ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

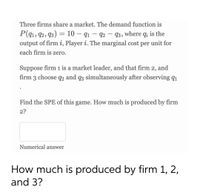

Transcribed Image Text:Three firms share a market. The demand function is

P(q1, 92, 93) = 10 – q1 – 92 – 93, where q; is the

output of firm i, Player i. The marginal cost per unit for

each firm is zero.

Suppose firm 1 is a market leader, and that firm 2, and

firm 3 choose q2 and q3 simultaneously after observing q1

Find the SPE of this game. How much is produced by firm

2?

Numerical answer

How much is produced by firm 1, 2,

and 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Hand written solutions are strictly prohibitedarrow_forward(J)arrow_forward1. Consider the following game in the normal form R 1,2 -1,2 3,2 1,5 M 1,1 2,-1 4,5 1,3 3.4 0,1 5,4 4,1 B 1,-1 N 4,4 6,1 1,4 a) Find the mixed strategy that dominates M b) Find the set B2 c) Find all the Pareto efficient strategy profilesarrow_forward

- Two firms X and Y compete with each other. Firm X can produce one of three products X1, X2, or X3. Similarly, firm Y can produce one of three products Y1, Y1, and Y3. Each firm's profit depends on its own and its competitor's decision about which product to produce. These profits are given in the table below where each cell presents profits corresponding to a pair of chosen strategies with the first number being the profit of firm X and the second being the profit of firm Y. For example, if X chooses to produce X3 and Y chooses to produce Y1, the profit of X will be $15 and the profit of Y will be $20. The firms make their product choice decisions simultaneously and independently of each other. Y1 Y2 Y3 X1 0, 0 12, 8 16, 16 15, 20 18, 9 20, 15 8, 12 18, 18 9, 18 X2 X3 11) Does this game have any equilibrium in dominant strategies? If yes, find all of them. 12) In addition to the equilibria (if any) you found in the previous question, does this game have any other equilibria? If yes,…arrow_forwardPLEASE CHECK THIS HOW TO SOLVEarrow_forwardThe total cost for a product-testing firm is C(q)=70 + 20q2 q= number of products tested Price of a product = average cost Each corporation purchases one product test per year from a product-testing firm in the same city. All other inputs are ubiquitous. Suppose five corporations are initially distributed uniformly, with one corporation in each city (A,B,C,D,E). Is the initial distribution a Nash Equilibrium? Demonstrate it is not by finding how much one corporation would pay if they deviate and move to another city? What is the average price of having two tests conducted? (Which is the price that the corporation would pay if they "live" in a city where two tests are conducted) The average price of moving and thus, having two tests is: $_____arrow_forward

- QUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forward8.8arrow_forwardTable 3. This table shows a game played between two firms, Firm A and Firm B. In this game each firm must decide how much output (Q) to produce: 5 units or 6 units. The profit for each firm is given in the table as (Profit for Firm A. Profit for Firm B). Firm A Q=5 Q=6 Firm B Q=5 (24, 24) (30, 10) Q=6 (10,30) (19, 19) Refer to Table 3. The dominant strategy For Firm A is to produce Select one: O a. 5 units and the dominant strategy for Firm B is to produce 5 units. b. 5 units and the dominant strategy for Firm B is to produce 6 units. c. 6 units and the dominant strategy for Firm B is to produce 5 units. d. 6 units and the dominant strategy for Firm B is to produce 6 units.arrow_forward

- Refer to the normal-form game of price competition in the payoff matrix below Firm B Low Price High Price Firm A Low Price 0, 0 50, −10 High Price −10, 50 20, 20 Suppose the game is infinitely repeated, and the interest rate is 20 percent. Both firms agree to charge a high price, provided no player has charged a low price in the past. This collusive outcome will be implemented with a trigger strategy that states that if any firm cheats, then the agreement is no longer valid, and each firm may make independent decisions. Will the trigger strategy be effective in implementing the collusive agreement? Please explain and show all necessary calculations.arrow_forwardTwo firms are competing on a market with demand P-47-3Q by sequentially choosing how much to produce Both firms have a marginal cost of 5 In the subgame perfect Nash equilibrium: Firm 1 will produce [Select] Firm 2 will produce [Select] The equilibrium price is [Select]arrow_forwardTwo firms simultaneously decide whether or not to enter a market, and if yes, when to enter a market. The market lasts for 5 periods: starting in period 1 and ending in period 5. A firm that chooses to enter can enter in any of the five periods. Once a firm enters the market in any period it has to stay in the market through period 5. In any period tt that the the firm is not in the market, it earns a zero profit. In any period tt, if a firm is a monopolist in the market, it makes the profit 10t−24. In any period tt if a firm is a duopolist in the market it makes a profit of 7t−24. A firm's payoff is the total profit it earns in all the periods it is in the market. How many strategies does each firm have? Firm 1's best response to Firm 2's choice Do not enter is to enter in period: In a Nash equilibrium, Firm 1 enters in period _______ (if there is more than one answer, write any one)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education