Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

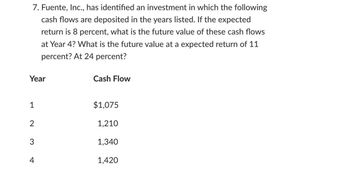

Transcribed Image Text:7. Fuente, Inc., has identified an investment in which the following

cash flows are deposited in the years listed. If the expected

return is 8 percent, what is the future value of these cash flows

at Year 4? What is the future value at a expected return of 11

percent? At 24 percent?

Year

Cash Flow

$1,075

1,210

3

1,340

4

1,420

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wainright Co. has identified an investment project with the following cash flows. Year Cash Flow 1 $ 720 2 930 3 1,190 4 1,275 If the discount rate is 10 percent, what is the present value of these cash flows? What is the present value at 18 percent? What is the present value at 24 percent?arrow_forwardMcCann Company has identified an investment project with the following cash flows. a. If the discount rate is 11 percent, what is the present value of these cash flows? b. What is the present value at 18 percent? c. What is the present value at 29 percent?arrow_forward6. Wainright Co. has identified an investment project with the following cash flows. Year Cash Flow 1 $ 720 2 930 3 1,190 4 1,275 If the discount rate is 10 percent, what is the present value of these cash flows? Present value $ What is the present value at 18 percent? Present value $ What is the present value at 24 percent? Present value $arrow_forward

- McCann Co. has identified an investment project with the following cash flows. Year Cash Flow 1 $800 2 1,030 3 1,340 4 1,110 a If the discount rate is 10 percent, what is the present value of these cash flows? b What is the present value at 18 and 28 percent?arrow_forwardMendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 $ 810 2 1,110 3 1,370 4 1,500 a. If the discount rate is 11 percent, what is the present value of these cash flows? b. If the discount rate is 17 percent, what is the present value of these cash flows? c. If the discount rate is 25 percent, what is the present value of these cash flows?arrow_forwardFuente, Inc., has identified an investment project with the following cash flows. Year Cash Flow 1 $ 1,075 2 1,210 3 1,340 4 1,420 a. If the discount rate is 8 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the discount rate is 11 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the discount rate is 24 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- B and Carrow_forwardCompute the payback period for an investment with the following net cash flows. (Round your answer to one decimal place.)arrow_forwardCalculate the EAR of the following investment, entered as a percentage (Example: if your answer is 0.145, enter 14.5) Year Number Cashflow 0 -11400 1 3500 2 3000 3 3100 4 2800 Your Answer:arrow_forward

- Mendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 2 3 $780 1,050 1,310 1,425 a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 17 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 25 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value at 8% b. Present value at 17% c. Present value at 25%arrow_forwardAssume that the amount of initial investment is $350,000 and the scheduled receipts are $250,000 in the end of the first year and $200,000 in the end of the second year, respectively. Consider the DCF (Discounted Cash Flows) upon the discount rate of 8 percent p.a., then answer the NPV (net present value).arrow_forwardFor the investment shown in the following table, calculate the total return earned over the unspecified time period. Cash flow during period Beginning-of- period value End-of- period value −$10 $3,200 $2,800 The total return on the investment is __%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education