:Western Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its 2018 financial

statements prepared in accordance with GAAP

The corporation's books and records reveal the following information:

• Western's book income included $15,000 of dividends, received from a domestic corporation in which Western owns less than 1

percent of the outstanding stock.

.

Western's depreciation expense per books was $55,000, and its MACRS depreciation was $70,000.

Western earned $5,000 of interest from municipal bonds and $6,000 of interest from corporate bonds.

• Western's capital losses exceeded its capital gains by $2,000.

• Western's federal income tax expense per books was $103,000.

a. Compute Western's federal taxable income and regular tax liability.

b. Prepare a Schedule M-1, page 5, Form 1120, reconciling Western's book and taxable income.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute Western's federal taxable income and regular tax liability. (Enter your answers in whole dollars not in millions.)

Taxable income

Tax liability

S

577,500

Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forwardWestern Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: Western’s book income included $15,000 of dividends, received from a domestic corporation in which Western owns less than 1 percent of the outstanding stock. Western’s depreciation expense per books was $55,000, and its MACRS depreciation was $70,000. Western earned $5,000 of interest from municipal bonds and $6,000 of interest from corporate bonds. Western’s capital losses exceeded its capital gains by $2,000. Western’s federal income tax expense per books was $103,000. Compute Western’s federal taxable income and regular tax liability. My Solutions: federal taxable income = $585,500, regular tax liability = $122,955 (This is a past homework problem that I got wrong. Could you please explain how to do this, I do not understand what I did…arrow_forwardWestern Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: Western’s book income included $15,000 of dividends, received from a domestic corporation in which Western owns less than 1 percent of the outstanding stock. Western’s depreciation expense per books was $55,000, and its MACRS depreciation was $70,000. Western earned $5,000 of interest from municipal bonds and $6,000 of interest from corporate bonds. Western’s capital losses exceeded its capital gains by $2,000. Western’s federal income tax expense per books was $103,000. Required: Compute Western’s federal taxable income and regular tax liability. Prepare a Schedule M-1, page 6, Form 1120, reconciling Western’s book and taxable income.arrow_forward

- Swifty Corporation has income from continuing operations of $319,000 for the year ended December 31, 2022. It also has the following items (before considering income taxes). 1. An unrealized loss of $58,800 on available-for-sale securities. 2. A gain of $25,300 on the discontinuance of a division (comprised of a $8,200 loss from operations and a $33,500 gain on disposal). Assume all items are subject to income taxes at a 20% tax rate.Prepare a partial income statement, beginning with income from continuing operations, and a statement of comprehensive income. SWIFTY CORPORATIONPartial Income Statementchoose the accounting period select an income statement item $enter a dollar amount select an income statement item select an income statement item…arrow_forwardTGW, a calendar year corporation, reported $4,088,000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation's records reveal the following information: • TGW's depreciation expense per books was $463,000, and its MACRS depreciation deduction was $385,400. TGW capitalized $693,000 indirect expenses to manufactured inventory for book purposes and $832,000 indirect expenses to manufactured inventory for tax purposes. TGW's cost of manufactured goods sold was $2,572,000 for book purposes and $2,668,000 for tax purposes. • Four years ago, TGW capitalized $2,340,000 goodwill when it purchased a competitor's business. This year, TGW's auditors required the corporation to write the goodwill down to $1,575,000 and record a $765,000 goodwill impairment expense. Required: Compute TGW's taxable income. (Do not round intermediate calculations. Amounts to be deducted should be indicated with a minus sign.) TGW's net book income before tax Adjustments:…arrow_forwardTGW, a calendar year corporation, reported $3,992,000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation’s records reveal the following information: TGW’s depreciation expense per books was $455,000, and its MACRS depreciation deduction was $381,400. TGW capitalized $685,000 indirect expenses to manufactured inventory for book purposes and $816,000 indirect expenses to manufactured inventory for tax purposes. TGW’s cost of manufactured goods sold was $2,564,000 for book purposes and $2,652,000 for tax purposes. Four years ago, TGW capitalized $2,292,000 goodwill when it purchased a competitor’s business. This year, TGW’s auditors required the corporation to write the goodwill down to $1,535,000 and record a $757,000 goodwill impairment expense. Required: Part A Compute TGW’s taxable income. Note: Do not round intermediate calculations. Amounts to be deducted should be indicated with a minus sign.arrow_forward

- Sheridan Corporation has income from continuing operations of $278,000 for the year ended December 31, 2022. It also has the following items (before considering income taxes). An unrealized loss of $74,000 on available-for-sale securities. 2. Again of $25,000 on the discontinuance of a division (comprised of a $19,000 loss from operations and a $44,000 gain on disposal). Assume all items are subject to income taxes at a 15% tax rate. Prepare a partial income statement, beginning with income from continuing operations, and a statement of comprehensive income. (Enter loss using either a negativign preceding the number eg.-2,945 or parentheses e.g. (2.945)) Income from Continuing Operations Discontinued Operations Gain from Disposal, Net of Income Taxes SHERIDAN CORPORATION Income Statement (Partial) For the Year Ended December 31, 2022 Ines from nortinne Nat of Income Tay Saunas 37400 16150 278000arrow_forwardH5.arrow_forwardVinubhaiarrow_forward

- The following information was taken from the records of Tamarisk Inc. for the year 2020: Income tax applicable to income from continuing operations $205,700: income tax applicable to loss on discontinued operations $28.050, and unrealized holding gain on available-for-sale securities (net of tax) $16,500. Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of Inventory $104,500 (a) 82,500 264.000 44,000 66,000 Shares outstanding during 2020 were 100,000. Cash dividends declared Retained earnings January 1, 2020 Cost of goods sold Selling expenses Sales Revenue $165,000 2.280,000 TAMARISK INC. 935,000 330,000 2,090,000 Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal places, e.g. 1.48.)arrow_forwardMunabhaiarrow_forwardGrand Corporation reported pretax book income of $645,000. Tax depreciation exceeded book depreciation by $430,000. In addition, the company received $322,500 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $53,750. Grand's beginning book (tax) basis in its fixed assets was $2,075,000 ($1,860,000) and its ending book (tax) basis is $2,575,000 ($1,945,000). Compute the company's current income tax expense or benefit. Note: Leave no answer blank. Enter N/A or zero. Answer is complete but not entirely correct. N/A expense Current income tax Deferred income tax $ 22,575arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning