FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I want to answer this question

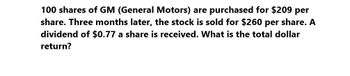

Transcribed Image Text:100 shares of GM (General Motors) are purchased for $209 per

share. Three months later, the stock is sold for $260 per share. A

dividend of $0.77 a share is received. What is the total dollar

return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give me true answer this financial accountingarrow_forwardKindly help me with accounting questionsarrow_forwardYou purchase 100 shares of COST (Costco) for $280 per share. Three months later, you sell the stock for $290 per share. You receive a dividend of $0.57 a share. What is your total dollar return?arrow_forward

- You purchase 800 shares of stock at a price of $420 per share. One year later, the shares are selling for $22 per share. In addition, a dividend of $2 per share is paid at the end of each year. What is the capital gains yield for the investment? 8.5% 10.0% 25.0% 20.0% 15.0%arrow_forwardQuick answer of this accounting questionsarrow_forwardIn you cash account, you buy 100 shares of XYZ Corporation at a price of $10 per share. Two months later, XYZ pays a dividend $0.21 per share. You sell all 100 shares of XYZ three months later at a price of $12 per share. What is your total return on this trade in dollar amount?arrow_forward

- On January 1, you sold short 100 shares of XYZ stock at $20 using a 50% initial margin. The interest rate on the margin account is 10% annually. On April 1 (in three-months), you covered the short sales by buying stock at a price of $15 per share. You paid 50 cents per share in commissions for each transaction. Assume you received interest on all your assets, i.e. the sum of the short sale proceeds and the margin. What is the value of your assets and equity on April 1? What is the total rate of return on equity?arrow_forwardWhat is the total dollar return on these accounting question?arrow_forwardUse the commission schedule from Company A shown in the table to find the annual rate of interest earned on the investment. (Note: commissions are rounded to the nearest cent.) An investor purchases 250 shares at $11.21 a share, holds the stock for 37 weeks, and then sells the stock for $13.65 a share. The annual rate is %. (Round to five decimal places.) Principal (Value of Stock) Under $3,000 $3,000 to $10,000 Over $10,000 Commission $25+1.8% of principal $37+1.4% of principal $107+0.7% of principalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education