Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please help me. fast solution.

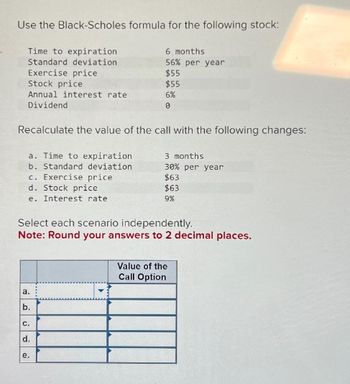

Transcribed Image Text:Use the Black-Scholes formula for the following stock:

Time to expiration

Standard deviation

Exercise price

6 months

56% per year

$55

Stock price

$55

Annual interest rate

6%

0

Dividend

Recalculate the value of the call with the following changes:

a. Time to expiration

b. Standard deviation

c. Exercise price

d. Stock price

e. Interest rate

3 months

30% per year

$63

$63

9%

Select each scenario independently.

Note: Round your answers to 2 decimal places.

a.

b.

C.

d.

e.

Value of the

Call Option

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Baghibenarrow_forwardAstromet is financed entirely by common stock and has a beta of 1.20. The firm pays no taxes. The stock has a price-earnings multiple of 11.0 and is priced to offer a 10.9% expected return. The company decides to repurchase half the common stock and substitute an equal value of debt. Assume that the debt yields a risk-free 4.6%. Calculate the following: Required: a. The beta of the common stock after the refinancing b. The required return and risk premium on the common stock before the refinancing c. The required return and risk premium on the common stock after the refinancing d. The required return on the debt e. The required return on the company (i.e, stock and debt combined) after the refinancing If EBIT remains constant: f. What is the percentage increase in earnings per share after the refinancing? g-1. What is the new price-earnings multiple? g-2. Has anything happened to the stock price? Complete this question by entering your answers in the tabs below. Reg A to E Reg F to G2…arrow_forwardHistorical Returns: Expected and Required Rates of Return You have observed the following returns over time: Assume that the risk-free rate is 5% and the market risk premium is 4%. a. What are the betas of Stocks X and Y? Do not round intermediate calculations. Round your answers to two decimal places. % Year 2017 2018 2019 2020 2021 % Stock X 12% 17 -13 2 22 % Stock Y 15% 7 -4 3 12 Stock X: Stock Y: b. What are the required rates of return on Stocks X and Y? Do not round intermediate calculations. Round your answers to two decimal places. Stock X: Stock Y: c. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y? Do not round intermediate calculations. Round your answer to two decimal places. Market 13% 12 -10 2 15arrow_forward

- 1. Use the one-period valuation model P = E/(1 + k) + P1/(1 + k) to price the following stocks (remember to decimalize percentages). Earnings (E = $) 1.00 1.00 1.00 0 0 0 1.00 1.50 2.00 0 Required return (k = %) 10 15 20 5 5 5 10 10 10 10 Expected Price Next Year (P1 = $) 20 20 20 20 30 40 50 50 50 1 Answer: Price Today (P = $) 19.10 18.26 17.50 19.05 28.57 38.10 46.36 46.82 47.27 0.91arrow_forwardUse the information below to compute the exepected retun of XYZ stock. Market state one year from now Today High Medium Low Probability 0.5 0.25 0.25 XYZ stock price $ 175.00 $ 200.00 $ 175.00 $ 150.00 Returns High Medium Low m XYZ stock returnarrow_forwardAsset W has an expected return of 8.8 percent and a beta of .90. If the risk-free rate is 2.6 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Do not round intermediate calculations. Enter your expected returns as a percent rounded to 2 decimal places, e.g., 32.16, and your beta answers to 3 decimal places, e.g., 32.161.) Portfolio Expected Percentage of Portfolio in Asset W Portfolio Return Beta 0 % 2.60 % 25 4.15 % 0.225 50 5.70 % 0.450 75 7.25 % 0.680 100 8.80 % 0.900 125 10.35 % 1.130 150 11.90 % 1.350 If you plot the relationship between portfolio expected return and portfolio beta, what is the slope of the line that results? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Slope of the linearrow_forward

- Assume these are the stock market and Treasury bill returns for a 5-year period: Year 2016 2017 2018 2019 2020 Stock Market Return (%) 33.30 13.20 -3.50 14.50 23.80 Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) 3 Required A Required B T-Bill Return Complete this question by entering your answers in the tabs below. Standard deviation (%) 0.12 0.12 0.12 0.07 0.09 x Answer is complete but not entirely correct. Required C What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. 13.69 X % घarrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two for one in the last period. Stock A B C Po 90 45 80 90 425 450 650 a. Rate of return b. New divisor c. Rate of return P1 95 40 90 91 425 450 650 % P2 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t= 1). Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. Calculate the new divisor for the price-weighted index in year 2. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. Calculate the rate of return for the second period (t=1 to t = 2). Note: Round your answer to 2 decimal places. % 92 425 450 95 40 45 1,300arrow_forwardConsider the rate of return of stocks ABC and XYZ. Year rABC rXYZ 1 20 % 28 % 2 8 11 3 16 19 4 4 1 5 2 −9 a. Calculate the arithmetic average return on these stocks over the sample period. b. Which stock has greater dispersion around the mean return? A. ABC B. XYZ c. Calculate the geometric average returns of each stock. What do you conclude? (Do not round intermediate calculations. Round your answers to 2 decimal places.) d. If you were equally likely to earn a return of 20%, 8%, 16%, 4%, or 2%, in each year (these are the five annual returns for stock ABC), what would be your expected rate of return? (Do not round intermediate calculations.) e. What if the five possible outcomes were those of stock XYZ? f. Given your answers to (d) and (e), which measure of average return, arithmetic or geometric, appears more useful for predicting future performance? A. Arithmetic B. Geometricarrow_forward

- Consider the three stocks in the following table. Pt represents price at time t, and ot represents shares outstanding at time t. Stock C splits two for one in the last period. Stock Po A 50 B 45 с 90 120 20 P1 a. Rate of return b. Rate of return 21 60 60 60 120 35 120 95 120 02 60 60 35 120 50 240 P2 Required: Calculate the first-period rates of return on the following indexes of the three stocks (t = 0 to t = 1): Note: Do not round intermediate calculations. Round your answers to 2 decimal places. a. A market-value-weighted index. b. An equally weighted index. % %arrow_forwardSolve for no. 3 onlyarrow_forwardASAP accurentlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning