Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

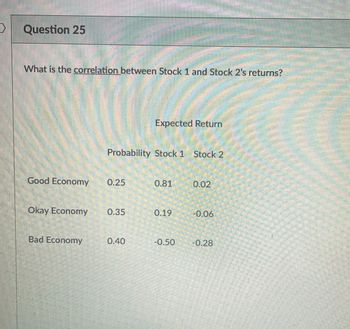

Transcribed Image Text:Question 25

What is the correlation between Stock 1 and Stock 2's returns?

Expected Return

Probability Stock 1 Stock 2

Good Economy

0.25

0.81

0.02

Okay Economy

0.35

0.19

-0.06

Bad Economy

0.40

-0.50

-0.28

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A4 5c Consider the following information on three stocks in four possible future states of the economy: State of economy Probability of state of economy Stock A Stock B Stock C Boom 0.3 0.35 0.45 0.38 Good 0.3 0.15 0.20 0.12 Poor 0.3 0.05 –0.10 –0.05 Bust 0.1 0.00 –0.30 –0.10 stock A: State of economy Probability Rate of return Average (a) (b) (c) (d = b × c)(d = b × c) Boom 0.3 0.35 0.105 Good 0.3 0.15 0.045 Poor 0.3 0.05 0.015 Bust 0.1 0 0 Expected rate of return 0.165 stock B: State of economy Probability Rate of return Average (a) (b) (c) (d = b × c)(d = b × c) Boom 0.3 0.45 0.135 Good 0.3 0.2 0.06 Poor 0.3 -0.1 -0.03 Bust 0.1 -0.3 -0.03 Expected rate of return 0.135 Stock C: State of economy Probability Rate of return Average (a) (b) (c) (d = b × c)(d = b…arrow_forwardA4 5a Consider the following information on three stocks in four possible future states of the economy: Rate of return if state occurs State of economy Probability of state of economy Stock A Stock B Stock C Boom 0.3 0.35 0.45 0.38 Good 0.3 0.15 0.20 0.12 Poor 0.3 0.05 –0.10 –0.05 Bust 0.1 0.00 –0.30 –0.10 a. Your portfolio is invested 30% in A, 50% in B, and 20% in C. What is the expected return of your portfolio?arrow_forwardSCHOOL OF BUSINESS ADMINISTRATION Corporate Financial Management FINC 401 Answer the following questions 1. Consider the following information: Rate of Return if State Occurs Probability of State of Economy State of Economy Stock A Stock B Recession .21 .06 -.21 Normal .58 .09 .08 Вoom .21 .14 .25 a. Calculate the expected return for Stocks A and B. b. Calculate the standard deviation for Stocks A and B. 2. Suppose a stock had an initial price of $74 per share, paid a dividend of $1.65 per share during the year, and had an ending share price of $61. a. Compute the percentage total return. b. What was the dividend yield and the capital gains yield? 3. Suppose you bought a bond with an annual coupon of 6% one year ago for $1,010. The bond sells for $1,025 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? 4. Consider the following information:…arrow_forward

- calculate the expected return Rate of return State of Economy Probability Stock A Stock B Recession 0.15 1.00% -0.25 Normal 0.55 9.00% 0.15 Boom 0.30 14.00% 0.38arrow_forwardQUESTION 1 Exhibit 5.5 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Stock Rit Rmt ai Beta A 10.6 15 0 0.8 Z 9.8 8.0 0 1.1 Rit = return for stock i during period t Rmt = return for the aggregate market during period t Refer to Exhibit 5.5. What is the abnormal rate of return for Stock A during period t using only the aggregate market return (ignore differential systematic risk)? a. 4.40 b. −1.70 c. 3.40 d. −4.40 e. −1.86arrow_forwardQuestion 2 Consider a market consisting of three stocks with the following information: Si Stock S2 S3 Price $100 $200 $500 Return 1.04 1.08 1.10 Standard 0.1 0.2 0.3 deviation For any two stocks i and j, o, = cov(x,,x,)=0,0,P,- Here, Piz =0.1,Piz =-0.8, P3 =0.2. What are the mean return and variance of this portfolio?arrow_forward

- Sh19 Please help me. Solutionarrow_forwardState of Economy Return on Stock A Return on Stock B Bear .073-094 Normal .134.142 Bull .062.321 Assume each state of the economy is equally likely to happen. a. Calculate the expected return of each stock. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation of each stock. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g 32.16.) c. What is the covariance between the returns of the two stocks? (A negative answer should be indicated by a minus sign, Do not round intermediate calculations and round your answer to 6 decimal places, e.g., .161616.) d. What is the correlation between the returns of the two stocks? (A negative answer should be indicated by a minus sign, Do not round intermediate calculations and round your answer to 4 decimal places, e.g., .1616.)arrow_forwardIan owns a two-stock portfolio that invests in Blue Llama Mining Company (BLM) and Hungry Whale Electronics (HWE). Three-quarters of Ian's portfolio value consists of BLM's shares, and the balance consists of HWE's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence Blue Llama Mining Hungry Whale Electronics Strong 0.50 27.5% 38.5% Normal 0.25 16.5% 22% Weak 0.25 -22% -27.5% Calculate expected returns for the individual stocks in Ian's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. • The expected rate of return on Blue Llama Mining's stock over the next year is • The expected rate of return on Hungry Whale Electronics's stock over the next year is • The expected rate of return on Ian's portfolio over the next year…arrow_forward

- Steps pls thankssarrow_forwardWhat is Stock X's geometric returns if it has the following returns? Year 1 8% Year 2 - 5% Year 3 10% Year 4 - 6% Year 5 15% a. 4.1%. b. 5.2% c. 6.8% d. 8.5%arrow_forwardWhat is the expected return for the following stock? State Probability Return Average 50 .25 Recession 35 .05 Depression .15 -35 Select one: Оа.0.12 O b.o.05 Ос.О.10 O d.o.09 Oe.o.11arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education