FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Waterways has two major public-park projects to provide with comprehensive irrigation in one of its service locations this month. Job

J57 and Job K52 involve 15 acres of landscaped terrain which will require special-order sprinkler heads to meet the specifications of

the project. Using a job cost system to produce these parts, the following events occurred during December.

Raw materials were requisitioned from the company's inventory on December 2 for $5,886; on December 8 for $1,224; and on

December 14 for $4,008. In each instance, two-thirds (2/3) of these materials were for J57 and the rest for K52.

Six time tickets were turned in for these two projects for a total amount of 18 hours of work. All the workers were paid $16.50 per

hour. The time tickets were dated December 3, December 9, and December 15. On each of those days, 6 labor hours were spent on

these jobs, two-thirds (2/3) for J57 and the rest for K52.

The predetermined overhead rate is based on machine hours. The estimated machine hour use for the year is 2,446 hours, and the

estimated overhead costs are $1,130,052 for the year. The machines were used by workers on projects K52 and J57 on December 3, 9,

and 15. Six machine hours were used for project K52 (2 each day), and 8.5 machine hours were used for project J57 (2.5 the first day

and 3 each of the other days). Both of these special orders were completed on December 15, producing 280 sprinkler heads for J57

and 168 sprinkler heads for K52.

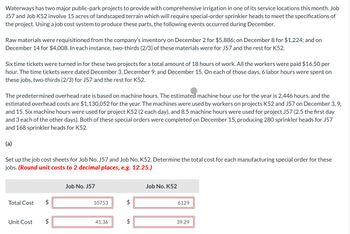

(a)

Set up the job cost sheets for Job No. J57 and Job No. K52. Determine the total cost for each manufacturing special order for these

jobs. (Round unit costs to 2 decimal places, e.g. 12.25.)

Total Cost

Unit Cost

Job No. J57

10753

41.36

$

Job No. K52

6129

39.29

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waterways has two major public-park projects to provide with comprehensive irrigation in one of its service locations this month. Job J57 and Job K52 involve 15 acres of landscaped terrain, which will require special-order, sprinkler heads to meet the specifications of the project. Using a job cost system to produce these parts, the following events occurred during December.Raw materials were requisitioned from the company’s inventory on December 2 for $5,091; on December 8 for $1,050; and on December 14 for $3,495. In each instance, two-thirds (2/3) of these materials were for J57 and the rest for K52.Six time tickets were turned in for these two projects for a total amount of 18 hours of work. All the workers were paid $17.5 per hour. The time tickets were dated December 3, December 9, and December 15. On each of those days, 6 labor hours were spent on these jobs, two-thirds (2/3) for J57 and the rest for K52.The predetermined overhead rate is based on machine hours. The expected…arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forwardProduction workers for Zachary Manufacturing Company provided 4,300 hours of labor in January and 3,400 hours in February. The company, whose operation is labor intensive, expects to use 48,300 hours of labor during the year. Zachary paid a $111,090 annual premium on July 1 of the prior year for an insurance policy that covers the manufacturing facility for the following 12 months. Required Based on this information, how much of the insurance cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.)arrow_forward

- The cost of materials transferred into the Bottling Department of Mountain Springs Water Company is $32,400, with $26,000 from the Purifying Department, plus an additional $6,400 from the materials storeroom. The conversion cost for the period in the Bottling Department is $8,750 ($3,750 factory applied and $5,000 direct labor). The total cost transferred to finished goods for the period was $31,980. The Bottling Department had a beginning inventory of $1,860. a. Journalize (1) the cost of transferred-in materials (2) conversion costs, and (3) the cost transferred out to finished goods. If an amount box does not require an entry, leave it blank. b. Determine the balance of Work in Process—Bottling at the end of the period.arrow_forwardAt the beginning of the year, Cinnabar Company initiated an environmental cost reduction program. To help assess the impact of the environmental cost reduction improvement program, the following data were collected for the year: Operating costs $2,500,000 Designing products 2,500 Auditing environmental activities 6,000 Recycling products 22,000 Disposing of toxic waste 37,000 Testing for contamination 15,000 Cleaning up oil spills 41,500 Which of the following expresses the environmental costs incurred on prevention activity as a percentage of operating costs (rounded to two decimal places)? a. 0.98% b. 0.15% c. 2.46% d. 4.96%arrow_forwardOn March 1, the Mixing Department had 200 rolls of paper in process. During March, the Mixing Department completed the mixing process for those 200 rolls and also started and completed the mixing process for an additional 4,800 rolls of paper. The department started but did not finish the mixing process for an additional 500 rolls, which were 20% complete with respect to both direct materials and conversion work at the end of March. Direct materials and conversion costs are incurred evenly throughout the mixing process.arrow_forward

- Velshi Printers has contracts to complete weekly supplements required by forty - six customers. For the year 2018, manufacturing overhead cost estimates total $2,080,000 for an annual production capacity of 16 million pages. For 2018 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis: Cost pool Design changes Manufacturing overhead costs Activity level 100 design changes $160,000 Setups 1,850,000 6,000 setups Inspections 70,000 9,000 inspections Total manufacturing overhead costs $2,080,000 During 2018, two customers, Money Managers and Hospital Systems, are expected to use the following printing services: Activity Money Managers Hospital Systems Pages 90,000 106,000 Design changes Setups Inspections 12 17 26 34 Assuming activity - cost…arrow_forwardLawn Products produces two products (X and Y) and a by-product (Z) from a joint process using a raw material (Alpha). The company chooses to allocate the costs on the basis of the physical quantities method. Last month, it processed 26,000 pounds of Alpha at a total cost of $102,000. The output of the process consisted of 30,150 units of product X, 36,850 units of product Y, and 7,400 units of by-product Z. By-product Z can be sold for $10,800. This is considered to be its net realizable value, which is deducted from the processing costs of the main products. Required: What amount of joint costs should be assigned to each of product X and product Y?arrow_forwardOn May 7, Lockmiller Company purchased on account 12,000 units of materials at $6 per unit. During May, raw materials were requisitioned for production as follows: 8,400 units for Job 275 at $6 per unit and 2,150 units for Job 310 at $4 per unit. Required: Journalize the entry on May 7 to record the purchase and on May 31 to record the requisition from the materials storeroom. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Lockmiller Company General Ledger ASSETS 110 Cash 121 Accounts Receivable 125 Notes Receivable 126 Interest Receivable 131 Materials 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance…arrow_forward

- and media purchases (air time and ad space). Overhead is allocated to each project as a percentage of media purchases. The predetermined overhead rate is 45% of media purchases. On August 1, the four advertising projects had the following accumulated costs: Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages Total During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts: Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages Total a. b. pur req b. ( At the end of August, both the Vault Bank and Take Off Airlines campaigns were completed. The costs of completed campaigns are debited to the cost of services account. C. August 1 Balances $81,400 24,400 57,000 35,000 $197,800 a. Journalize the summary entry to record the direct labor costs for the month. If an amount box does not require an entry, leave it blank. app ani c. C d. of V ami d. ( Direct Labor $55,300…arrow_forwardProduction workers for Adams Manufacturing Company provided 5,000 hours of labor in January and 2,100 hours in February. The company, whose operation is labor intensive, expects to use 48,000 hours of labor during the year. Adams paid a $100,800 annual premium on July 1 of the prior year for an insurance policy that covers the manufacturing facility for the following 12 months. Required Based on this information, how much of the insurance cost should be allocated to the products made in January and to those made in February? Note: Do not round intermediate calculations. Month January February Allocated Costarrow_forwardSmith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Beginning work-in-process Costs added in October Total costs Direct Materials $ 8,200 $ 8,200 Required: 1. Calculate each of the following amounts using weighted-average process costing: a. Equivalent units of direct materials and conversion. b. Equivalent unit costs of direct materials and conversion.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education