Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solution

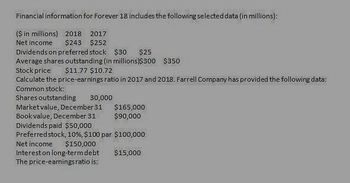

Transcribed Image Text:Financial information for Forever 18 includes the following selected data (in millions):

($ in millions) 2018

2017

Net income

$243 $252

Dividends on preferred stock $30

$25

Average shares outstanding (in millions) $300 $350

Stock price

$11.77 $10.72

Calculate the price-earnings ratio in 2017 and 2018. Farrell Company has provided the following data:

Common stock:

Market value, December 31

Shares outstanding

Book value, December 31

30,000

$165,000

$90,000

Dividends paid $50,000

Preferred stock, 10%, $100 par $100,000

Net income $150,000

Interest on long-term debt

The price-earnings ratio is:

$15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.arrow_forwardTreasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.arrow_forwardFinancial information for Forever 18 includes the following selected data:($ in millions) 2021 2020Net income $ 129 $ 308Dividends on preferred stock $ 20 $ 15Average shares outstanding 150 400Stock price $ 12.02 $ 10.97Required:1. Calculate earnings per share in 2020 and 2021. Did earnings per share increase in 2021?2. Calculate the price-earnings ratio in 2020 and 2021. In which year is the stock priced lower in relation to reported earnings?arrow_forward

- Helparrow_forwardYou are given the following information: Stockholder's Equity Price/Earnings Ratio Share Outstanding Market/Book Ratio $1,250 5 25 1.5 Calculate the market price of a share of the company's stock. Consider the summarized data from the balance sheets and income statements of Wiper Inc. If Wiper's stock had a price/earnings ratio of 12 at the end of 2020, what was the market price of the stock? Wiper Inc. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 2019 2018 Current assets $764 $981 $843 Other assets Total assets 2,424 1,931 1,730 $3,188 $2,912 $2,573 Current liabilities Long-term liabilities Stockholders' equity $588 $841 $734 1,582 1,034 910 1,018 1,037 929 Total liabilities and stockholders' equity $3,188 $2,912 $2,573 Wiper Inc. Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales $3,061 $2,924 Operating income 307 321 Interest expense 95 76 Net income 224 219 Other…arrow_forwardPlease read and answer question susing the table providedarrow_forward

- The financial statements of Friendly Fashions include the following selected data (in millions):($ in millions) 2021 2020Sales $ 10,043 $ 11,134Net income $ 312 $ 818Stockholders’ equity $ 1,850 $ 2,310Average shares outstanding (in millions) 675 –Dividends per share $ 0.31 –Stock price $ 6.20 –Required:1. Calculate the return on equity in 2021.2. Calculate the dividend yield in 2021.3. Calculate earnings per share in 2021.4. Calculate the price-earnings ratio in 2021.arrow_forwardBelow is a company’s stock quote on March 1, 2021: Name Close Net Chg Div P/E DSD 20.25 -.15 1.05 16 What is the company’s earnings per share (EPS)?arrow_forwardThe following information relates to SE11-8 through SE11-10: Evans & Sons, Inc., disclosed the following information in a recent annual report: Net income Preferred stock dividends. Average common stockholders' equity. Dividend per common share.. Earnings per share. . . . . Market price per common share, year-end. 2018 $ 35,000 3,000 1,000,000 1.90 2.85 19.00 2019 $ 48,000 3,000 1,500,000 2.00 3.20 21.00 SE11-8. Return on Common Stockholders' Equity Calculate the return on common stockholders' equity for Evans & Sons for 2018 and 2019. Did the return improve from 2018 to 2019? SE11-9. Dividend Yield Calculate the dividend yield for Evans & Sons for 2018 and 2019. Did the dividend yield improve from 2018 to 2019? SE11-10. Dividend Payout Ratio Calculate the dividend payout for Evans & Sons for 2018 and 2019. Did the dividend payout increase from 2018 to 2019? SE11-11. Change in Stockholders' Equity Nikron Corporation issued 20,000 shares of $0.50 par value common stock during the year…arrow_forward

- Computing earnings per share, price/earnings ratio, and rate of return on common stockholders’ equity Bianchi Company reported these figures for 2018 and 2017: Requirements Compute Bianchi Company’s earnings per share for 2018. Assume the company paid the minimum preferred dividend during 2018. Round to the nearest cent. Compute Bianchi Company’s price/earnings ratio for 2018. Assume the company’s market price per share of common stock is $9. Round to two decimals. Compute Bianchi Company’s rate of return on common stockholders’ equity for 2018. Assume the company paid the minimum preferred dividend during 2018. Round to the nearest whole percent.arrow_forwardComputing earnings per share, price/earnings ratio, and rate of return on common stockholders’ equity Gullo Company reported these figures for 2018 and 2017: Requirements Compute Gullo Company’s earnings per share for 2018. Assume the company paid the minimum preferred dividend during 2018. Round to the nearest cent. Compute Gullo Company’s price/earnings ratio for 2018. Assume the company’s market price per share of common stock is $9. Round to two decimals. Compute Gullo Company’s rate of return on common stockholders’ equity for 2018. Assume the company paid the minimum preferred dividend during 2018. Round to the nearest whole percent.arrow_forwardFinancial information for Forever 18 includes the following selected data: ($ in millions) 2024 2023 Net income $160 $171 Dividends on preferred stock $22 $17 Average shares outstanding 250 300 Stock price $11.92 $10.87 2-a. Calculate the price-earnings ratio in 2023 and 2024. 2-b. In which year is the stock priced lower in relation to reported earnings?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning