ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

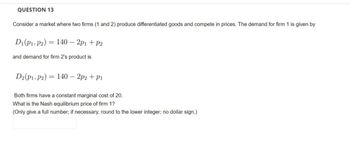

Transcribed Image Text:QUESTION 13

Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by

D₁(P₁, P2) = 140 - 2p1 + P2

and demand for firm 2's product is

D2 (P1, P2)

140 - 2p2 + P1

Both firms have a constant marginal cost of 20.

What is the Nash equilibrium price of firm 1?

(Only give a full number; if necessary, round to the lower integer; no dollar sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Consider a Cournot competition environment with one good and two firms, Firm 1 and Firm 2. The (pure) strategy space of Firm 1 is S₁ = [0, 1], and the strategy s₁ of Firm 1 corresponds to the amount of the good they produce. Similarly, the (pure) strategy space of Firm 2 is S2 = [0, 1], and the strategy s2 of Firm 2 corresponds to the amount of the good they produce. If Firm 1 were to produce quantity s₁ and Firm 2 were to produce quantity s2, the prevailing price in the good market would be 1 — 81 — 82, the utility of Firm 1 would be their profit, u₁ (81, 82) = (1-81-82 - c)81, and the utility of Firm 2 would be their profit, u2($1, $2) = (1-81-82-c)s2, where 0 ≤ c< 1 is the marginal cost of production for both firms. (a) Find the pure-strategy Nash equilibria of this game. (b) Are there other Nash equilibria in this game.arrow_forwardCan you show me the answer of question c and d? Thank you so much for your helparrow_forwardPlease no written by hand and no image (Bertrand's duopoly game with discrete prices) Consider the variant of the example of Bertrand's duopoly game in this section in which each firm is restricted to choose a price that is an integral number of cents. Take the monetary unit to be a cent, and assume that c is an integer and a>c+!. Is (c,c) a nash equilibrium of this game? Is there any other nash equilibrium?arrow_forward

- Two companies are the only Snowplow merchants in a small town. Inverse market demand curve is P 100- 10Q, where Q=ql + q2 (Firm l's output =q1; Firm 2's output = q2). Each firm has marginal costs of $25. In the Nash equilibrium in this market, the market price is $ O 50 O 40 25 60arrow_forwardPart 2: First Long Question There are two French bakeries in a small town: Le Meilleur Croissant (C), owned by Camille, and Le Meilleur Pain Au Chocolat (P), owned by Paul. In each period of an infinitely repeated game, they compete a la Bertrand, with market demand given by Q(pmin) = 10 - Pmin- Even though they sell identical goods, they have different marginal costs: cc = 2 and %3D Cp = 4 (Paul bakes just as well but is bad at business decisions). There are no fixed costs. Question 6 Turns out that Camille and Paul are married, and so they choose prices to maximize the joint profits of the two firms. Because both love baking and love each other, they also jointly decide that both firms should be selling positive amounts in their optimal plan. What prices do they choose? Pc = 6, pp = 11 Pc = 6.5, pp = 6.5 Pc = 6, pp = 6 Pc = 7, pp = 7 %3D O pc = 6, pp = 7arrow_forwardQ16arrow_forward

- Note: the answer should be typed.arrow_forwardTime remaining: 00:09:51 Economics The market demand function is Q=10,000-1,000p. Each firm has a marginal cost of m=$0.16. Firm 1, the leader, acts before Firm 2, the follower. Solve for the Stackelberg-Nash equilibrium quantities, prices, and profits. Compare your solution to the Cournot-Nash equilibrium. The Stackelberg-Nash equilibrium quantities are: q1=___________ units and q2=____________units The Stackelberg-Nash equilibrium price is: p=$_____________ Profits for the firms are profit1=$_______________ and profit2=$_______________ The Cournot-Nash equilibrium quantities are: q1=______________units and q2=______________units The Cournot-Nash equilibrium price is: p=$______________ Profits for the firms are profit1=$_____________ and profit2=$_______________arrow_forwardPLEASE CHECK THIS HOW TO SOLVE PLEASE TEACH EXPLAIN STEP BY STEParrow_forward

- Consider a market in which there are two firms: A and B. Each firm produces a differentiated product and chooses its price Assume that each firm can set price equal to $60 or $70. The payoffs associated with each set of prices are shown If the firms choose price simultaneously, then the Nash equilibrium price for firm A If firm A chooses price first and can commit to that price, then firm A will Firm B's Price is set its price equal to $00 $70 OA. $60, $60 OB. $70, $70 $2700 $2475 $60 OC 570, $60 OD. $60, $70 $2700 $3375 Firm A's Price $3375 $3300 $70 $2475 $3300arrow_forward(J)arrow_forwardThe demand for a product is Q = a - P/2. If there are 4 firms in an industry and marginal cost is MC = 20, then the price in Nash equilibrium is P = 56. What is a?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education