FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

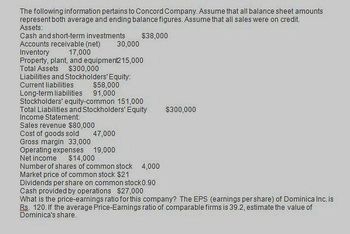

Transcribed Image Text:The following information pertains to Concord Company. Assume that all balance sheet amounts

represent both average and ending balance figures. Assume that all sales were on credit.

Assets:

Cash and short-term investments

Accounts receivable (net)

Inventory

17,000

$38,000

30,000

Property, plant, and equipment215,000

Total Assets $300,000

Liabilities and Stockholders' Equity:

Current liabilities

Long-term liabilities

$58,000

91,000

Stockholders' equity-common 151,000

Total Liabilities and Stockholders' Equity

Income Statement:

Sales revenue $80,000

Cost of goods sold 47,000

Gross margin 33,000

Operating expenses 19,000

Net income $14,000

Number of shares of common stock 4,000

Market price of common stock $21

Dividends per share on common stock 0.90

Cash provided by operations $27,000

$300,000

What is the price-earnings ratio for this company? The EPS (earnings per share) of Dominica Inc. is

Rs. 120. If the average Price-Earnings ratio of comparable firms is 39.2, estimate the value of

Dominica's share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- The following information pertains to Cachet Company. Assume that allBalance sheet amounts represent both average and ending balance figures.Assume that all sales were on credit.AssetsCash and short-term investments P 40,000Accounts receivable (net) 30,000Inventory 25,000Property, plant and equipment 215,000Total Assets P310, 000Liabilities and Stockholders’ EquityCurrent liabilities P 60,000Long-term liabilities 95,000Stockholders’ equity—common 55,000Total Liabilities and Stockholders’ Equity P310, 000Income StatementSales P 90,000Cost of goods sold 45,000Gross margin 45,000Operating expenses 20,000Net income P 25,000Number of shares of common stock 6,000Market price of common stock P20Dividends per share P1.00What is the price-earnings ratio for this company?A. 6 timesB. 4.2 timesC. 8 times D. 4.8 times Can you please give me a coherent solution for this?arrow_forwardWe are given the following information for Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $2,068,000 150,000 923,000 763,000 a. Accounts receivable b. Marketable securities c. Capital assets. d. Long-term debt $ Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items: LA LA LA $ $ 1.00 times 2.60 times $ 40 % 4 times 517000arrow_forwardWe are given the following information for Pettit Corporation. Sales (credit) Cash Inventory Current liabilities. Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $4,344,000 229,000 873,000 773,000 a. Accounts receivable b. Marketable securities c. Capital assets d. Long-term debt $ $ Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items: ta ta ta 1.45 times 2.80 times $ $ 50 % 8 timesarrow_forward

- The following information pertains to Bonita Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short-term investments $ 48000 Accounts receivable (net) 25000 Inventory 25000 Property, plant and equipment 200000 Total Assets $298000 Liabilities and Stockholders’ Equity Current liabilities $ 51000 Long-term liabilities 84000 Stockholders’ equity—common 163000 Total Liabilities and Stockholders’ Equity $298000 Income Statement Sales (net) $ 115000 Cost of goods sold 65000 Gross profit 50000 Operating expenses 27000 Net income $ 23000 Number of shares of common stock 4000 Market price of common stock $22 Dividends per share 0.40 What is the inventory turnover for Bonita? 3.55 times 2.60 times 5.60 times 0.38 timesarrow_forwardBronco Electronics' current assets consist of cash, short-term investments, accounts receivable, and inventory. The following data were abstracted from a recent financial statement: inventory $190,000 total assets 1,970,000 current ration 3.6 acid test ratio 2.35 debt to equity ratio 1.5 COMPUTE THE CURRENT ASSETSarrow_forwardReturn on Assetsarrow_forward

- Please show calculationarrow_forwardWe are given the following information for the Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $ 2,880,000 188,000 890,000 811,000 1.35 times 2.30 times a. Accounts receivable b. Marketable securities c. Fixed assets d. Long-term debt 40 % 5 times Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Lienser Fraktala TAMARA TANT RISHI TRITATE FAST JET PARETSTRANS I nemal osted or annemangen MANENBER HAGPAINT MANSION LARPURCO Calculate the following balance sheet items. (Do not round intermediate calculations. Round your final answers to the nearest whole number.)arrow_forwardCompute the debt ratio from the data shown below: Balance Sheet (Millions of $) Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of $) Net sales Operating costs except depreciation Depreciation Earnings bef interest and taxes (EBIT) 2007 $1,290 9,890 13,760 $24,940 $18,060 $43.000 $8,170 6,020 4.730 $18,920 $8,815 $27.735 $5,805 2.460 $15.265 $43,000 2007 $51.600 48,246 903 $2,451 Karrow_forward

- HCB, Inc.'s financial partial statements are shown below. HCB Income Statement 2021 Sales 2,000.0 Assets 2021 Cash 86.0 Accounts receivable 360.0 Inventory 320.0 Short-term investments 223.0 Total current assets 989.0 Net fixed assets 1,940.0 Total assets 2,929.0 Liabilities and equity 2021 Accounts payable 200.0 Accruals 240.0 Short-term debt 292.9 Total current liabilities 732.9 Long-term debt 1,757.4 Total liabilities 2,490.3 Par + paid in capital less treasury 238.7 Retained earnings 200.0…arrow_forwardQq.33. Subject :- Accountarrow_forwardConsider the following company’s balance sheet and income statement Return on assets. Return on equity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education