FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

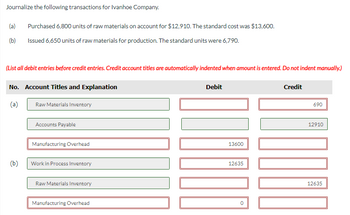

Transcribed Image Text:Journalize the following transactions for Ivanhoe Company.

(a) Purchased 6,800 units of raw materials on account for $12,910. The standard cost was $13,600.

(b)

Issued 6,650 units of raw materials for production. The standard units were 6,790.

(List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No. Account Titles and Explanation

(a)

Raw Materials Inventory

Accounts Payable

Manufacturing Overhead

Debit

13600

(b)

Work in Process Inventory

12635

Raw Materials Inventory

Manufacturing Overhead

Credit

690

12910

12635

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I have the entire chart completed as seen in the attachment but I can not figure out what I am doing wrong on the two parts marked with red x's.Please help. Duke Company’s records show the following account balances at December 31, 2021: Sales revenue $ 16,800,000 Cost of goods sold 9,900,000 General and administrative expense 1,090,000 Selling expense 590,000 Interest expense 790,000 Income tax expense has not yet been determined. The following events also occurred during 2021. All transactions are material in amount. $390,000 in restructuring costs were incurred in connection with plant closings. Inventory costing $490,000 was written off as obsolete. Material losses of this type are considered to be unusual. It was discovered that depreciation expense for 2020 was understated by $59,000 due to a mathematical error. The company experienced a negative foreign currency translation adjustment of $290,000 and had an unrealized gain on debt securities…arrow_forwardRite Shoes was involved in the transactions described below. Purchased $8,200 of inventory on account. Paid weekly salaries, $920. Recorded sales for the first week: Cash: $7,100; On account: $5,300. Paid for inventory purchased in event (1). Placed an order for $6,200 of inventory. Required:Prepare the appropriate journal entry for each transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardplease explain your answer...arrow_forward

- Credit Prepare separate entries for each transaction for Sandhill Company. The merchandise purchased by Teal Mountain on June 10 cost Sandhill $2,090, and the goods returned cost Sandhill $280. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date く Account Titles and Explanation > (To record credit sale) > (To record cost of goods sold) > Debit To record credit for recoint of goods returned)arrow_forwardSplish Company sold $8,950 of its specialty shelving to Elkins Office Supply Co. on account. Prepare the entries ignoring cost of goods sold entries when (a) Splish makes the sale. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) (b) Splish grants an allowance of $658 when some of the shelving does not meet exact specifications but still could be sold by Elkins. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) (c) at year-end; Splish estimates that an additional $200 in allowances will be granted to Elkins. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account…arrow_forwardSold $32,800 of merchandise on April 28 to Valez Ltd., terms n/30. The goods sold had cost Hiroole $24,000. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (b) . Date April 28 April 28 Account Titles and Explanation May 3 May 3 Accounts Receivable Sales Refund Liability (To record sales) Cost of Goods Sold Estimated Inventory Returns Inventory (To record cost of goods sold) Date Account Titles and Explanation (To record sales returns) Debit (To record cost of goods returned) 32800 Debit 23040 960 On May 3, merchandise with a selling price of $1,260 was returned by Valez. The goods had a cost of $960 and they were restor to inventory. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is…arrow_forward

- rrarrow_forwardOn March 2, Riverbed Company sold $832,000 of merchandise on account to Swifty Corporation, terms 2/10, n/30. The cost of the merchandise sold was $603,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation (b) Your answer is correct. (c) Inventory Accounts Payable e Textbook and Media List of Accounts ✓ Your answer is correct. Inventory eTextbook and Media On March 6, Swifty Corporation returned $83,200 of the merchandise purchased on March 2. The cost of the returned merchandise was $60,300. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Accounts Payable List of Accounts ➡ Your answer is partially correct. Account Titles and Explanation…arrow_forward(a) Your answer is correct. On March 2, Riverbed Company sold $832,000 of merchandise on account to Swifty Corporation, terms 2/10, n/30. The cost of the merchandise sold was $603,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (b) Inventory Accounts Payable eTextbook and Media List of Accounts Debit 832,000 Debit Credit 832,000 Attempts: 1 of 3 used On March 6, Swifty Corporation returned $83,200 of the merchandise purchased on March 2. The cost of the returned merchandise was $60,300. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Creditarrow_forward

- Orion Flour Mills purchased a new machine and made the following expenditures: Purchase price Sales tax $74,000 5,950 Shipment of machine Insurance on the machine for the first year Installation of machine 990 690 1,980 The machine, including sales tax, was purchased on account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Record the above expenditures for the new machine. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet re to search ASUSarrow_forwardPart C: Recognizing that Splish’s products must still move through the bottling department before being ready for sale, record the journal entry to recognize the completion and removal of units from the manufacturing department. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount Part D:arrow_forwardhh. Subject:- Accounting On December 31, the company purchases equipment for $10,000 and pays for the purchase in cash.Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education