Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Baghiben

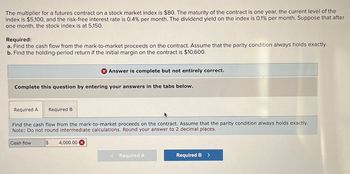

Transcribed Image Text:The multiplier for a futures contract on a stock market index is $80. The maturity of the contract is one year, the current level of the

index is $5,100, and the risk-free interest rate is 0.4% per month. The dividend yield on the index is 0.1% per month. Suppose that after

one month, the stock index is at 5,150.

Required:

a. Find the cash flow from the mark-to-market proceeds on the contract. Assume that the parity condition always holds exactly.

b. Find the holding-period return if the initial margin on the contract is $10,600.

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Find the cash flow from the mark-to-market proceeds on the contract. Assume that the parity condition always holds exactly.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Cash flow

$

4,000.00 x

<Required A

Required B >

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- the multiplier of a futures contract on the stock market index is $250. The maturity of the contract is one year. The current level of the index is 2600 , and the risk free interest rate is .2% per month. The dividend yield on the index is ..4% per month. Suppose that after five months, the stock index is at $2533. Assume that the party condition always hold exactly. Find the holding period return for the short position if the initial margin of the contract is 10% of the original contract value.arrow_forwardConsider the futures contract written on the S&P 500 index and maturing in one year. The interest rate is 3%, and the future value of dividends expected to be paid over the next year is $35. The current index level is 2,000. Assume that you can short sell the S&P index.a. Suppose the expected rate of return on the market is 8%. What is the expected level of the index in one year?b. What is the theoretical no-arbitrage price for a 1-year futures contract on the S&P 500 stock index?c. Suppose the actual futures price is 2,012. Is there an arbitrage opportunity here? If so, how would you exploit it?arrow_forwardConsider a 4-month forward contract for which the underlying asset is a stock index with value of 3, 825.97 and a continuous dividend yield of 0.5% Assume the continuous risk-free annual interest rate is 4.5%, a. Determine the no arbitrage forward price. $ Round your answer to the nearest cent b. Calculate the value of a long position if 2 month(s) later the index changes to 3, 825.97 and the risk-free rate is still 4.5% $ Round your answer to the nearest centarrow_forward

- You observe that the settlement price of a one-year futures contract for 1 share of a dividend paying stock is currently at $52. The current stock price is $50 and the risk-free interest rate is 10% p.a. (compounded annually). It is also known that the dividend yield on the stock is 4% p.a. (compounded annually). Set up a strategy to realize an arbitrage profit today and show the initial and terminal cash flows from each position taken in the strategy. Assume that investors can short-sell or buy the stock on margin and that they can borrow and lend at the risk-free rate. Thank you!arrow_forwardF2 please help....arrow_forwardA Index has currently a value of $10,000, and pays a dividend yield of 3%. What should be the price of a futures contract on the index for delivery in 1 year and what for delivery in 2 years? The picture shows the solution/ calculation Question is Make a graph that shows the spot price and the one year pricearrow_forward

- Consider a six-month futures contract on the FTSE 100. Assume the stocks underlying the index provide an annual dividend yield of 6.2% and the value of the index is 6754.5. Calculate the price of the index (to the nearest full index point) if the continuously compounded risk-free interest rate is (i) 6.9% and (ii) 5.arrow_forwardThe S&P portfolio pays a dividend yield of 1% annually. Its current value is 2,000. The T-bill rate is 4%. Suppose the S&P futures price for delivery in 1 year is 2,050. Construct an arbitrage strategy to exploit the mispricing and show that your profits 1 year hence will equal the mispricing in the futures market.arrow_forwardConsider these futures market data for the June delivery S&P 500 contract, exactly one year from today. The S&P 500 index is at 2,145, and the June maturity contract is at Fo = 2,146. a. If the current interest rate is 2.5%, and the average dividend rate of the stocks in the index is 1.9%, what fraction of the proceeds of stock short sales would need to be available to you to earn arbitrage profits? (Enter your answer in numbers and not in percentage. Eg; Enter 0.12 and not 12%. Do not round intermediate calculations. Round your answer to 4 decimal places.) Answer is complete but not entirely correct. Fraction 0.7787arrow_forward

- Assume that the Index is currently at 2,000. You manage a $10 million indexed equity portfolio. The Index futures contract has a multiplier of $50. A) If you are temporarily bearish on the stock market, how many contract should you sell to fully eliminate your exposure over the next six months? B) If T-bills pay 2% per six months and the semiannual dividend yield is 1%, what is the parity value of the futures price? Explain with each step and proper formatting.arrow_forwardA stock has a current price of $67. An option on this stock that expires in six months has an exercise price of $65. The stock will pay a dividend of $5 in three months. Assume an annualized volatility of 30% and a continuously compounded risk - free rate of 5% per annum. Use the Black - Sholes - Merton model to price this option. 1) Suppose the option is a European put. Calculate the value of the put. 2) Suppose this option is an American call. Use Black's approximation to calculate the value of this call.arrow_forwarda. A futures contract on a non-dividend-paying stock index with current value $130 has a maturity of one year. If the T-bill rate is 6%, what should the futures price be? b. What should the futures price be if the maturity of the contract is 2 years? c. What if the interest rate is 9% and the maturity of the contract is 2 years? Complete this question by entering your answers in the tabs below. Required A Required B Required C A futures contract on a non-dividend-paying stock index with current value $130 has a maturity of one year. If the T-bill rate is 6%, what should the futures price be? Note: Round your answer to 2 decimal places. Futures pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education