FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

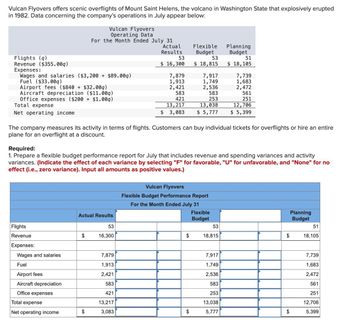

Transcribed Image Text:Vulcan Flyovers offers scenic overflights of Mount Saint Helens, the volcano in Washington State that explosively erupted

in 1982. Data concerning the company's operations in July appear below:

Vulcan Flyovers

Operating Data

For the Month Ended July 31

Flights (q)

Revenue ($355.00g)

Expenses:

Wages and salaries ($3,200+ $89.009)

Fuel ($33.009)

Airport fees ($840 + $32.009)

Aircraft depreciation ($11.00q)

Office expenses ($200 + $1.009)

Total expense

Net operating income

Actual

Results

Flexible

Budget

Planning

Budget

53

53

51

$ 16,300

$ 18,815

$ 18,105

7,879

7,917

7,739

1,913

1,749

1,683

2,421

2,536

2,472

583

583

561

421

253

251

13,217

13,038

12,706

$ 3,083

$ 5,777

$ 5,399

The company measures its activity in terms of flights. Customers can buy individual tickets for overflights or hire an entire

plane for an overflight at a discount.

Required:

1. Prepare a flexible budget performance report for July that includes revenue and spending variances and activity

variances. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e., zero variance). Input all amounts as positive values.)

Vulcan Flyovers

Flights

Revenue

Actual Results

53

$

16,300

Flexible Budget Performance Report

For the Month Ended July 31

Flexible

Planning

Budget

Budget

53

51

$

18,815

$

18,105

Expenses:

Wages and salaries

7,879

7,917

7,739

Fuel

1,913

1,749

1,683

Airport fees

2,421

2,536

2,472

Aircraft depreciation

583

583

561

Office expenses

421

253

251

Total expense

13,217

13,038

12,706

Net operating income

$

3,083

$

5,777

$

5,399

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Goldenrod Company makes artificial flowers and reports the following data for the month: Purchases of materials, on account $ 51,000Materials requisitions: Direct materials 42,300 Indirect materials 500Labor incurred (not yet paid): Direct labor 20,300 Indirect labor 1,340Journalize the entries relating to materials and labor.arrow_forwardPlease do not give solution in image format thankuarrow_forward[The following information applies to the questions displayed below.]Information on Kwon Manufacturing’s activities for its first month of operations follows: Purchased $101,700 of raw materials on credit. Materials requisitions show the following materials used for the month. Job 201 $ 49,900 Job 202 25,300 Total direct materials 75,200 Indirect materials 10,320 Total materials used $ 85,520 Time tickets show the following labor used for the month. Job 201 $ 40,900 Job 202 14,300 Total direct labor 55,200 Indirect labor 25,900 Total labor used $ 81,100 Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. Transferred Job 201 to Finished Goods Inventory. (1) Sold Job 201 for $168,860 on credit. (2) Record cost of goods sold for Job 201. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment $ 33,700 Rent on factory building (payable)…arrow_forward

- The following report was prepared for evaluating the performance of the plant manager of Marching Ants Inc. Evaluate and correct this report. Marching Ants Inc.Manufacturing CostsFor the Quarter Ended June 30 Materials used in production (including $56,200 of indirect materials) $607,500 Direct labor (including $84,400 maintenance salaries) 562,500 Factory overhead: Supervisor salaries 517,500 Heat, light, and power 140,650 Sales salaries 348,750 Promotional expenses 315,000 Insurance and property taxes—plant 151,900 Insurance and property taxes—corporate offices 219,400 Depreciation—plant and equipment 123,750 Depreciation—corporate offices 90,000 Total $3,076,950 Marching Ants Inc.Manufacturing CostsFor the Quarter Ended June 30 $- Select - - Select - Factory overhead: $- Select - - Select - - Select - - Select - - Select - - Select - - Select - Total…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardSagararrow_forward

- Aelan Products Company, a small manufacturer, has submitted the items below concerning last year's operations. The president's secretary, trying to be helpful, has alphabetized the list. Administrative salaries $4,800 Advertising expense 2,400 Depreciation—factory building 1,600 Depreciation—factory equipment 3,200 Depreciation—office equipment 360 Direct labour cost 43,800 Raw materials inventory, beginning 4,200 Raw materials inventory, ending 6,400 Finished goods inventory, beginning 93,960 Finished goods inventory, ending 88,820 General liability insurance expense 480 Indirect labour cost 23,600 Insurance on factory 2,800 Purchases of raw materials 29,200 Repairs and maintenance of factory 1,800 Sales salaries 4,000 Taxes on factory 900 Travel and entertainment expense 2,820 Work in process inventory, beginning 3,340 Work in process inventory, ending 2,220…arrow_forwardWaterways has two major public-park projects to provide with comprehensive irrigation in one of its service locations this month. Job J57 and Job K52 involve 15 acres of landscaped terrain, which will require special-order, sprinkler heads to meet the specifications of the project. Using a job cost system to produce these parts, the following events occurred during December.Raw materials were requisitioned from the company’s inventory on December 2 for $5,091; on December 8 for $1,050; and on December 14 for $3,495. In each instance, two-thirds (2/3) of these materials were for J57 and the rest for K52.Six time tickets were turned in for these two projects for a total amount of 18 hours of work. All the workers were paid $17.5 per hour. The time tickets were dated December 3, December 9, and December 15. On each of those days, 6 labor hours were spent on these jobs, two-thirds (2/3) for J57 and the rest for K52.The predetermined overhead rate is based on machine hours. The expected…arrow_forwardAt the beginning of December, Altro Corporation had $26,000 of raw materials on hand. During the month, the Corporation purchased an additional $76,000 of raw materials. During December, $72,000 of raw materials were requisitioned from the storeroom for use in production. The credits entered in the Raw Materials account during the month of December total: Multiple Choice O $76.000 $72,000 $102,000 $26,000arrow_forward

- 44) Same information as before - You have collected the following information about activity and costs - Activity - Machine Cost - Utilities Month Hours March 2,400 $18,500 2,600 $19,750 April May 2,900 $23,740 $25,500 $18,350 $17,290 June 3,100 July August September 1,950 October 2,100 1,900 $17,150 3,150 $25,200 November 3,000 $24,100 Using the High-Low method and your answers from the two previous questions, what is the estimated cost for December if the machines run for 2,550 hours ?arrow_forwardSamir graduated from NAIT's School of Business with a bachelor's degree and is now employed by an accounting firm as a candidate towards becoming a CPA. He now regularly works more than 40 hours per week. According to Alberta's Employment Standards rules, is Samir entitled to overtime? The correct answer is that: Select one: a. Yes. Every employee in Alberta is entitled to be paid overtime for work hours in excess of 40 hours in the work week. b. Yes. Every employee in Alberta is entitled to be paid overtime for work hours in excess of 8 on each work day in the work week, or an employee's hours of work in excess of 40 hours in the work week, whichever is greater. Oc. If Samir's employment contract stipulates that he has waived overtime, then he is not entitled to overtime. Otherwise, the Employment Standards Act stipulates that he is to be paid time and a half for each hour worked over 40 hours in the work week. d. No, not as a candidate. Under Section 2(2) of the Employment Standards…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education