Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

answ

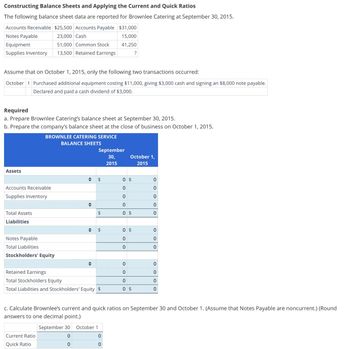

Transcribed Image Text:Constructing Balance Sheets and Applying the Current and Quick Ratios

The following balance sheet data are reported for Brownlee Catering at September 30, 2015.

Accounts Receivable $25,500 Accounts Payable $31,000

Notes Payable

Equipment

23,000 Cash

15,000

51,000 Common Stock

41,250

Supplies Inventory

13,500 Retained Earnings

?

Assume that on October 1, 2015, only the following two transactions occurred:

October 1 Purchased additional equipment costing $11,000, giving $3,000 cash and signing an $8,000 note payable.

Declared and paid a cash dividend of $3,000.

Required

a. Prepare Brownlee Catering's balance sheet at September 30, 2015.

b. Prepare the company's balance sheet at the close of business on October 1, 2015.

BROWNLEE CATERING SERVICE

Assets

BALANCE SHEETS

September

30,

2015

October 1,

2015

0 $

0

Accounts Receivable

0

0

Supplies Inventory

0

0

÷

0

0

Total Assets

$

0 $

0

Liabilities

Notes Payable

Total Liabilities

$

0 $

0

0

0

0

0

Stockholders' Equity

0

0

Retained Earnings

0

0

Total Stockholders Equity

0

0

Total Liabilities and Stockholders' Equity $

0 $

0

c. Calculate Brownlee's current and quick ratios on September 30 and October 1. (Assume that Notes Payable are noncurrent.) (Round

answers to one decimal point.)

September 30

October 1

Current Ratio

Quick Ratio

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardFINANCIAL RATIOS Based on the financial statements for Jackson Enterprises (income statement, statement of owners equity, and balance sheet) shown on pages 596597, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 21,600. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owners equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventoryarrow_forwardSelected information from the comparative financial statements of AppleVerse Company for the year ended December 31 appears below: 2018 2017 Php Php Accounts receivable (net) 175,000 200,000 Inventory 130,000 150,000 Total assets 1,100,000 800,000 Current liabilities 140,000 110,000 Long-term debt 410,000 300,000 Net credit sales 800,000 700,000 Cost of goods sold 600,000 530.000 Interest expense 40.000 25,000 Income tax expense 60.000 29,000 Net income 150.000 85,000 Net cash provided by operating 220,000 135,000 activities Compute for the Receivables Turnover for 2018. O 2.13 O 4.27 O 5.95 O 3.23arrow_forward

- Use the following information to prepare a classified balance sheet for Alpha Co. at the end of 2016. $26,500 Accounts receivable Accounts payable 12,200 Cash 20,500 Common stock 30,000 Land 10,000 Long-term notes payable 17,500 26,300 Merchandise inventory Retained earnings 23,600arrow_forwardThe following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, n/45. Accounts receivable, end of year Sales on account 20Y3 $ 725,000 5,637,500 2012 $ 650,000 4,687,500 20Y1 $600,000 Horizontally analyze the financial data in Exercise 17-9. (b) Calculate how many days it took Sigmon Inc. to collect its recieivables (i.e. Sigmon's average collection period) in 20Y3. Show your work.arrow_forwardSuppose the 2017 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.40 billion at the beginning of the year and $3.54 billion at the end of the year. Compute 3M Company's receivable turnover. (Round answer to 1 decimal place, e.g. 12.5.) times Accounts receivable turnover ratio SHOW LIST OF ACCOUNTS LINK TO TEXT INTERACTIVE TUTORIAL Compute 3M Company's average collection period for accounts receivable in days. (Round answer to 1 decimal place, e.g. 12.5. Use 365 days for calculation.) Average collection period daysarrow_forward

- Calculate COGSarrow_forwardConstructing Financial Statements from Account Data Barth Company reports the following year-end account balances at December 31, 2011. Prepare the 2011 income statement and the balance sheet as of December 31, 2011. $ 32,000 60,000 400,000 Goodwill 302,000 Retained earnings 96,000 Sales revenue 300,000 Supplies inventory 360,000 Supplies expense 140,000 Wages expense Accounts payable Accounts receivable Bonds payable, long-term Buildings Cash Common stock Cost of goods sold Equipment Barth Company Income Statement For Year Ended December 31, 2011 $ Expenses Total expenses Net income Assets Cash Total current assets Total assets ◆ ◆ → ◆ ◆ ◆ ◆ ◆ ♦ + $ $ $ Inventory $72,000 Land 160,000 16,000 120,000 800,000 6,000 12,000 80,000 Barth Company Balance Sheet December 31, 2011 Liabilities and equity Total liabilities Total equity Total liabilities and equity ◆ ♦ ◆ $arrow_forwardBlossom Company has been operating for several years, and on December 31, 2025, presented the following balance shee Cash Receivables Inventory Plant assets (net) (a) (b) (c) (d) BLOSSOM COMPANY Balance Sheet December 31, 2025 Current ratio $44,000 Accounts payable Mortgage payable Common stock ($1 par) Retained earnings 69.600 Acid-test ratio 79,200 238,500 $431,300 The net income for 2025 was $25,878. Assume that total assets are the same in 2024 and 2025. Compute each of the following ratios. (Round answers to 2 decimal places, eg. 1.59 or 45.87%.) Debt to assets ratio Return on assets $80,000 % 178,780 % 152.300 20.220 $431,300arrow_forward

- The following financial information is for Chesapeake Corporation are for the fiscal years ending 2018 & 2017 (all balances are normal): Item/Account Cash 2018 2017 $35,000 $24,000 Accounts Receivable 56,000 52,000 Inventory Current Liabilities 40,000 38,000 76,000 42,000 Net Sales (all credit) 550,000 485,000 Cost of Goods Sold 320,000 265,000 Use this information to determine the number of days in inventory for 2018.arrow_forwardGeneral accountingarrow_forwardRead and identify the following balance sheet. Complete the missing information, using the information below the balance sheet: Assets Skretting Arc Ecuador S.A. Balance Sheet December 31, 20 20 Liabilities and Stockholders' Equity Cash $32,720 Marketable securities 25,000 Accounts receivable Inventories Total current assets Net fixed assets Total assets $ Accounts payable Notes payable 2. The gross profit margin was 25%. 3. Inventory turnover was 6.0. 4. There are 365 days in the year. Accruals Total current liabilities The following financial data for year 2020 is available: 1. Sales totaled $1,800,000. Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ $120,000 5. The average collection period was 40 days. 6. The current ratio was 1.60. 7. The total asset turnover ratio was 1.20. 8. The debt ratio was 60%. 20,000 $600,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,