ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

This question addresses the impact of saving on an economy by examining what happens if tax laws change to induce saving and how changes in tax laws can discourage saving.

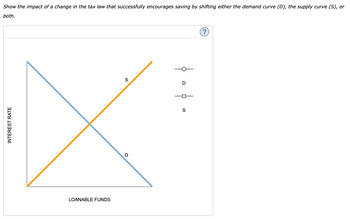

The following graph shows the market for loanable funds.

Show the impact of a change in the tax law that successfully encourages saving by shifting either the demand curve (D), the supply curve (S), or both.

A tax law change that successfully encourages saving will (increase/decrease) interest rates, which leads to (less/more) investment and economic growth .

To better understand how changes in tax laws can affect saving, suppose that Madison, a rising third-year in college, plans to save $550 from her summer job in order to buy textbooks for the upcoming fall semester. Madison's parents are so impressed with her plans that they offer to pay her an additional 30% interest per month on the money she saves, which means that Madison is now earning a large rate of return on her saving. By the end of the summer, it turns out that Madison saved $600 (before the interest paid by her parents) from her job. This means that the (income/substitution) effect must be bigger than the (income/substitution) effect for Madison in this case.

Transcribed Image Text:Show the impact of a change in the tax law that successfully encourages saving by shifting either the demand curve (D), the supply curve (S), or

both.

INTEREST RATE

LOANABLE FUNDS

S

D

D

S

(?)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose there are two types of investment in the economy: business fixed investment and residential investment. Suppose that loanable fund market is in equilibrium and the government grants an investment tax credit only for business investment. How does this policy affect the supply and demand for loanable funds, the equilibrium interest rate and equilibrium quantity of loanable funds? Use graph to explain your answer.arrow_forwardAmid the global pandemic, economic activity in many countries in the world decreased substantially causing a significant reduction in tax revenues. Mexico had a projected a budget deficit of $20 billion dollars. Assume that the government of Mexico borrowed $20 billion more from the market for loanable funds. Answer both parts below assuming that Mexico is a closed economy. a) Use a diagram for the market for loanable funds to analyze this policy. Does the interest rate rise or fall? What happens to investment and national saving? Note: make sure you label your diagram properly. b) Suppose households believe that greater government borrowing today implies higher taxes to pay off the government debt in the future. What does this belief do to private saving and the supply of loanable funds today? Does this change the results you discussed in part (a)? + v В I U A 川、 Paragrapharrow_forwardLet's say that due to political turmoil in the US and abroad, people all over the world start to lose confidence in American securities. Both Americans and foreigners prefer to do their financial investment elsewhere. As a result, we'd expect the supply of loanable funds to shift to the right and the real interest rate to fall the supply of loanable funds to shift to the left and the real interest rate to rise the supply of bonds to shift to the right and the real interest rate to fall the supply of bonds to shift to the left and the real interest rate to risearrow_forward

- On the following graph, show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves. Supply X Demand 2 10 20 30 40 50 QUANTITY OF LOANABLE FUNDS (Billions of dollars) 12 IN TEREST RATE 10 0 0 60 ģ Demand Supply ? Suppose that for each one-percentage-point increase in the interest rate, the level of investment spending declines by $1.25 billion. by According to the change you made to the loanable funds market in the previous scenario, the increase in government purchases causes the interest rate in the money market to from 6% to %. The change in the interest rate causes the level of investment spending to $ billion. by After the multiplier effect is accounted for, the change in investment spending will cause the quantity of output demanded to $ billion at each price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is known as the effect. Place the purple line (diamond…arrow_forwardIn the standard loanable funds market graph, … …an increase in the supply of loanable funds (rightward shift)... Group of answer choices A) none of the other options. B) could be caused by a tax increase for individuals on interest earned from savings accounts. C) would cause an increase in the real interest rate. D) could be caused by a tax break for businesses on investment spending. E) would cause a decrease in the real interest rate.arrow_forwardAccording to how we model the Loanable Funds market in Ch. 6 (considering household savings and taking (T – G) as government’s net ‘saving,’ which could be negative it there were a budget deficit), which of the following shifts the Supply of Loanable Funds curve to the left? (T = taxes; G = government spending.) Group of answer choices A) higher tax rates on business investment spending B) a change in tastes toward consuming less C) higher budget deficit D) change in tastes toward saving more E) lower budget deficitarrow_forward

- The graph below represents the market for loanable funds for an economy. Use the graph to answer the following questions. real interest rate 6% 51000 Loanable fund $ Assume there currently is a surplus in the market for loanable funds. The current real interest rate is I Select) the equilibrium real interest rate. As the market moves to the equilibrium real interest rate we expect I Select ] Demand for loanable funds comes from the activities of ISelect) 13arrow_forwardMacmillan Learning U The graph depicts the market for loanable funds. Shift the appropriate curves to indicate what will happen to the market if there is an improvement in the technology firms use in production. As a result of this change, the real interest rate is now % Real interest rate 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 and the quantity of funds is $ billion. 0.5 Supply Demand 0.0 0 5 10 15 20 25 30 35 40 45 50 Loanable funds (in billions)arrow_forwardJustify for the correct optionarrow_forward

- The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. Supply 5 Demand 1 100 200 300 400 500 600 LOANABLE FUNDS (Billions of dollars) is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied Suppose the interest rate is 3.5%. Based on the previous graph, the quantity of loanable funds supplied is than the quantity of loans ▼ of loanable funds. This would encourage lenders to the interest rates they charge, thereby demanded, resulting in a the quantity of loanable funds supplied and the quantity of loanable funds demanded, moving the market toward 0% the equilibrium interest rate of INTEREST RATE (Percent)arrow_forward7 1) Suppose that the government spending decreases. Use the model of loanable funds in a closed economy to explain clearly what happens to the quantity of national savings, public savings, private savings, investment, consumption, and the interest rate: Illustrate the answer with the appropriate graph.arrow_forward(Figure: Market for Loanable Funds 2) Based on the graph, if business taxes increase, the demand for loanable funds curve will shift from to and the new equilibrium will be at point holding supply constant at So. So Real Interest Rates (%) Do; D₁; c Do; D₁; b D₁; Do; a a b Loanable Funds ($) d S₁ Do D₁arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education